New law establishes a refundable tax credit for qualified investors in Delaware small businesses

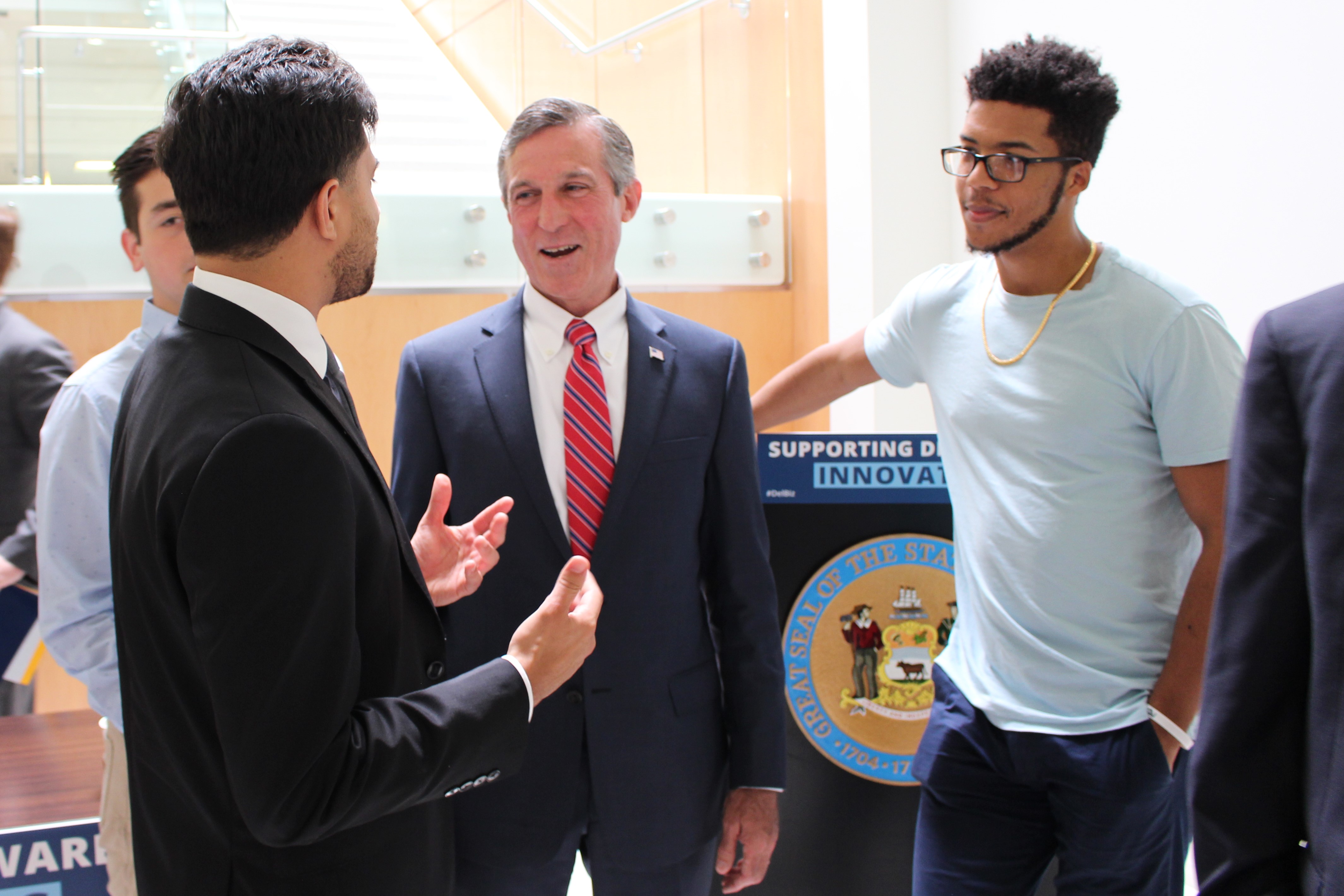

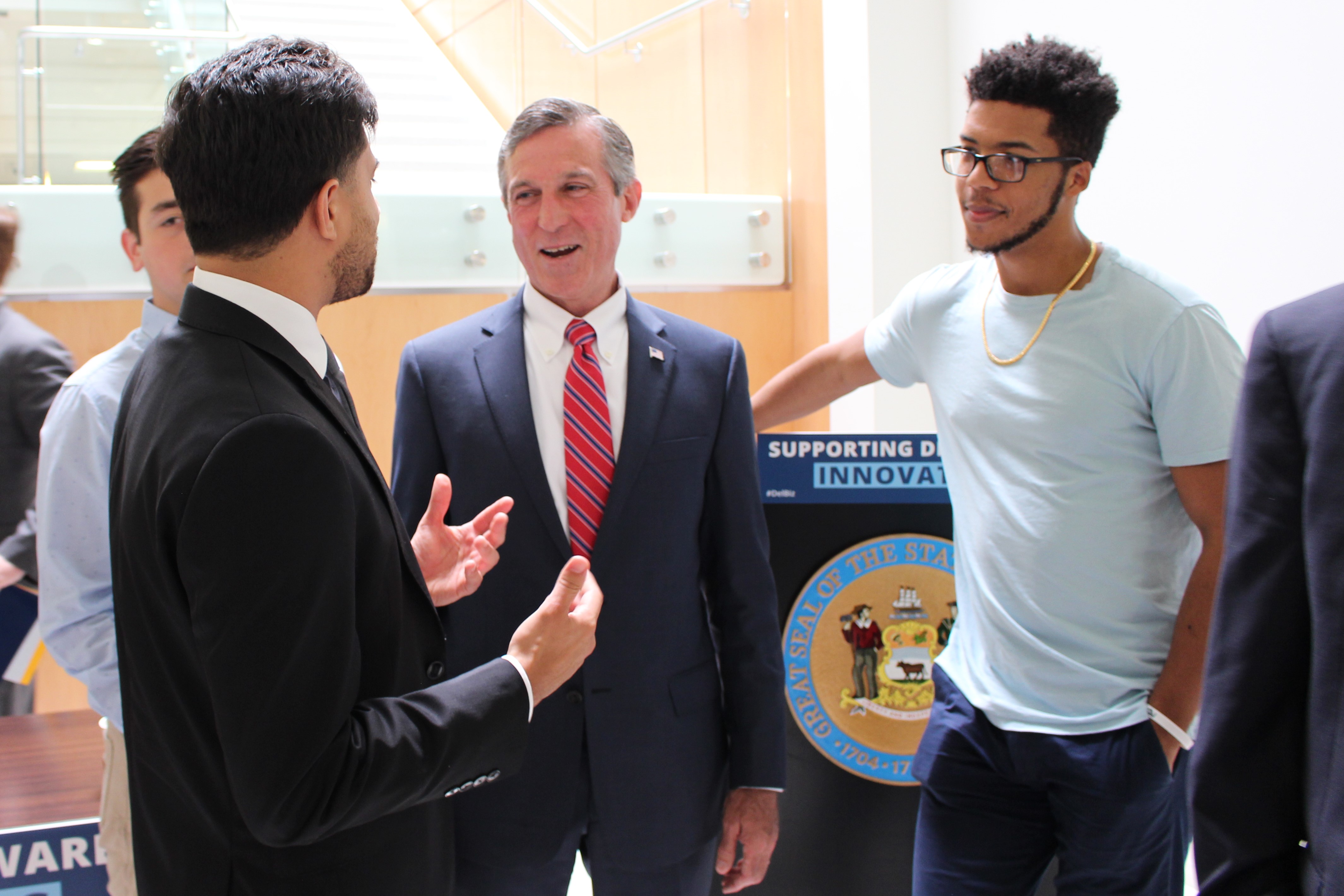

NEWARK, Del. – Governor John Carney on Thursday signed into law House Bill 170, the Angel Investor Job Creation and Innovation Act, at the Delaware Technology Park at the University of Delaware’s STAR Campus.

The Angel Investor Job Creation and Innovation Act establishes a refundable tax credit for qualified investors in Delaware small businesses to spur job creation and innovation. The law establishes guidelines for awarding a tax credit worth up to 25 percent of the investment in a qualified, Delaware-based small business. Businesses receiving the investment must pay decent wages, employ fewer than 25 employees, and engage in innovation in one of several areas as its primary business activity.

“We should do everything we can to support Delaware’s innovators and entrepreneurs who are leading Delaware’s new economy, and this law will help connect our most talented entrepreneurs with the resources they need to be successful,” said Governor Carney. “Delaware is already a hub of innovation, and this tax credit will help to encourage investments in innovative, Delaware-based small businesses.”

Governor Carney called for passage of the Angel Investor Job Creation and Innovation Act in his 2018 State of the State Address. The bipartisan legislation was sponsored by Representative Michael Ramone, Representative Bryon Short, Representative Melanie George Smith, and Representative Dave Wilson. Senate sponsors included Senate President Pro Tem David McBride and Senator Cathy Cloutier.

“As a prime sponsor of the Angel Investor Act, I know that by enacting this legislation we are taking a significant step in helping to strengthen Delaware’s economic development climate,” said Representative Michael Ramone. “Getting to this point today was certainly a collaborative effort by legislators, the Governor, and the small business community, and one that I believe will result in definite job growth in Delaware.”

“By encouraging investment in technology startups, Delaware is making another strategic move to enhance its economic competitiveness. It is painstaking and difficult work to advance a startup and this new program will provide an infusion of capital to businesses at a critical time,” said Representative Bryon Short. “These resources will foster innovation in our state and support entrepreneurs growing their businesses.”

“We believe that keeping innovation created in Delaware in the state is a key component of future success for the life sciences industry,” said Helen Stimson, President and CEO of Delaware BioScience Association. “We are delighted to have this new Angel Investor Tax Credit program to entice investors to support our startup companies. This benefit coupled with Delaware’s attractive R&D tax credit program provides key benefits needed to keep our innovators in the state.”

“As a longtime advocate and mentor of early stage technology-based businesses, the Angel Investor Tax Credit should be a stimulus for new investors to support entrepreneurs in Delaware,” said Michael Bowman, Associate Director of the University of Delaware’s Office of Economic Innovation and Partnerships, and President of the Delaware Technology Park.

###

Details about the Angel Investor Job Creation and Innovation Act:

The Angel Investor Job Creation and Innovation Act establishes guidelines for awarding a tax credit worth up to 25 percent of the investment in a qualified, Delaware-based small business. Businesses receiving the investment must pay decent wages, employ fewer than 25 employees, and engage in innovation in one of several areas as its primary business activity. By statute, the Delaware Division of Small Business will have until November 1, 2018 to create and publish an application for small businesses looking to participate in the program in calendar year 2019.

Qualified business activities include:

- Using proprietary technology to add value to a product, process, or service in a qualified high-technology field.

- Researching or developing a proprietary product, process, or service in a qualified high-technology field.

- Researching, developing, or producing a proprietary product, process, or service in the fields of agriculture, manufacturing, wildlife preservation, environmental science, financial technology, or transportation.

- Researching, developing, or producing a new proprietary technology for use in the fields of agriculture, manufacturing, financial technology, or transportation.