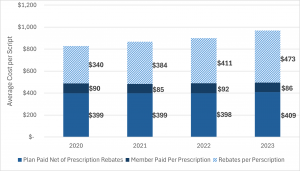

Use of GLP-1s – the popular medications to treat Type 2 Diabetes and obesity – nearly doubled among Delaware’s fully-insured commercial members from 2020 to 2023, according to a new first-in-the-nation analysis from the Department of Insurance’s Office of Value-Based Health Care Delivery. Data shows the expense of the medications was nearly fully balanced by manufacturer rebates.“It’s long been suggested that the cost of GLP-1s have been a primary contributor to rising health insurance costs, but this data shows that simply is not the case. Considering the rebates from drug manufacturers and other entities, even with increased utilization, they are not a substantive cost driver,” said Insurance Commissioner Trinidad Navarro. “While we can’t necessarily quantify the other savings they produce, for example by managing chronic conditions, preventing emergency care, and reductions in other medications, GLP-1 medications are proving to be an important cost-effective tool in managing obesity and diabetes.”

Prices for the medications were relatively flat, after subtracting rebates, the analysis of data provided to the OVBHCD by Delaware’s three largest pharmacy benefit managers found. Rebates are payments typically made by a pharmaceutical manufacturer to a pharmacy benefit manager, who then shares all or some of rebate with the health insurer or employer.

Driven by the increase in use, total spending on GLP-1 medications more than doubled over the reviewed period. GLP-1 medications accounted for about 6 percent of all pharmacy spending for the Delaware commercial fully insured market. The trends in Delaware mirror those nationally.

In the coming months, the OVBHCD will expand its analysis of pharmacy spending to include all medications, offering further context to pharmacy spending among the commercial, fully insured population.

This report does not provide State of Delaware Group Health Insurance Plan GLP-1 data. Such data is not available in a manner that is inclusive of rebates, and solely reporting on spending can be inherently misleading due to the significant value of rebates received and fully retained by the State. In future contracts, the State’s PBM will be required to submit OVBHCD pharmacy data templates so information can be similarly analyzed by this expert team.

The Department of Insurance remains committed to supporting evidence-based care, improving access to effective treatments, and promoting transparency in the health care market. The Office’s findings will inform ongoing conversations about how to balance innovation with affordability in Delaware’s health care system.

Access the Report: Utilization Not Cost of GLP-1 Medications Drives Increased Spending