Free one-on-one counseling and information available to residents; Bureau earns federal grant

The Delaware Medicare Assistance Bureau (DMAB), a division of the Delaware Department of Insurance, is encouraging residents to get ready for Medicare Open Enrollment. DMAB, which provides free, one-on-one Medicare counseling, offers a myriad of virtual appointment options for residents, as well as video tutorials and other guides that can assist in beneficiaries’ preparation. DMAB has provided more than 3,000 counseling sessions so far this year, saving beneficiaries more than $372,438 in premiums through application help.

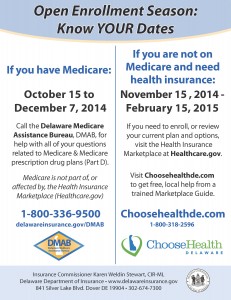

DMAB will engage in thousands of counseling sessions during Medicare Open Enrollment, which takes place October 15 through December 7. During this time, beneficiaries can make changes to their health and drug coverage and review existing coverage against other options. DMAB will offer virtual appointments throughout this period, available via Webex, Duo, and Microsoft Teams, as well as by phone. Residents are encouraged to register for a MyMedicare.gov account prior to their counseling session so that DMAB can generate personalized plan comparisons.

“Our DMAB team works to increase residents’ understanding of the complex Medicare system and can even help save you money. I encourage the community to reach out to our team for Medicare assistance and information,” said Insurance Commissioner Trinidad Navarro.

A Virtual Medicare Seminar, which DMAB began to offer in 2020, is available on-demand online, and educates participants on topics including Medicare benefits, supplemental insurance policies, Medicare Advantage plans, prescription drug coverage and details on signing up. While specifically created for new or soon-to-be eligible beneficiaries, the informative series can be helpful for all Medicare participants.

“Many people have questions about Medicare and don’t know where to start, and COVID-19 has only increased the stress of choosing the right healthcare plans. We are here to help people in Delaware deal with the complex and often confusing health insurance system,” said DMAB Director Lakia Turner, “and, we’re more accessible than ever through our new virtual programs.”

As Medicare Open Enrollment approaches, the Department of Insurance reminds residents to scrutinize any contact during the open enrollment period to ensure it is from a known, credible source. The most frequent fraudulent contact occurs by phone, but residents should review all communications carefully.

“If you are receiving contact regarding Medicare that you did not initiate, or contact not from one of your healthcare providers, it could be fraudulent,” said Commissioner Navarro. “Protect your Medicare Number like you do your Social Security number or bank account information, and never give it out to unknown or unexpected callers.”

DMAB has been awarded a Medicare Improvement for Patients and Providers Act (MIPPA) 2021 Grant from the federal government, which will provide the bureau $71,943. The annual MIPPA grant has and will assist the bureau’s outreach, education, and one-on-one beneficiary assistance programs over the next year by assisting those beneficiaries who are likely to be eligible for the Low-Income Subsidy program (also called “Extra Help”) or Medicare Savings Programs.

The Delaware Medicare Assistance Bureau provides free one-on-one health insurance counseling for people eligible for Medicare. Residents can call DMAB at 1-(800) 336-9500 or (302) 674-7364 to set up a free, confidential session. Counselors can assist with Medicare, Medicaid, Medigap (Medicare supplement insurance), long term care insurance, billing issues, prescription savings, and much more.