A wide-ranging group of community organizations serving Delawareans from all walks of life have been selected to receive year 2022 grants from the Financial Literacy Education Fund (FLEF).

“Financial literacy levels the playing field across all communities in our state,” said Delaware State Bank Commissioner Robert Glen. “For this round of grants, our team reviewed a great collection of applications, and we were thoroughly impressed with the breadth and depth of financial literacy programming being offered by our nonprofit partners.”

Since the FLEF was established in 2010, over $3 million has been awarded to dozens of organizations to improve financial literacy for Delawareans of all ages. Grants from the FLEF program have supported programs to teach students the importance of saving, guide families on the path to homeownership, and support single parents with tools to build financially healthy households.

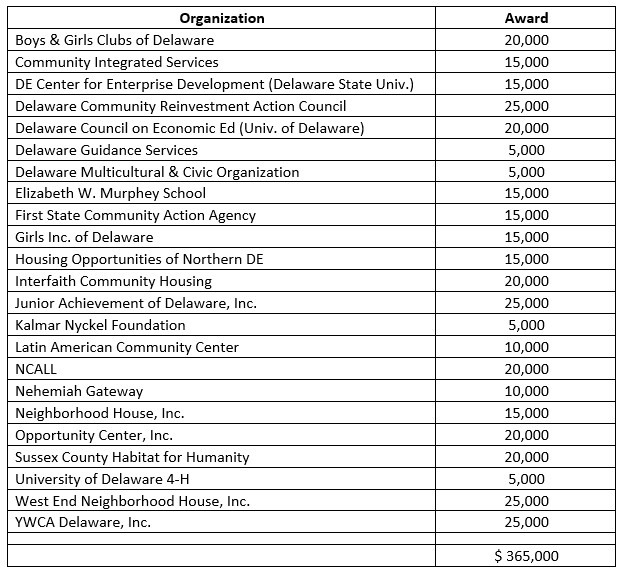

For this round of grants, a total of $458,577.05 was awarded to 21 nonprofit organizations to support programs that met criteria established by the Office of the State Bank Commissioner. Funding for the FLEF is derived from a license fee charged to businesses that make high-cost payday loans and car title loans.

Applications for FLEF grants were scored on their potential to improve the financial literacy of Delawareans, especially programs that are proactive, preventative, and forward-thinking. Programs and services funded with FLEF grants are designed to reach populations or geographic regions that have limited access to financial literacy resources, with special emphasis on reaching out to members of the military, seniors, and minority communities.

| Organization | Grant |

| Boys & Girls Clubs of Delaware | $20,000.00 |

| Christina Cultural Arts Center | $12,500.00 |

| Community Integrated Services | $26,050.05 |

| Delaware Community Reinvestment Action Council, Inc. | $32,000.00 |

| Delaware Council on Economic Education | $20,000.00 |

| Delaware State University/DE Center for Enterprise Development | $6,000.00 |

| Elizabeth W. Murphey School Inc. | $20,000.00 |

| Housing Opportunities of Northern Delaware Inc. | $20,000.00 |

| Interfaith Community Housing of Delaware, Inc. | $40,000.00 |

| Junior Achievement of Delaware, Inc. | $20,000.00 |

| Kalmar Nyckel Foundation | $8,500.00 |

| La Plaza Delaware, Greater Lewes Foundation | $40,000.00 |

| Latin American Community Center | $20,000.00 |

| Lewes Public Library | $5,000.00 |

| Nehemiah Gateway CDC | $10,000.00 |

| NeighborGood Partners (formerly NCALL) | $40,000.00 |

| Opportunity Center Inc. (dba ServiceSource) | $30,000.00 |

| Sussex County Habitat for Humanity | $30,000.00 |

| University of Delaware 4-H Program | $8,527.00 |

| West End Neighborhood House, Inc. | $15,000.00 |

| YWCA Delaware Inc | $35,000.00 |

|

TOTAL |

$458,577.05 |

The Office of the State Bank Commissioner is responsible for regulating and examining State-chartered banks and trust companies and licensed financial services businesses, including mortgage loan brokers, licensed lenders, mortgage loan originators, check sellers, money transmitters, check cashers, motor vehicle sales finance companies, money transporters, business, and industrial development corporations and pre-need funeral contract providers. The Office resolves complaints against financial institutions and provides consumer education programs to Delaware residents.