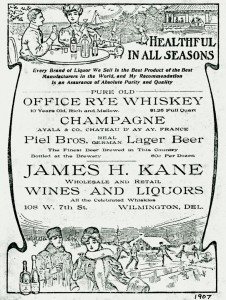

(DOVER, Del.—April 5, 2016)—Lewes, Del.’s Zwaanendael Museum is currently featuring a new exhibit entitled “Wine and Spirits in Delaware: Producing, Preserving, and Presenting” which utilizes graphics as well as historical objects from the collections of the State of Delaware to tell the story of Delaware’s wine and spirits trade from the time of European settlement to the present day. Historical items on display include bottles, jugs and flasks used as containers for wine, spirits and mixers; decanters, goblets and glasses used for serving these beverages; and accessories including a liquor chest, trays, trivets, corks, corkscrews and a bitters shaker.

Highlights from the exhibit include displays on distillers from the past including Levy & Glosking of Dover which produced fruit brandies and rye whiskey from the late-19th century to the beginning of Prohibition in 1920, Diamond State Distilling Co. of Cheswold which produced apple jack from 1933 to 1948 and William Brown Distiller of Fruit Brandies from west of Felton which operated from the early-20th century to 1920. Present day spirits-manufacturers featured in the exhibit include Dogfish Head of Milton and Rehoboth Beach, Painted Stave Distilling Co. of Smyrna, Delaware Distilling Co. of Rehoboth Beach and Beach Time Distilling of Lewes.

Research has produced no evidence of Delaware wine-making for commercial purposes until the 1993 opening of Nassau Valley Vineyards located near Lewes. The exhibit includes information on that vineyard as well as other present-day Delaware wineries including Pizzadili Vineyard and Winery in Felton, Harvest Ridge Winery in Marydel and Fenwick Wine Cellars in Selbyville.

“Wine and Spirits in Delaware: Producing, Preserving, and Presenting” will be on display through Dec. 31, 2016 at the Zwaanendael Museum, located at 102 Kings Highway in Lewes, Del. Museum operating-hours from April 1 to Oct. 31 are Tuesdays through Saturdays, 10 a.m. to 4:30 p.m.; and Sundays, 1:30 to 4:30 p.m. From Nov. 1 through March 31, museum operating-hours are Wednesdays through Saturdays, 10 a.m. to 4:30 p.m. Admission is free and open to the public. For additional information, call 302-645-1148.

The Zwaanendael Museum was built in 1931 to commemorate the 300th anniversary of the state’s first European colony, Swanendael, established by the Dutch along Hoorn Kill (present-day Lewes-Rehoboth Canal) in 1631. Designed by E. William Martin (architect of Legislative Hall and the Hall of Records in Dover), the museum is modeled after the town hall in Hoorn, the Netherlands, and features a stepped facade gable with carved stonework and decorated shutters. The museum’s exhibits and presentations provide a showcase for Lewes-area maritime, military and social history.

-End-

Contact:

Jim Yurasek

Delaware Division of Historical and Cultural Affairs

Phone: 302-736-7413

E-mail: Jim.Yurasek@delaware.gov

Web: http://history.delaware.gov