NEWS FEED

DPH Recognizes May as Lyme Disease Awareness Month

Date Posted: May 10, 2024

AG Jennings announces $10.25 million settlement with multiple major wireless carriers over deceptive advertising

Date Posted: May 9, 2024

Dept. of Labor Announces New Apprenticeship Pathway to College Credit for Delaware’s Vocational Workforce

Date Posted: May 9, 2024

Delaware Teachers Deserve Continuous Appreciation

Date Posted: May 8, 2024

Delaware to Join Public-Private Partnership to Build New Port

Date Posted: May 8, 2024

Jason Schaffer promoted to Deputy Warden at James T. Vaughn Correctional Center

Date Posted: May 7, 2024

DHSS Releases Fourth Annual Health Care Benchmark Trend Report

Date Posted: May 7, 2024

Departments of Labor & Education Team with Jobs for the Future to Celebrate National Youth Apprenticeship Week

Date Posted: May 7, 2024

Navarro Announces Completion of First Pharmacy Benefit Manager Exams

Date Posted: May 7, 2024

AG Jennings Secures Over $270 Million Settlement in Principle with Amneal Pharmaceuticals for Role in Opioid Crisis

Date Posted: May 6, 2024

May is Motorcycle Awareness Month

Date Posted: May 6, 2024

Delawareans Can Buy Discounted Compost Bins Online Through State-Initiated Program

Date Posted: May 6, 2024

Governor Carney Commends State of Delaware Employees in Celebration of Public Service Recognition Week, May 5-11

Date Posted: May 6, 2024

Brutal jewelry store robbery and assault results in conviction on all charges

Date Posted: May 6, 2024

Office of Marijuana Commissioner Opens Social Equity Workshop Registration

Date Posted: May 3, 2024

DNREC, City of Wilmington Unveil Revamped 7th Street Boating and Fishing Access Area

Date Posted: May 3, 2024

The Mezzanine Gallery to exhibit “15,000 Dowels” by Gregg Silvis

Date Posted: May 3, 2024

Governor Carney Announces Compassionate Champion Award Winners to Kick off Trauma Awareness Month

Date Posted: May 2, 2024

The Office of the Marijuana Commissioner Has Published the Official Proposed Regulations.

Date Posted: May 2, 2024

Nominate a Young Environmentalist for DNREC Awards

Date Posted: May 2, 2024

First employers sign onto transformative Delaware EARNS retirement benefit

Date Posted: May 2, 2024

Governor Carney Announces Delaware’s General Obligation Bonds Again Earn Triple-A Ratings and Attract Excellent Pricing

Date Posted: May 1, 2024

Northeast Insurance Departments Highlight Lyme Awareness Month

Date Posted: May 1, 2024

DOJ secures a murder conviction for violent gun offender

Date Posted: April 30, 2024

Delaware Forest Service Celebrates Arbor Day and Poster Contest Winners at Abbott’s Mill

Date Posted: April 30, 2024

Delaware Expands Electric Vehicle Rebates to Include Used Models Starting May 1

Date Posted: April 30, 2024

New Enforcement for Traffic Safety of Motorists Around Commercial Motor Vehicles

Date Posted: April 29, 2024

DOJ secures guilty plea for violent gun offender in cold case murder

Date Posted: April 29, 2024

DNREC Reopens Mulberry Landing Boat Ramp After Parking Lot Expansion

Date Posted: April 29, 2024

OSHA Delaware Unveils SafeDE on Worker’s Memorial Day, Pioneering a Safer Future for Workers

Date Posted: April 29, 2024

DSB Highlights Activities for National Small Business Week/Month 2024

Date Posted: April 26, 2024

Apply Now for Nonprofit Security Grant Program

Date Posted: April 26, 2024

DNREC, Center for Inland Bays to Partner on ‘Water Family Fest’ and Native Plant Sale Saturday, May 4

Date Posted: April 26, 2024

Charter School of Wilmington Wins 2024 Delaware Envirothon Championship

Date Posted: April 25, 2024

DSHA Celebrates $125 Million In Funding To Help Delawareans Achieve Homeownership

Date Posted: April 25, 2024

DNREC to Offer Training for Volunteer Monitors of Delaware’s Beach-Nesting Birds

Date Posted: April 25, 2024

Delaware Tutoring Efforts Recognized by National Learning Collaborative

Date Posted: April 25, 2024

DNREC Launches Online Flood Planning Tool

Date Posted: April 24, 2024

Kids Invited to Cast a Line at Youth Fishing Tournament

Date Posted: April 23, 2024

Delaware Officials Provide Latest Updates, Underscore Urgency Regarding Substance Use Disorder Outcomes in Delaware

Date Posted: April 22, 2024

DSB Partners with SBDC to Support Small Business Loan Program

Date Posted: April 22, 2024

Governor Carney Announces Opening of Application Period for Student Representative on State Board of Education

Date Posted: April 22, 2024

Delaware Forest Service Joins Daughters of the American Revolution to Establish Memorial Forest in Sussex County

Date Posted: April 22, 2024

Delaware Division of the Arts and The Biggs Museum of American Art Open Award Winners XXIV Exhibition

Date Posted: April 22, 2024

Delaware State Housing Authority Welcomes Emily Cunningham As Chief Of Staff

Date Posted: April 22, 2024

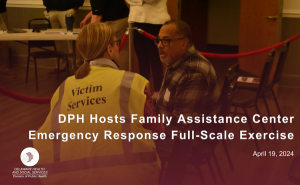

DPH Hosts Family Assistance Center Emergency Response Full-Scale Exercise

Date Posted: April 19, 2024

Attorney General Kathy Jennings supports new rules targeting money laundering

Date Posted: April 19, 2024

Delaware Division of the Arts Announces 13th Annual State Employee Art Exhibition Winners

Date Posted: April 19, 2024

NASCAR Driver Ross Chastain Partners with the Delaware Office of Highway Safety for 2024 Events

Date Posted: April 18, 2024

Three Schools Earn Delaware Purple Star Recognition

Date Posted: April 18, 2024

Wilmington’s Cab Calloway School of the Arts Crowned Junior Solar Sprint Champion

Date Posted: April 18, 2024

State Honors Top High School Seniors as 2024 Secretary of Education Scholars

Date Posted: April 18, 2024

DHSS Announces Health Fund Applications Due July 15

Date Posted: April 17, 2024

Delaware State Housing Authority Announces The Launch Of Its New And Improved Website

Date Posted: April 17, 2024

Governor Carney Orders Lowering of Flags

Date Posted: April 16, 2024

Delaware State Fire Commission Welcomes Mental Health and Wellness Administrator.

Date Posted: April 16, 2024

DelDOT Highlights National Work Zone Safety Awareness Week “Become a hero toward zero, their lives depend on it.”

Date Posted: April 16, 2024

The Delaware Office of Highway Safety Increases Enforcement for National Distracted Driving Awareness Month

Date Posted: April 15, 2024

Suspended Trooper faces prison after pleading guilty to six charges, including two felonies

Date Posted: April 12, 2024

Lt. Governor, School Districts, Philanthropist Launch Monetary Awards Program for Black Students

Date Posted: April 11, 2024

Attorney General Jennings obtains victory for manufactured housing residents

Date Posted: April 11, 2024

Delaware Cancer Consortium Hosts 2024 Biennial Retreat

Date Posted: April 10, 2024

$100,000 Grant Announced To Support Eviction Prevention Services In Delaware

Date Posted: April 9, 2024

Final NorthPak defendant convicted of two murders, more than 50 felonies

Date Posted: April 8, 2024

DHSS Seeks Comment on State Plan on Aging at Public Hearings This Month

Date Posted: April 5, 2024

Delaware Advances Toward 1 Million Tree Planting Goal

Date Posted: April 5, 2024

Treasurer Davis Encourages Delawareans to Prioritize Saving

Date Posted: April 5, 2024

Delaware Overdose Deaths Decrease for the First Time in Decade

Date Posted: April 4, 2024

State Offers Support for Students Applying for Financial Aid

Date Posted: April 4, 2024

Governor Carney, Secretary Garvin Celebrate Expansion of White Clay Creek State Park

Date Posted: April 3, 2024

State Agencies Join Forces Against Illegal Trash Dumping

Date Posted: April 2, 2024

DNREC to Offer Earth Day Beach Cleanup, Kids Crafts

Date Posted: April 2, 2024

Future Health Care Workers Win State Awards

Date Posted: April 2, 2024

The Mezzanine Gallery to exhibit “Within the Intimate Realm” by E. Schwinn

Date Posted: April 1, 2024

31-year DOC veteran named Warden of Howard R. Young Correctional Institution

Date Posted: March 28, 2024

Scotton Landing Boat Ramp Reopens for Spring

Date Posted: March 27, 2024

Delaware Teachers Named Finalists for National Mathematics, Science Teaching Award

Date Posted: March 27, 2024

Walk Down Memory Lane at Delaware Public Archives

Date Posted: March 27, 2024

DE Auditor Issues Special Report on Unemployment Insurance

Date Posted: March 26, 2024

DMV on the Go Gears Up for 2024 Season

Date Posted: March 26, 2024

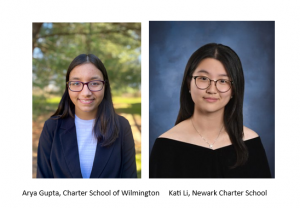

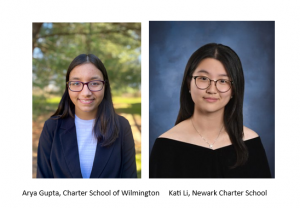

Two Students to Represent Delaware at National Science Camp

Date Posted: March 26, 2024

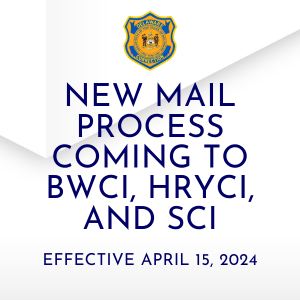

Department of Correction Expands Enhanced Mail Screening System To All State Prison Facilities

Date Posted: March 26, 2024

2024 Lt. Governor’s Challenge Seeks Applicants for Wellness Leader Awards

Date Posted: March 25, 2024

51st Annual DETSA Conference Celebrates Young Leaders, STEM and Innovation

Date Posted: March 25, 2024

DNREC Announces ‘Take a Kid Fishing!’ Spring Events

Date Posted: March 22, 2024

Bill Introduced to Protect Entities Serving the Legal Marijuana Industry

Date Posted: March 21, 2024

DNREC to Host Virtual Meeting on Deauville Beach Management Transition and New Entrance Fee Proposal

Date Posted: March 21, 2024

Delaware Inducts Three Farm Families into Century Farm Program

Date Posted: March 21, 2024

DPH Observes World Tuberculosis (TB) Day on March 24

Date Posted: March 21, 2024

DNREC, Kent Conservation District Offer Chesapeake Bay Implementation Grant Funding for Septic Tank Pump-outs

Date Posted: March 21, 2024

DNREC to Seek Community Water Project Proposals

Date Posted: March 20, 2024

Selbyville Fire

Date Posted: March 19, 2024

Delaware Department of Health and Social Services, Gov. Carney Announce Further Child Care Investments and Initiatives

Date Posted: March 19, 2024

Middle and High School Students Invited to Compete in Digital Mapping Technology Contest

Date Posted: March 19, 2024

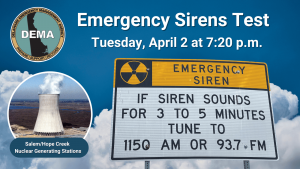

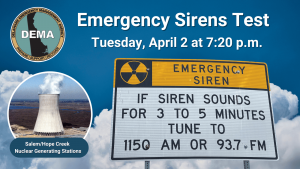

Emergency Sirens Test on April 2 and Potassium Iodide Event on April 4 in Middletown

Date Posted: March 19, 2024

Governor Carney Seeks Applications for Governor’s Summer Fellowship Program

Date Posted: March 19, 2024

Delaware to Open Upstate Trout Season With Youth-Only Fishing Day Set for April 6

Date Posted: March 19, 2024

First State Food System Program Opens Third Grant Application Cycle

Date Posted: March 18, 2024

Cynthia Karnai Confirmed As Director Of Delaware State Housing Authority

Date Posted: March 18, 2024

Governor’s Outstanding Volunteer Service Award Honorees to Be Recognized at April 4 Ceremony

Date Posted: March 18, 2024