NEW CASTLE (March 7, 2019) – The Department of Health and Social Services (DHSS) is urging working individuals and families in Delaware to meet with volunteer tax preparers at locations across the state to determine if they are eligible for the federal Earned Income Tax Credit (EITC) and to file a federal tax return by April 15 if they are.

In January, DHSS sent out notices to clients who might be eligible for the EITC, the single largest check that many working families receive each year. To be eligible, an individual or couple must have earned income from a job and meet other requirements. Income can come from salaries, wages, tips, commissions, royalties, self-employment net earnings, jury duty pay, union strike benefits, non-taxable combat pay or long-term disability benefits before the minimum retirement age.

“For thousands of working families and their children in Delaware, the Earned Income Tax Credit is a proven benefit, lifting many families out of poverty,” said DHSS Secretary Dr. Kara Odom Walker. “We urge individuals and families to meet with tax preparers across the state to help determine if they are eligible for this important tax credit and to file their tax returns.”

To qualify for EITC, for example, a single parent of two qualifying children must have earned income and adjusted gross income of less than $45,802 in 2018. For a married couple filing jointly with two qualifying children, the limit is less than $51,492. Other income requirements:

• A single parent with three or more children: $49,194 ($54,884 if married and filing jointly)

• A single parent with one child: $40,320 ($46,010 if married and filing jointly)

• Single, with no children: $15,270 ($20,950 if married and filing jointly)

The refundable tax credit means that tax filers are likely to get back more from the federal government than they pay in taxes, so they are in line for a significant refund. In Delaware last year, about 71,000 eligible workers and families received about $171 million through the Earned Income Tax Credit, with an average credit of $2,401. In the U.S., about 25 million eligible workers and families received about $63 billion through the EITC last year, with an average credit of $2,488.

“It is important to DHSS and our community partners to increase the number of Delaware working families who know about the Earned Income Tax Credit, as well as the number who apply for it,” said Ray Fitzgerald, director of DHSS’ Division of Social Services. “This is money that can make a real difference in the lives of so many people in Delaware and enhance the lives of their children.”

The list of Delaware Tax and Financial Services Campaign Sites open through April 15:

- Claymont Library (drop off only): 400 Lenape Way, Claymont; 10 a.m.-4 p.m. Friday and Saturday

- Northeast State Service Center: 1624 Jessup St., Wilmington; 9 a.m.-4 p.m. Monday, Wednesday and Friday

- Woodlawn Library (Spanish speakers available): 2020 W. Ninth St., Wilmington; 3-8 p.m. Monday; 10 a.m.-3 p.m. Tuesday, Wednesday, Thursday and Saturday

- Route 9 Library and Innovation Center: 3022 New Castle Ave., New Castle; 10 a.m.-8 p.m. Monday and Tuesday; 10 a.m.-4 p.m. Friday

- Hudson State Service Center: 501 Ogletown Road, Newark; Noon-8 p.m. Monday; 9 a.m.-1 p.m. Tuesday and Friday; 9 a.m.-4 p.m. Wednesday, Thursday and Saturday

- Williams State Service Center: 805 River Road, Dover; noon-4 p.m. Monday, Wednesday and Thursday; 8 a.m.-4 p.m. Tuesday

- Goodwill of Delaware-Milford: 694 N. DuPont Highway, Milford; 1-7 p.m. Tuesday, Thursday and Friday; 9 a.m.-4 p.m. Saturday

- First State Community Action Agency-Georgetown (Spanish speakers available): 308 N. Railroad Ave., Georgetown; 9 a.m.-6 p.m. daily

- Free Taxes-$tand By Me Delaware (online self-prepared returns only): myfreetaxesde.org/

Fitzgerald said individuals and couples who plan to go to tax preparation sites need to bring these documents with them:

- Driver’s license or another form of photo ID

- Social Security cards (for yourself, spouse, children and other dependents listed on the tax return)

- W-2s, 1095s, 1098s and 1099s

- List of other income/expenses (for possible itemized deductions)

- Child care information (provider’s EIN number, address and receipts for amounts paid)

- Bank account information for direct deposit

- Copy of last year’s return if available

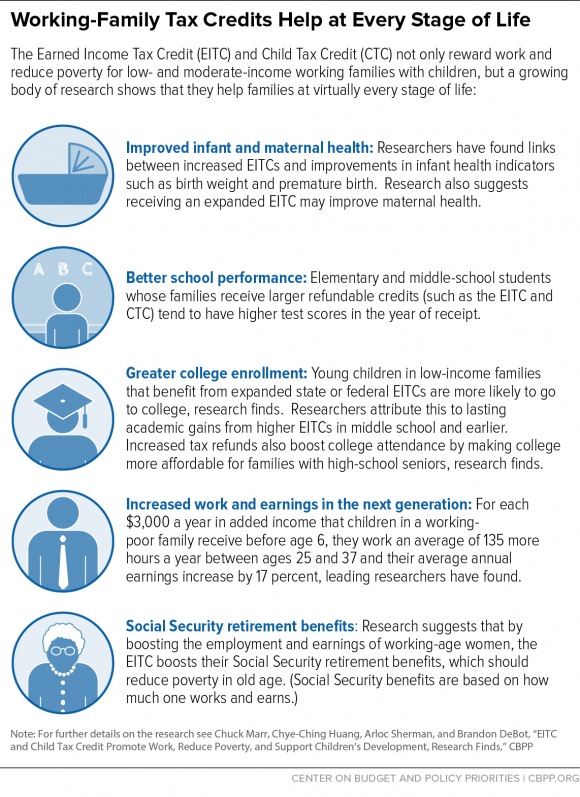

A growing body of research has found that the EITC increases incentives to work, stabilizes income, is linked to improvement in maternal and infant health, leads to better performance by children in school, and increases work effort and earnings when children reach adulthood. The IRS estimates that 20 percent to 25 percent of qualifying workers do not receive the tax credit because they do not file a federal return to claim it.

In Delaware, volunteers are needed at tax sites. Those who are interested can go to www.nehemiahgateway.org to sign up.