Successes in serving residents continue

The Delaware Department of Insurance (DOI) today published performance and productivity data for 2021. While the pandemic necessitated continued operational adjustments, staff continued to focus efforts on consumer services and saw great success. The department also released an infographic of key statistics.

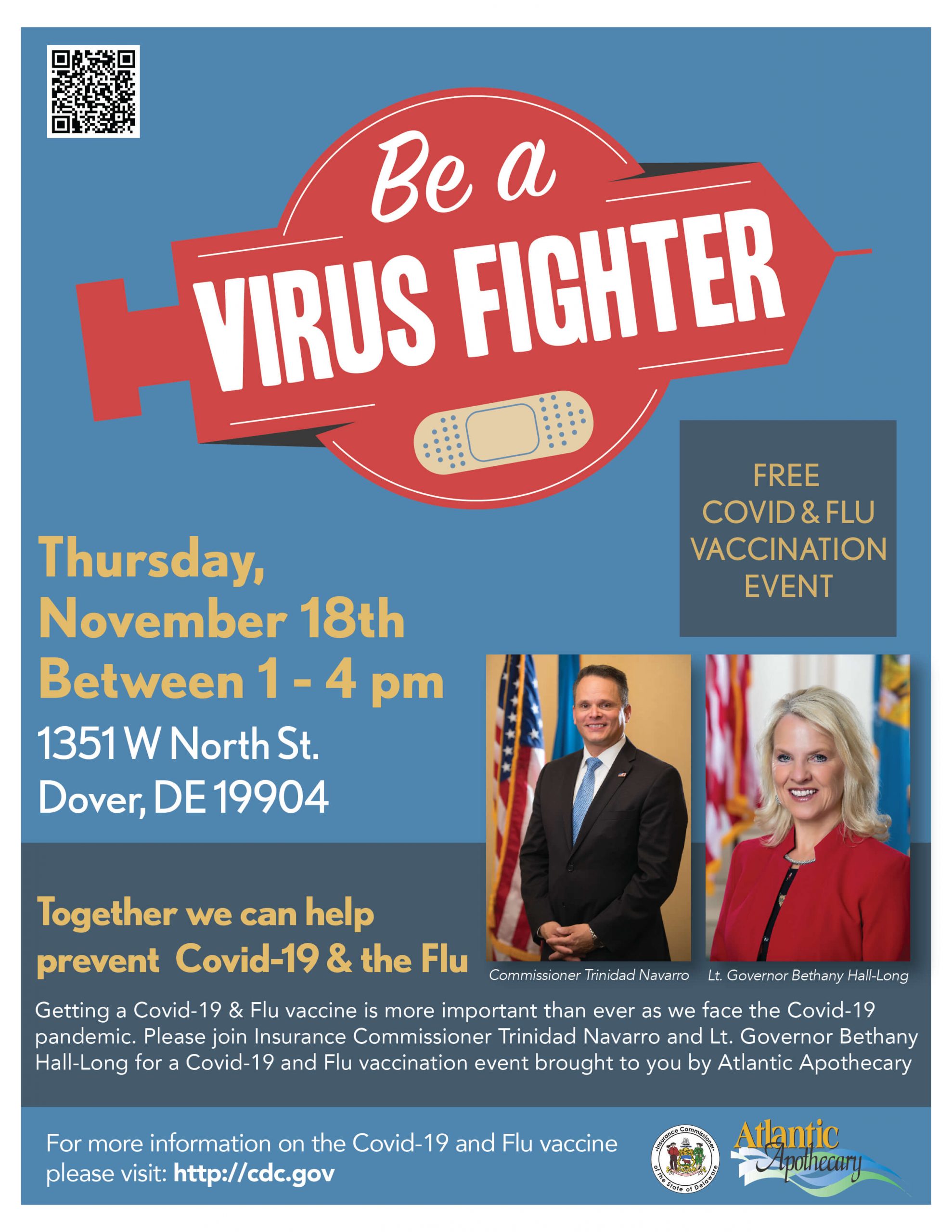

“Year after year, our DOI team delivers for Delaware. In the face of many changes and challenges due to COVID-19, we continued to prioritize consumer services, and never wavered from that commitment,” said Insurance Commissioner Trinidad Navarro. “This year in review provides just a glimpse into the incredibly vast and diverse array of work our team takes on, and I look forward to continuing to make a difference every day in 2022.”

Despite minimal in-person events, services directed to individual consumers and local businesses continued to thrive in 2021. The Delaware Medicare Assistance Bureau (DMAB) held more than 5,500 free one-on-one counseling sessions with residents, ultimately saving beneficiaries a combined $521,000 – an increase of more than $230,000 compared to 2020 savings. The Consumer Services Division managed over 3,000 complaints and inquiries, recovering nearly $700,000 for consumers. In the Legal Division, 274 settled arbitration cases resulted in awards totaling more than $640,000. These services, combined with $12.3 million in ACA plan refunds and $7.4 million in workplace safety savings, amount to over $21.5 million for Delaware’s insurance consumers in 2021.

A critical focus of the department during COVID-19 continues to be ensuring health insurer compliance with state and federal rules, coverage requirements, and initiatives to reduce burdens on hospitals and those seeking care. The Market Conduct team continued investigations into insurer’s Mental Health Parity compliance, resulting in $635,000 in fines. Throughout the ACA Special Enrollment Period, more than 21,000 residents took advantage of increased subsidies and savings from the American Rescue Plan, saving an average of 53% on their monthly premiums – a savings of $1.2 million in total. To protect consumers and create a nationwide network of strong regulation, Commissioner Navarro successfully worked to create the National Improper Marketing of Health Plans Working Group within the National Association of Insurance Commissioners.

Nationally, Commissioner Navarro and the department remain engaged in numerous industry organizations. The Commissioner was recently named Vice-Chair of the National Association of Insurance Commissioners’ Market Regulation and Consumer Affairs (D) Committee, a prestigious honor, in addition to being elected to the Executive Committee of the Northeast Zone and continuing to serve as Chair of the National Anti-Fraud Task Force. Delaware continues to participate in the Special Committee on Race and Insurance, the Healthcare Fraud Prevention Partnership, the National Insurance Crime Bureau Medical Task Force, the Delaware Valley Association of International Special Investigative Units, and other committees and groups.

In 2021, the General Assembly utilized virtual procedures for session. DOI pursued 14 pieces of legislation with our partners in Legislative Hall and engaged with more than 30 insurance-related bills, including legislation to regulate the multi-billion-dollar Pharmacy Benefit Manager industry, protecting consumers of auto and homeowner’s insurance, and making progress on issues like health care access and pharmaceutical costs. The DOI also continued to work on other legislative mandates, such as the Office of Value-Based Health Care Delivery.

In Market Conduct, 16 completed insurer examinations resulted in $1.2 million in fines, and several examinations are in progress. More than 50,000 licenses were issued, and licenses total more than 200,000. Across all lines of insurance, more than 30,000 rates and forms were processed and approved.

The Bureau of Examination, Rehabilitation and Guaranty oversees the financials of 136 domestic companies that manage $680.6 billion, and more than 2,000 other companies operating in the state. They completed 62 financial examinations, and have 49 exams in progress, in addition to completing nearly 3,500 other projects including Uniform Certificate of Authority Application amendments and Security Exchange Requests.

The Fraud Bureau worked to investigate many tips and reports, and 5 criminal cases of insurance fraud were indicted in addition to the collection of nearly $9,500 in civil penalties.

Going into 2022, businesses will see the fifth consecutive decrease in Workers’ Compensation premiums, an average reduction of more than 20%. The Workplace Safety team engaged more than 1,200 companies in earning additional savings in 2021.

The Captive Division, named a finalist for International Captive Domicile of the Year, received 70 new applications and has 759 licenses in effect.

View the 2021 Infographic