Income Tax Deadlines Extended

State Tax Due Dates Remain Unchanged

Last week, the Delaware Division of Revenue (DOR) announced that the deadlines for taxpayers to file certain personal and corporate income tax returns and payments had been extended to July 15, 2020 due to “rolling conformity” with federal income tax rules adopted by the IRS in response to the COVID-19 emergency.

The new deadline of July 15, 2020 applies to corporate income tax tentative returns due April 15 as well as final personal income tax returns, estimated personal income tax payments, and fiduciary income tax returns each due April 30.

All State of Delaware agencies continue to process State tax filings, accept tax payments, and issue refunds, where applicable. The State is not extending the deadlines for filing returns and payments for other State taxes and fees, including but not limited to the following categories:

- Personal Income Tax Withholding

- Personal Income Tax Estimated Payment due 6/15/2020

- Corporate Income Tax Tentative Payment due 6/15/2020

- Unemployment Insurance Tax (Non-profits and other reimbursable organizations will receive a 90-day deferment on UI payments)

- Corporate Franchise Tax

- LLC, LP, and GP Annual Tax

- Gross Receipts Tax and Business License Renewals

- Realty Transfer Tax

- Tobacco and Cigarette Tax

- Bank Franchise Tax and Fees

- Insurance Taxes and Fees

- Public Utility Tax

- Alcoholic Beverage Tax

- Public Accommodations Tax

- Motor Fuel Tax

State staff are available to respond to taxpayer questions throughout the COVID-19 emergency. Taxpayers are urged to visit the websites of applicable agencies for additional COVID-19 information or call or email the following offices:

| Division of Revenue Leslie A. Poland, Community Relations Coordinator leslie.poland@delaware.gov |

|

| Division of Unemployment Insurance DOL_UI_Employer_Tax_Questions@delaware.gov Kenneth Briscoe, Communications Coordinator & Public Information Officer kenneth.briscoe@delaware.gov |

|

| Division of Corporations Doug Denison, Director of Community Relations douglas.denison@delaware.gov |

|

| Delaware Bank Commissioner Dawn Hollinger, Public Information Officer dawn.hollinger@delaware.gov |

|

| Delaware Department of Transportation (302-744-2724) Charles McLeod, Director of Community Relations charles.mcleod@delaware.gov |

|

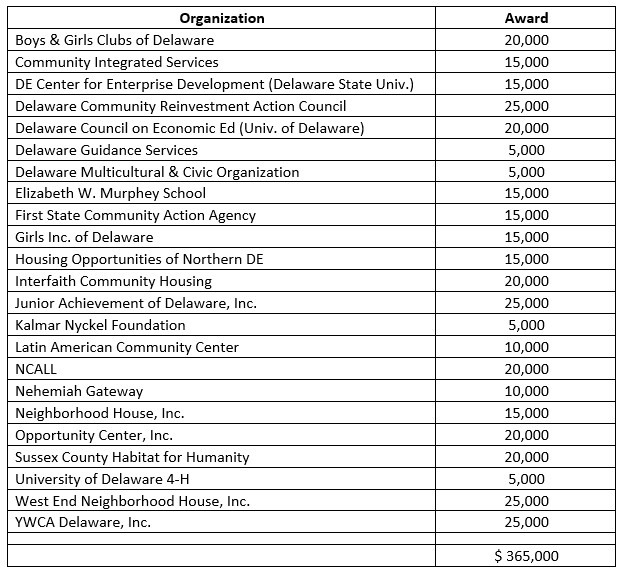

“Our communities grow and prosper when more Delawareans have the tools they need to manage their financial lives, make smart decisions with their money, and plan for their futures,” said Secretary of State Jeff Bullock, whose department oversees the FLEF grant program. “By supporting the organizations that help promote financial literacy, we’re making an investment in the future economic health of our state.”

“Our communities grow and prosper when more Delawareans have the tools they need to manage their financial lives, make smart decisions with their money, and plan for their futures,” said Secretary of State Jeff Bullock, whose department oversees the FLEF grant program. “By supporting the organizations that help promote financial literacy, we’re making an investment in the future economic health of our state.”