Working Individuals, Families Urged to Meet with Volunteer Tax Preparers to Check Earned Income Tax Credit Eligibility

Delaware Health and Social Services | Date Posted: Thursday, March 7, 2019

Delaware Health and Social Services | Date Posted: Thursday, March 7, 2019

NEW CASTLE (March 7, 2019) – The Department of Health and Social Services (DHSS) is urging working individuals and families in Delaware to meet with volunteer tax preparers at locations across the state to determine if they are eligible for the federal Earned Income Tax Credit (EITC) and to file a federal tax return by April 15 if they are.

In January, DHSS sent out notices to clients who might be eligible for the EITC, the single largest check that many working families receive each year. To be eligible, an individual or couple must have earned income from a job and meet other requirements. Income can come from salaries, wages, tips, commissions, royalties, self-employment net earnings, jury duty pay, union strike benefits, non-taxable combat pay or long-term disability benefits before the minimum retirement age.

“For thousands of working families and their children in Delaware, the Earned Income Tax Credit is a proven benefit, lifting many families out of poverty,” said DHSS Secretary Dr. Kara Odom Walker. “We urge individuals and families to meet with tax preparers across the state to help determine if they are eligible for this important tax credit and to file their tax returns.”

To qualify for EITC, for example, a single parent of two qualifying children must have earned income and adjusted gross income of less than $45,802 in 2018. For a married couple filing jointly with two qualifying children, the limit is less than $51,492. Other income requirements:

• A single parent with three or more children: $49,194 ($54,884 if married and filing jointly)

• A single parent with one child: $40,320 ($46,010 if married and filing jointly)

• Single, with no children: $15,270 ($20,950 if married and filing jointly)

The refundable tax credit means that tax filers are likely to get back more from the federal government than they pay in taxes, so they are in line for a significant refund. In Delaware last year, about 71,000 eligible workers and families received about $171 million through the Earned Income Tax Credit, with an average credit of $2,401. In the U.S., about 25 million eligible workers and families received about $63 billion through the EITC last year, with an average credit of $2,488.

“It is important to DHSS and our community partners to increase the number of Delaware working families who know about the Earned Income Tax Credit, as well as the number who apply for it,” said Ray Fitzgerald, director of DHSS’ Division of Social Services. “This is money that can make a real difference in the lives of so many people in Delaware and enhance the lives of their children.”

The list of Delaware Tax and Financial Services Campaign Sites open through April 15:

Fitzgerald said individuals and couples who plan to go to tax preparation sites need to bring these documents with them:

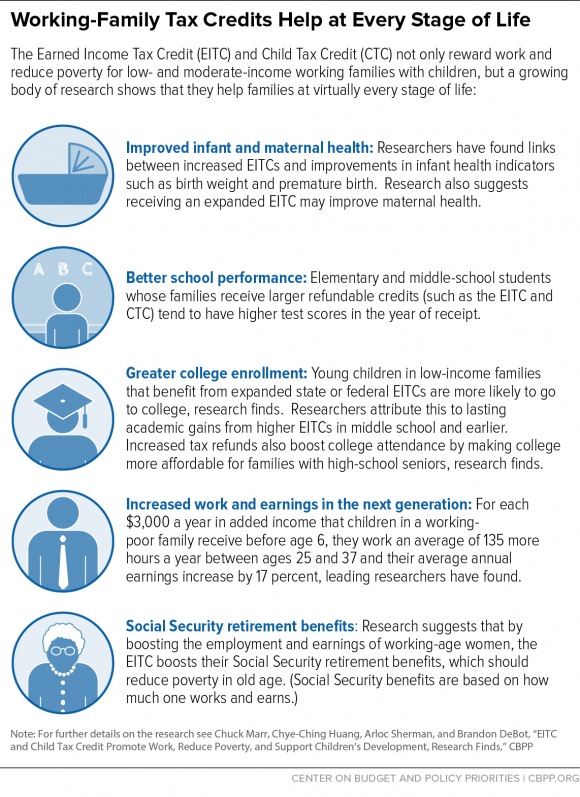

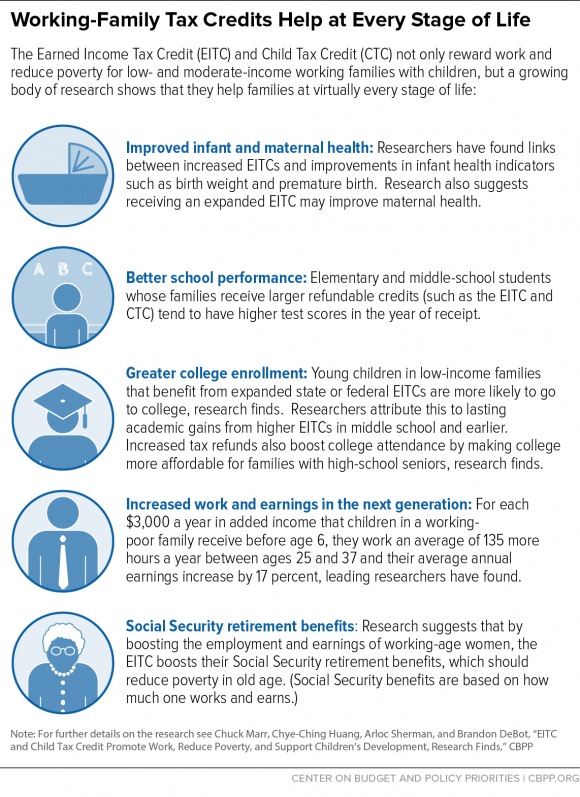

A growing body of research has found that the EITC increases incentives to work, stabilizes income, is linked to improvement in maternal and infant health, leads to better performance by children in school, and increases work effort and earnings when children reach adulthood. The IRS estimates that 20 percent to 25 percent of qualifying workers do not receive the tax credit because they do not file a federal return to claim it.

In Delaware, volunteers are needed at tax sites. Those who are interested can go to www.nehemiahgateway.org to sign up.

Keep up to date by receiving a daily digest email, around noon, of current news release posts from state agencies on news.delaware.gov.

Here you can subscribe to future news updates.

Delaware Health and Social Services | Date Posted: Thursday, March 7, 2019

NEW CASTLE (March 7, 2019) – The Department of Health and Social Services (DHSS) is urging working individuals and families in Delaware to meet with volunteer tax preparers at locations across the state to determine if they are eligible for the federal Earned Income Tax Credit (EITC) and to file a federal tax return by April 15 if they are.

In January, DHSS sent out notices to clients who might be eligible for the EITC, the single largest check that many working families receive each year. To be eligible, an individual or couple must have earned income from a job and meet other requirements. Income can come from salaries, wages, tips, commissions, royalties, self-employment net earnings, jury duty pay, union strike benefits, non-taxable combat pay or long-term disability benefits before the minimum retirement age.

“For thousands of working families and their children in Delaware, the Earned Income Tax Credit is a proven benefit, lifting many families out of poverty,” said DHSS Secretary Dr. Kara Odom Walker. “We urge individuals and families to meet with tax preparers across the state to help determine if they are eligible for this important tax credit and to file their tax returns.”

To qualify for EITC, for example, a single parent of two qualifying children must have earned income and adjusted gross income of less than $45,802 in 2018. For a married couple filing jointly with two qualifying children, the limit is less than $51,492. Other income requirements:

• A single parent with three or more children: $49,194 ($54,884 if married and filing jointly)

• A single parent with one child: $40,320 ($46,010 if married and filing jointly)

• Single, with no children: $15,270 ($20,950 if married and filing jointly)

The refundable tax credit means that tax filers are likely to get back more from the federal government than they pay in taxes, so they are in line for a significant refund. In Delaware last year, about 71,000 eligible workers and families received about $171 million through the Earned Income Tax Credit, with an average credit of $2,401. In the U.S., about 25 million eligible workers and families received about $63 billion through the EITC last year, with an average credit of $2,488.

“It is important to DHSS and our community partners to increase the number of Delaware working families who know about the Earned Income Tax Credit, as well as the number who apply for it,” said Ray Fitzgerald, director of DHSS’ Division of Social Services. “This is money that can make a real difference in the lives of so many people in Delaware and enhance the lives of their children.”

The list of Delaware Tax and Financial Services Campaign Sites open through April 15:

Fitzgerald said individuals and couples who plan to go to tax preparation sites need to bring these documents with them:

A growing body of research has found that the EITC increases incentives to work, stabilizes income, is linked to improvement in maternal and infant health, leads to better performance by children in school, and increases work effort and earnings when children reach adulthood. The IRS estimates that 20 percent to 25 percent of qualifying workers do not receive the tax credit because they do not file a federal return to claim it.

In Delaware, volunteers are needed at tax sites. Those who are interested can go to www.nehemiahgateway.org to sign up.

Keep up to date by receiving a daily digest email, around noon, of current news release posts from state agencies on news.delaware.gov.

Here you can subscribe to future news updates.