DOVER, DE – The Holidays are quickly approaching and most people have already begun shopping, decorating or planning a trip to see family or friends over the coming weeks. Take some time today to review your insurance coverage and to ensure that you, your family, and your home are prepared for the colder weather and other perils that occur more frequently during this time of the year.

Holiday gatherings for most people include indulging in great food and drinks. With all of that extra cooking and baking going on there’s just more potential for a fire. According to the Insurance Information Institute, the average home fire claim costs $34,306. A claim after a fire would likely be lower for renters, since they are only insuring the contents of their rented home or apartment, but many renters do not realize that their belongings are likely not covered by their landlord’s insurance.

While the kitchen remains the number one place where fires start in the home, holiday decorations and space heaters greatly increase the chances for fires if you aren’t careful. Never leave candles or space heaters unattended and keep them away from flammable objects. If you have a live Christmas tree, be sure to water it often. Get rid of old strings of lights that get hot and could cause a fire. According to statistics from Allstate Insurance, the median cost for a home fire caused by a Christmas tree is more than $100,000! Christmas trees burn hot and fast, so a tiny spark can become a huge fire in mere minutes. When plugging in lights and decorations outside, do not overload outlets or use substandard extension cords.

Allstate Insurance found that theft claims went up by 7 percent during the holidays, which makes sense since our houses and cars are often filled with expensive gifts. When shopping, keep gifts in your car out of sight and, when possible, schedule package deliveries for times when you will be home. Some people send deliveries to their workplace so they can sign for, and accept, deliveries during the work day.

Be sure to notify your insurance company if you buy high-value items, like jewelry, art or electronics. There are usually limits on how much the policy will pay for specific categories of items. If an item is worth a lot of money you should ask your agent about scheduling an endorsement (also referred to as a “rider”) to better protect your investment should an item be stolen or damaged in a fire, etc.

In today’s world of Twitter, Facebook and Instagram, remember that it’s not always a good idea to overshare the details of when your family will be away visiting Grandma. Don’t make it easy on thieves to come steal presents bought with your hard-earned money.

If you’re hosting a party, remember to serve alcohol responsibly and do not let intoxicated friends or family drive home. When the weather brings snow and ice be sure to clear sidewalks and put down salt or de-icer, if necessary. Homeowners and renters insurance policies both provide liability coverage if someone is injured on your property, but know the limits of your policy.

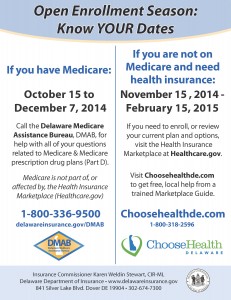

Don’t forget that it’s also open enrollment time for health insurance plans on the Health Insurance Marketplace (Healthcare.gov). All plans purchased through the Marketplace will expire on December 31, 2014, no matter when your coverage began in 2014. If you would like to re-enroll, change plans or sign up for health insurance for the first time you can do so until February 15, 2015. However, anyone who wants a plan to be effective starting on January 1, 2015, needs to sign up or re-enroll by December 15, 2014. For more information about your health insurance options visit www.choosehealthde.com or www.healthcare.gov.

If you have health insurance through your employer your open enrollment period may be going on now, or may begin soon. Pay close attention to the deadlines and be sure to give yourself plenty of time to review your options. There’s much more to consider than the monthly premium alone. Make sure you review the deductible; sometimes paying a little more in premiums will make for a much lower deductible.

If you are traveling, be sure to take your health insurance information with you. Always keep a record of your medications, and if you’re flying, it’s usually safer to keep medicine in your carry-on since luggage can sometimes be lost for days—if not forever. Remember, if you need to seek medical care and you’re out-of-network you will likely be subject to higher co-pays and/or deductibles. If you need medical care for a non-emergency issue find a local urgent care clinic or medical aid unit, which will typically be cheaper than an ER visit.

For more information about insurance visit www.delawareinsurance.gov

###

For more information: Jerry Grant 302-674-7303