Revenue Offers Assistance to Income Tax Filers

Department of Finance | Division of Revenue | Date Posted: Monday, October 15, 2018

Delaware’s First 2024 Evidence of West Nile Virus Detected in DNREC’s Sentinel Chickens

Date Posted: July 26, 2024

Governor Carney Honors DNREC’s 2024 Young Environmentalists, Youth Anglers at Delaware State Fair

Date Posted: July 25, 2024

DelDOT Announces EPA Climate Pollution Reduction Grant Award

Date Posted: July 24, 2024

Health Equity Institute of Delaware Offers Training to Clinical and Public Health Workers

Date Posted: July 24, 2024

Cape Henlopen State Park Community Workshop to be Held July 31

Date Posted: July 24, 2024

Delaware Tourism Office to Reopen the Sports Tourism Capital Investment Fund

Date Posted: July 24, 2024

Governor Carney Signs House Bill 125

Date Posted: July 23, 2024

Commissioner Navarro Launches Office of Long-Term Care Insurance

Date Posted: July 23, 2024

Use Extreme Caution Traveling through Work Zones

Date Posted: July 22, 2024

DSHA Celebrates $500 Million in Mortgage Financing with Discover Bank, Launches New Mortgage Products

Date Posted: July 22, 2024

DNREC Sinks Two Vintage Vessels on Delaware Reef Site 11, ‘The Redbird Reef,’ to Enhance Recreational Opportunities

Date Posted: July 22, 2024

AG Jennings takes action against financial adviser for charging unreasonable fees

Date Posted: July 19, 2024

Fire Commission Releases New Updates for EMS Protocols

Date Posted: July 19, 2024

DOJ secures significant prison time for habitual shoplifter turned robber

Date Posted: July 18, 2024

Application Period for Tree-Planting Project Funding Open

Date Posted: July 18, 2024

DNREC Highlights Boating Safety with New Life Rings at Woodland Beach

Date Posted: July 17, 2024

Volunteers Needed to Clean Up the Coast

Date Posted: July 16, 2024

DPH Urges the Public to Attempt to Reunite Stray Pets

Date Posted: July 16, 2024

Box Tree Moth Found at Private Residence in Kent County, Delaware

Date Posted: July 15, 2024

DNREC Unveils Delaware’s First Publicly Available All-Terrain Wheelchair

Date Posted: July 12, 2024

Delaware Students Excel at National STEM Conference

Date Posted: July 12, 2024

Grants to Support Students Experiencing Homelessness

Date Posted: July 12, 2024

DOJ secures lengthy prison sentence for violent gun offender

Date Posted: July 11, 2024

DNREC Again to Offer Popular ‘Life in the Bay’ Educational Seining Program for Families of All Ages

Date Posted: July 11, 2024

Delaware and r4 Technologies Launch Innovative Project to Address Food Insecurity and Food Waste

Date Posted: July 10, 2024

DNREC Soliciting Project Proposals For Surface Water Matching Planning Grants

Date Posted: July 10, 2024

SkillsUSA Students Earn National Recognition

Date Posted: July 9, 2024

“Odd Little Creatures” Take Over The Mezzanine Gallery This Summer

Date Posted: July 8, 2024

Governor Carney Announces Selections to Delaware Women’s Hall of Fame for 2024

Date Posted: July 8, 2024

AG Jennings launches portal to help businesses prepare for Personal Data Privacy Act enforcement

Date Posted: July 8, 2024

Governor Carney Orders Lowering of Flags

Date Posted: July 8, 2024

Delaware Division of Child Support Services Holding Town Hall Meetings

Date Posted: July 8, 2024

![]()

Explore Delaware’s Public Health Data Portal During National Environmental Public Health Tracking Awareness Week

Date Posted: July 8, 2024

Grants to Support Community Learning Centers

Date Posted: July 5, 2024

Free and Reduced-Price Meal Policy: Annual Announcement

Date Posted: July 5, 2024

Future Health Professionals Bring Home Honors

Date Posted: July 5, 2024

DNREC to Hold Virtual Joint Public Hearing July 9 on Proposed Offshore Wind Project

Date Posted: July 3, 2024

Mark Short Named Administrator of Delaware Standardbred Breeders’ Fund

Date Posted: July 2, 2024

Warning: Be Cautious of Predatory Practices related to Social Equity Licenses

Date Posted: July 2, 2024

Smyrna future educators bring home second consecutive national win

Date Posted: July 2, 2024

DPH Releases 2024 Burden of Chronic Disease Report

Date Posted: July 1, 2024

Groundbreaking Study Reveals Economic and Social Impact of Non-Profit Arts and Culture Sector in Delaware

Date Posted: July 1, 2024

Registration is Now Open for Delaware EARNS Retirement Benefit Program

Date Posted: July 1, 2024

DNREC Announces Arrival of 2024/25 Delaware Hunting and Trapping Guide

Date Posted: July 1, 2024

Hall-Long Highlights Historic Investments, Action for Delawareans

Date Posted: June 30, 2024

Governor Carney Shares Highlights from the Legislative Session

Date Posted: June 30, 2024

Governor Carney’s Statement on the Delaware Supreme Court Ruling

Date Posted: June 28, 2024

In unanimous ruling, Court sides with Jennings on voting rights

Date Posted: June 28, 2024

Governor Carney’s Statement on House Bill 282

Date Posted: June 27, 2024

AG Jennings’ statement on Supreme Court ruling in Harrington v. Purdue Pharma

Date Posted: June 27, 2024

Delaware Rare Disease Advisory Council Hosts First Meeting

Date Posted: June 27, 2024

AG Jennings announces leadership changes at DOJ

Date Posted: June 27, 2024

Fireworks in Delaware

Date Posted: June 26, 2024

DNREC Reminds Drive-On Surf Anglers Reservations are Required for Fourth of July Holiday

Date Posted: June 26, 2024

Black Bear in Newark Area Struck and Killed by Vehicle

Date Posted: June 26, 2024

DPH Cautions Public to Watch for Rabid Animals During Active Season

Date Posted: June 26, 2024

Former “Smackdown” defendant sentenced to 12 years for fentanyl charges

Date Posted: June 26, 2024

Safe Harbor for Financial Institutions Serving Legal Cannabis Businesses

Date Posted: June 26, 2024

Governor Carney’s Statement on Veto of House Bill 282

Date Posted: June 25, 2024

Deadline for Young Environmentalist Awards Nominations Extended to July 5

Date Posted: June 24, 2024

DNREC Invites Youngsters to Enjoy ‘Small Fry Adventures’ at Aquatic Resources Education Center

Date Posted: June 24, 2024

Two Men Arrested After Assaulting a Child and His Mother

Date Posted: June 23, 2024

With Delaware Under Severe Heat Watch for the Weekend, DPH Offers Tips to Vulnerable Populations at Risk

Date Posted: June 21, 2024

Governor Carney’s Statement on the Passage of the FY25 Budget and One-Time Supplemental

Date Posted: June 20, 2024

Delaware Tourism Office Announces Sports Tourism Capital Investment Fund Awardees

Date Posted: June 20, 2024

Governor Carney’s Statement on Senate Confirmations

Date Posted: June 20, 2024

DPH Partners with Delta Sigma Theta Sorority to Provide Free Health Screenings, Cancer Prevention Education to Kent Co.

Date Posted: June 20, 2024

DOJ secures conviction in violent gun case

Date Posted: June 20, 2024

Electronic Speed Safety Program to begin in I-95/Route 896 Construction Zone

Date Posted: June 18, 2024

The Office of the Marijuana Commissioner launched the Social Equity Eligibility Validation Application and DIA Map

Date Posted: June 18, 2024

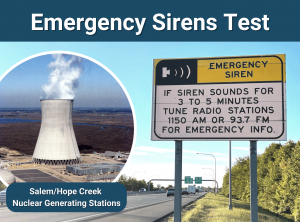

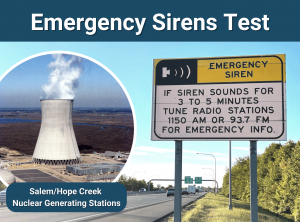

Emergency Sirens Test on July 2

Date Posted: June 18, 2024

DPH Notifies of Rise in Pertussis (Whooping Cough) Cases in New Castle County

Date Posted: June 14, 2024

Jennings can fight for Nemours funding, appeals court rules

Date Posted: June 14, 2024

Governor Carney Signs House Bill 350

Date Posted: June 13, 2024

DNREC Revises Recreational Striped Bass Summer Slot Season Limit for Compliance With ASMFC Plan

Date Posted: June 13, 2024

Summer Safety

Date Posted: June 12, 2024

DNREC to Treat Two Downstate Public Ponds During June for Invasive Aquatic Weed Hydrilla

Date Posted: June 12, 2024

End of Cape Henlopen Fishing Pier to Remain Closed for Structural Repairs

Date Posted: June 12, 2024

Attorney General Kathy Jennings Reaches $700 Million Settlement Against Johnson and Johnson

Date Posted: June 11, 2024

Information Meetings To Highlight Energy Efficiency Programs

Date Posted: June 11, 2024

DNREC and Kent Conservation District Announce Fall Cover Crop Cost Share Sign-Up Period Through Aug. 30

Date Posted: June 10, 2024

Delaware Announces Option for Dolly Parton’s Imagination Library Bilingual Book Collection

Date Posted: June 10, 2024

Winners Announced in DNREC’s Haiku Poetry Contest

Date Posted: June 8, 2024

DelDOT, Georgetown Celebrate Completion of Park Avenue Phase 1 Project

Date Posted: June 7, 2024

Delaware 250 Grants for Museums, Heritage Groups, and Non-Profits – Summer 2024 Cycle

Date Posted: June 7, 2024

The Mezzanine Gallery to exhibit Don James’ “Beyond the Facade: Architectural Portraits”

Date Posted: June 7, 2024

DPH’s PANO Program Hosts Second Annual Advancing Healthy Lifestyles Conference

Date Posted: June 6, 2024

Dagsboro Angler Wins Annual Youth Fishing Tournament Second Year in a Row

Date Posted: June 6, 2024

Middle and High School Students Honored in Digital Mapping Technology Contest

Date Posted: June 6, 2024

Governor Carney Orders Lowering of Flags

Date Posted: June 6, 2024

DNREC to Offer June 13 Lecture on Living Shorelines for Home and Property Owners

Date Posted: June 4, 2024

Governor Carney Announces Judicial Nominations

Date Posted: June 3, 2024

Delaware First to Focus on Healthier Start for New Moms with 12 Weeks of Free Diapers, Home-Delivered Meals

Date Posted: June 3, 2024

Gov. Carney, DSHA and Habitat for Humanity of New Castle County Join Forces to Promote Homeownership Month

Date Posted: June 3, 2024

Program to Help Foster Youth Pursue Higher Education Returns

Date Posted: June 3, 2024

Delaware Day of Action with REFORM Alliance Highlights Reentry Supports, System Change

Date Posted: May 31, 2024

Defendant faces lengthy prison sentence after child pornography convictions

Date Posted: May 31, 2024

Delaware 250 Announces Spring 2024 Grant Recipients

Date Posted: May 31, 2024

Fentanyl dealer sentenced to 18 years

Date Posted: May 30, 2024

Hall-Long, Community Leaders Celebrate 2024 Lt. Governor’s Challenge Honorees

Date Posted: May 30, 2024

Delaware’s First 2024 Evidence of West Nile Virus Detected in DNREC’s Sentinel Chickens

Date Posted: July 26, 2024

Governor Carney Honors DNREC’s 2024 Young Environmentalists, Youth Anglers at Delaware State Fair

Date Posted: July 25, 2024

DelDOT Announces EPA Climate Pollution Reduction Grant Award

Date Posted: July 24, 2024

Health Equity Institute of Delaware Offers Training to Clinical and Public Health Workers

Date Posted: July 24, 2024

Cape Henlopen State Park Community Workshop to be Held July 31

Date Posted: July 24, 2024

Delaware Tourism Office to Reopen the Sports Tourism Capital Investment Fund

Date Posted: July 24, 2024

Governor Carney Signs House Bill 125

Date Posted: July 23, 2024

Commissioner Navarro Launches Office of Long-Term Care Insurance

Date Posted: July 23, 2024

Use Extreme Caution Traveling through Work Zones

Date Posted: July 22, 2024

DSHA Celebrates $500 Million in Mortgage Financing with Discover Bank, Launches New Mortgage Products

Date Posted: July 22, 2024

DNREC Sinks Two Vintage Vessels on Delaware Reef Site 11, ‘The Redbird Reef,’ to Enhance Recreational Opportunities

Date Posted: July 22, 2024

AG Jennings takes action against financial adviser for charging unreasonable fees

Date Posted: July 19, 2024

Fire Commission Releases New Updates for EMS Protocols

Date Posted: July 19, 2024

DOJ secures significant prison time for habitual shoplifter turned robber

Date Posted: July 18, 2024

Application Period for Tree-Planting Project Funding Open

Date Posted: July 18, 2024

DNREC Highlights Boating Safety with New Life Rings at Woodland Beach

Date Posted: July 17, 2024

Volunteers Needed to Clean Up the Coast

Date Posted: July 16, 2024

DPH Urges the Public to Attempt to Reunite Stray Pets

Date Posted: July 16, 2024

Box Tree Moth Found at Private Residence in Kent County, Delaware

Date Posted: July 15, 2024

DNREC Unveils Delaware’s First Publicly Available All-Terrain Wheelchair

Date Posted: July 12, 2024

Delaware Students Excel at National STEM Conference

Date Posted: July 12, 2024

Grants to Support Students Experiencing Homelessness

Date Posted: July 12, 2024

DOJ secures lengthy prison sentence for violent gun offender

Date Posted: July 11, 2024

DNREC Again to Offer Popular ‘Life in the Bay’ Educational Seining Program for Families of All Ages

Date Posted: July 11, 2024

Delaware and r4 Technologies Launch Innovative Project to Address Food Insecurity and Food Waste

Date Posted: July 10, 2024

DNREC Soliciting Project Proposals For Surface Water Matching Planning Grants

Date Posted: July 10, 2024

SkillsUSA Students Earn National Recognition

Date Posted: July 9, 2024

“Odd Little Creatures” Take Over The Mezzanine Gallery This Summer

Date Posted: July 8, 2024

Governor Carney Announces Selections to Delaware Women’s Hall of Fame for 2024

Date Posted: July 8, 2024

AG Jennings launches portal to help businesses prepare for Personal Data Privacy Act enforcement

Date Posted: July 8, 2024

Governor Carney Orders Lowering of Flags

Date Posted: July 8, 2024

Delaware Division of Child Support Services Holding Town Hall Meetings

Date Posted: July 8, 2024

![]()

Explore Delaware’s Public Health Data Portal During National Environmental Public Health Tracking Awareness Week

Date Posted: July 8, 2024

Grants to Support Community Learning Centers

Date Posted: July 5, 2024

Free and Reduced-Price Meal Policy: Annual Announcement

Date Posted: July 5, 2024

Future Health Professionals Bring Home Honors

Date Posted: July 5, 2024

DNREC to Hold Virtual Joint Public Hearing July 9 on Proposed Offshore Wind Project

Date Posted: July 3, 2024

Mark Short Named Administrator of Delaware Standardbred Breeders’ Fund

Date Posted: July 2, 2024

Warning: Be Cautious of Predatory Practices related to Social Equity Licenses

Date Posted: July 2, 2024

Smyrna future educators bring home second consecutive national win

Date Posted: July 2, 2024

DPH Releases 2024 Burden of Chronic Disease Report

Date Posted: July 1, 2024

Groundbreaking Study Reveals Economic and Social Impact of Non-Profit Arts and Culture Sector in Delaware

Date Posted: July 1, 2024

Registration is Now Open for Delaware EARNS Retirement Benefit Program

Date Posted: July 1, 2024

DNREC Announces Arrival of 2024/25 Delaware Hunting and Trapping Guide

Date Posted: July 1, 2024

Hall-Long Highlights Historic Investments, Action for Delawareans

Date Posted: June 30, 2024

Governor Carney Shares Highlights from the Legislative Session

Date Posted: June 30, 2024

Governor Carney’s Statement on the Delaware Supreme Court Ruling

Date Posted: June 28, 2024

In unanimous ruling, Court sides with Jennings on voting rights

Date Posted: June 28, 2024

Governor Carney’s Statement on House Bill 282

Date Posted: June 27, 2024

AG Jennings’ statement on Supreme Court ruling in Harrington v. Purdue Pharma

Date Posted: June 27, 2024

Delaware Rare Disease Advisory Council Hosts First Meeting

Date Posted: June 27, 2024

AG Jennings announces leadership changes at DOJ

Date Posted: June 27, 2024

Fireworks in Delaware

Date Posted: June 26, 2024

DNREC Reminds Drive-On Surf Anglers Reservations are Required for Fourth of July Holiday

Date Posted: June 26, 2024

Black Bear in Newark Area Struck and Killed by Vehicle

Date Posted: June 26, 2024

DPH Cautions Public to Watch for Rabid Animals During Active Season

Date Posted: June 26, 2024

Former “Smackdown” defendant sentenced to 12 years for fentanyl charges

Date Posted: June 26, 2024

Safe Harbor for Financial Institutions Serving Legal Cannabis Businesses

Date Posted: June 26, 2024

Governor Carney’s Statement on Veto of House Bill 282

Date Posted: June 25, 2024

Deadline for Young Environmentalist Awards Nominations Extended to July 5

Date Posted: June 24, 2024

DNREC Invites Youngsters to Enjoy ‘Small Fry Adventures’ at Aquatic Resources Education Center

Date Posted: June 24, 2024

Two Men Arrested After Assaulting a Child and His Mother

Date Posted: June 23, 2024

With Delaware Under Severe Heat Watch for the Weekend, DPH Offers Tips to Vulnerable Populations at Risk

Date Posted: June 21, 2024

Governor Carney’s Statement on the Passage of the FY25 Budget and One-Time Supplemental

Date Posted: June 20, 2024

Delaware Tourism Office Announces Sports Tourism Capital Investment Fund Awardees

Date Posted: June 20, 2024

Governor Carney’s Statement on Senate Confirmations

Date Posted: June 20, 2024

DPH Partners with Delta Sigma Theta Sorority to Provide Free Health Screenings, Cancer Prevention Education to Kent Co.

Date Posted: June 20, 2024

DOJ secures conviction in violent gun case

Date Posted: June 20, 2024

Electronic Speed Safety Program to begin in I-95/Route 896 Construction Zone

Date Posted: June 18, 2024

The Office of the Marijuana Commissioner launched the Social Equity Eligibility Validation Application and DIA Map

Date Posted: June 18, 2024

Emergency Sirens Test on July 2

Date Posted: June 18, 2024

DPH Notifies of Rise in Pertussis (Whooping Cough) Cases in New Castle County

Date Posted: June 14, 2024

Jennings can fight for Nemours funding, appeals court rules

Date Posted: June 14, 2024

Governor Carney Signs House Bill 350

Date Posted: June 13, 2024

DNREC Revises Recreational Striped Bass Summer Slot Season Limit for Compliance With ASMFC Plan

Date Posted: June 13, 2024

Summer Safety

Date Posted: June 12, 2024

DNREC to Treat Two Downstate Public Ponds During June for Invasive Aquatic Weed Hydrilla

Date Posted: June 12, 2024

End of Cape Henlopen Fishing Pier to Remain Closed for Structural Repairs

Date Posted: June 12, 2024

Attorney General Kathy Jennings Reaches $700 Million Settlement Against Johnson and Johnson

Date Posted: June 11, 2024

Information Meetings To Highlight Energy Efficiency Programs

Date Posted: June 11, 2024

DNREC and Kent Conservation District Announce Fall Cover Crop Cost Share Sign-Up Period Through Aug. 30

Date Posted: June 10, 2024

Delaware Announces Option for Dolly Parton’s Imagination Library Bilingual Book Collection

Date Posted: June 10, 2024

Winners Announced in DNREC’s Haiku Poetry Contest

Date Posted: June 8, 2024

DelDOT, Georgetown Celebrate Completion of Park Avenue Phase 1 Project

Date Posted: June 7, 2024

Delaware 250 Grants for Museums, Heritage Groups, and Non-Profits – Summer 2024 Cycle

Date Posted: June 7, 2024

The Mezzanine Gallery to exhibit Don James’ “Beyond the Facade: Architectural Portraits”

Date Posted: June 7, 2024

DPH’s PANO Program Hosts Second Annual Advancing Healthy Lifestyles Conference

Date Posted: June 6, 2024

Dagsboro Angler Wins Annual Youth Fishing Tournament Second Year in a Row

Date Posted: June 6, 2024

Middle and High School Students Honored in Digital Mapping Technology Contest

Date Posted: June 6, 2024

Governor Carney Orders Lowering of Flags

Date Posted: June 6, 2024

DNREC to Offer June 13 Lecture on Living Shorelines for Home and Property Owners

Date Posted: June 4, 2024

Governor Carney Announces Judicial Nominations

Date Posted: June 3, 2024

Delaware First to Focus on Healthier Start for New Moms with 12 Weeks of Free Diapers, Home-Delivered Meals

Date Posted: June 3, 2024

Gov. Carney, DSHA and Habitat for Humanity of New Castle County Join Forces to Promote Homeownership Month

Date Posted: June 3, 2024

Program to Help Foster Youth Pursue Higher Education Returns

Date Posted: June 3, 2024

Delaware Day of Action with REFORM Alliance Highlights Reentry Supports, System Change

Date Posted: May 31, 2024

Defendant faces lengthy prison sentence after child pornography convictions

Date Posted: May 31, 2024

Delaware 250 Announces Spring 2024 Grant Recipients

Date Posted: May 31, 2024

Fentanyl dealer sentenced to 18 years

Date Posted: May 30, 2024

Hall-Long, Community Leaders Celebrate 2024 Lt. Governor’s Challenge Honorees

Date Posted: May 30, 2024

Department of Finance | Division of Revenue | Date Posted: Monday, October 15, 2018

The Division of Revenue is aware that some business taxpayers may be struggling with the complexity of changes resulting from recent federal tax reform. For those businesses filing in multiple states, many of which have different rules and deadlines, the complexity is compounded. The Division recognizes that some taxpayers may have trouble meeting Delaware’s filing deadline because the extended due date of Delaware income tax returns coincides with the extended due date for federal returns.

As a result, the Division will consider requests for abatement of penalties for late filing, with reasonable cause, of any Forms 1100, 1100-S, 300, and 400 on a case-by-case basis – provided those returns are filed on or before November 15, 2018. Please note: you should not submit a request for abatement until after you have received a notice proposing the assessment of penalties.

The taxpayer’s request for abatement of late filing penalties due to reasonable cause should be submitted by email to: taxconferee@delaware.gov, or in writing to:

Campbell Hay, Esquire

Tax Conferee

Delaware Division of Revenue

P. O. Box 8714

Wilmington, DE 19801

Related Topics: abatement, business tax, due date, filing deadline, tax conferee, tax return

Keep up to date by receiving a daily digest email, around noon, of current news release posts from state agencies on news.delaware.gov.

Here you can subscribe to future news updates.

Department of Finance | Division of Revenue | Date Posted: Monday, October 15, 2018

The Division of Revenue is aware that some business taxpayers may be struggling with the complexity of changes resulting from recent federal tax reform. For those businesses filing in multiple states, many of which have different rules and deadlines, the complexity is compounded. The Division recognizes that some taxpayers may have trouble meeting Delaware’s filing deadline because the extended due date of Delaware income tax returns coincides with the extended due date for federal returns.

As a result, the Division will consider requests for abatement of penalties for late filing, with reasonable cause, of any Forms 1100, 1100-S, 300, and 400 on a case-by-case basis – provided those returns are filed on or before November 15, 2018. Please note: you should not submit a request for abatement until after you have received a notice proposing the assessment of penalties.

The taxpayer’s request for abatement of late filing penalties due to reasonable cause should be submitted by email to: taxconferee@delaware.gov, or in writing to:

Campbell Hay, Esquire

Tax Conferee

Delaware Division of Revenue

P. O. Box 8714

Wilmington, DE 19801

Related Topics: abatement, business tax, due date, filing deadline, tax conferee, tax return

Keep up to date by receiving a daily digest email, around noon, of current news release posts from state agencies on news.delaware.gov.

Here you can subscribe to future news updates.

Delaware's Governor

State Agencies

Elected Officials

General Assembly

Delaware Courts

State Employees

Cities & Towns

Delaware State Code

State Regulations

Business First Steps

Phone Directory

Locations Directory

Public Meetings

Voting & Elections

Transparency

Delaware Marketplace

Tax Center

Personal Income Tax

Privacy Policy

Weather & Travel

Contact Us

Corporations

Franchise Tax

Gross Receipts Tax

Withholding Tax

Delaware Topics

Help Center

Mobile Apps

E-mail / Text Alerts

Social Media

Built by the Government Information Center

©MMXXIV Delaware.gov