It’s Time to Think about Your Health Coverage

Whether you’re covered under Medicare, or don’t have any health insurance at all,

the time to review your health coverage is fast approaching

DOVER, DE–If you are unhappy with your health insurance coverage, or don’t have any at all,Delaware Insurance Commissioner Karen Weldin Stewart wants to alert you to two important sets of dates coming up soon.

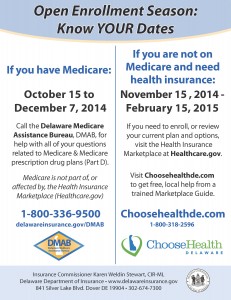

October 15 through December 7 is the time for Medicare Open Enrollment. It’s the time when all people with Medicare are encouraged to review their current health and prescription drug coverage, including any changes in costs, coverage, and benefits that will take effect next year.

Call the Delaware Medicare Assistance Bureau, DMAB, at 1-800-336-9500 for help with all of your questions related to Medicare and Medicare prescription drug plans, such as Part D. You can also get information on DMAB’s website, www.delawareinsurance.gov/DMAB. Staff and trained volunteers are available to meet with Medicare recipients at various locations throughout each county to review your current prescriptions and options in-person.

If you want to change your Medicare coverage for next year, this is the time to do it. If you’re satisfied that your current coverage will continue to meet your needs for next year, you don’t need to do anything. Staff members are also able to help with questions about Medicare Advantage plans.

If you are not on Medicare and need health insurance, November 15 through February 15 is the open enrollment period for the Health Insurance Marketplace at www.HealthCare.gov. If you need to enroll in a plan, or review your current plan and options, visit www.ChooseHealthDE.com to get connected to free, local help from a trained Marketplace Guide. Help is also available by phone at 1-800-318-2596 (this number connects to a national call center).

Many individuals and their families will qualify for federal subsidies to help lower health insurance premiums. Talk to a Marketplace Guide or set up an account on Healthcare.gov to get more information about plans and coverage available, as well as costs and subsidies.

###

Delaware Department of Insurance: “Protecting Delawareans through regulation and

education while providing oversight of the insurance industry to best serve the public.”