Revised Flood Insurance Rate Maps to become effective Jan. 22 for portions of New Castle County

Department of Natural Resources and Environmental Control | Division of Watershed Stewardship | Date Posted: Wednesday, January 8, 2020

Department of Natural Resources and Environmental Control | Division of Watershed Stewardship | Date Posted: Wednesday, January 8, 2020

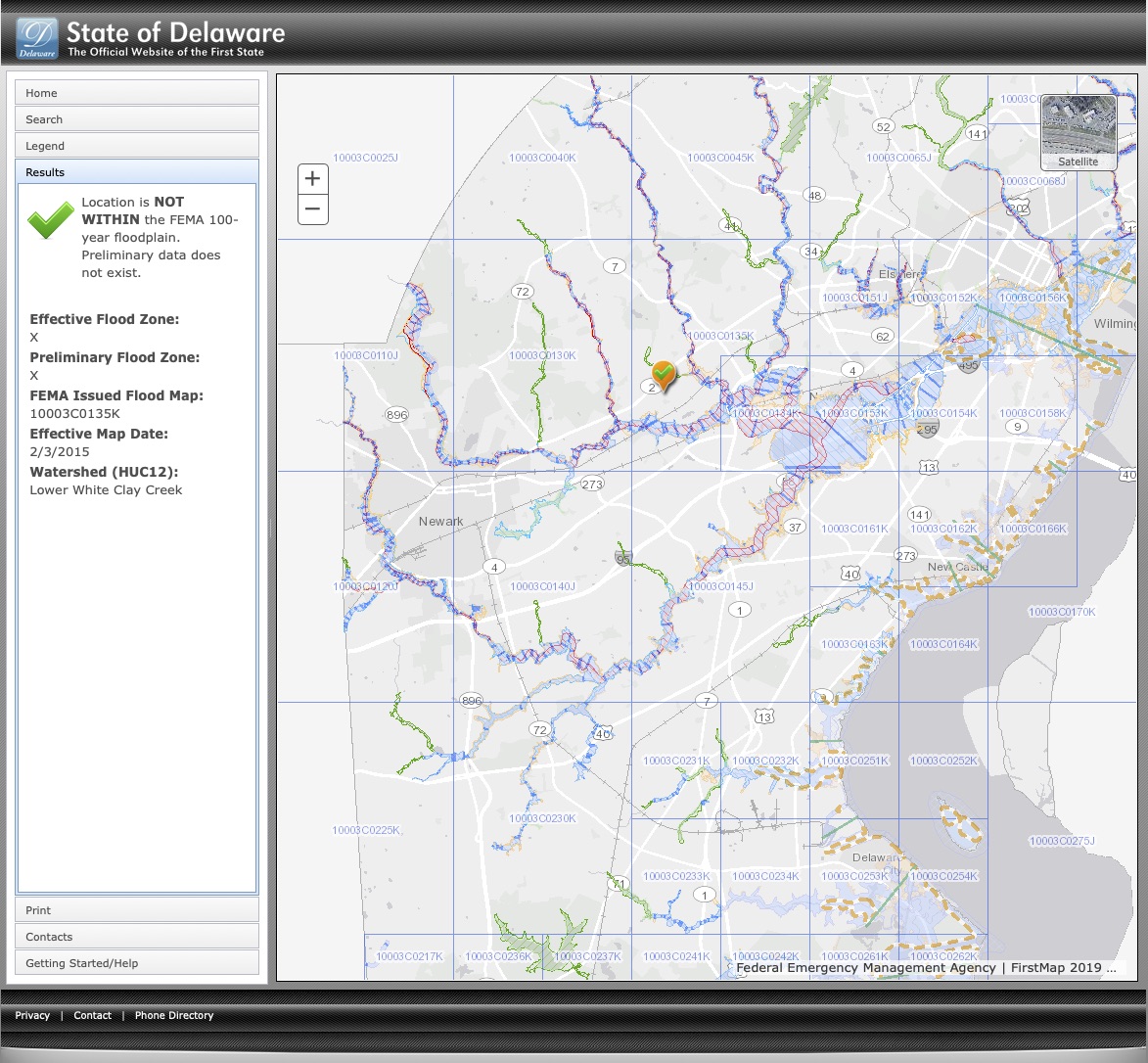

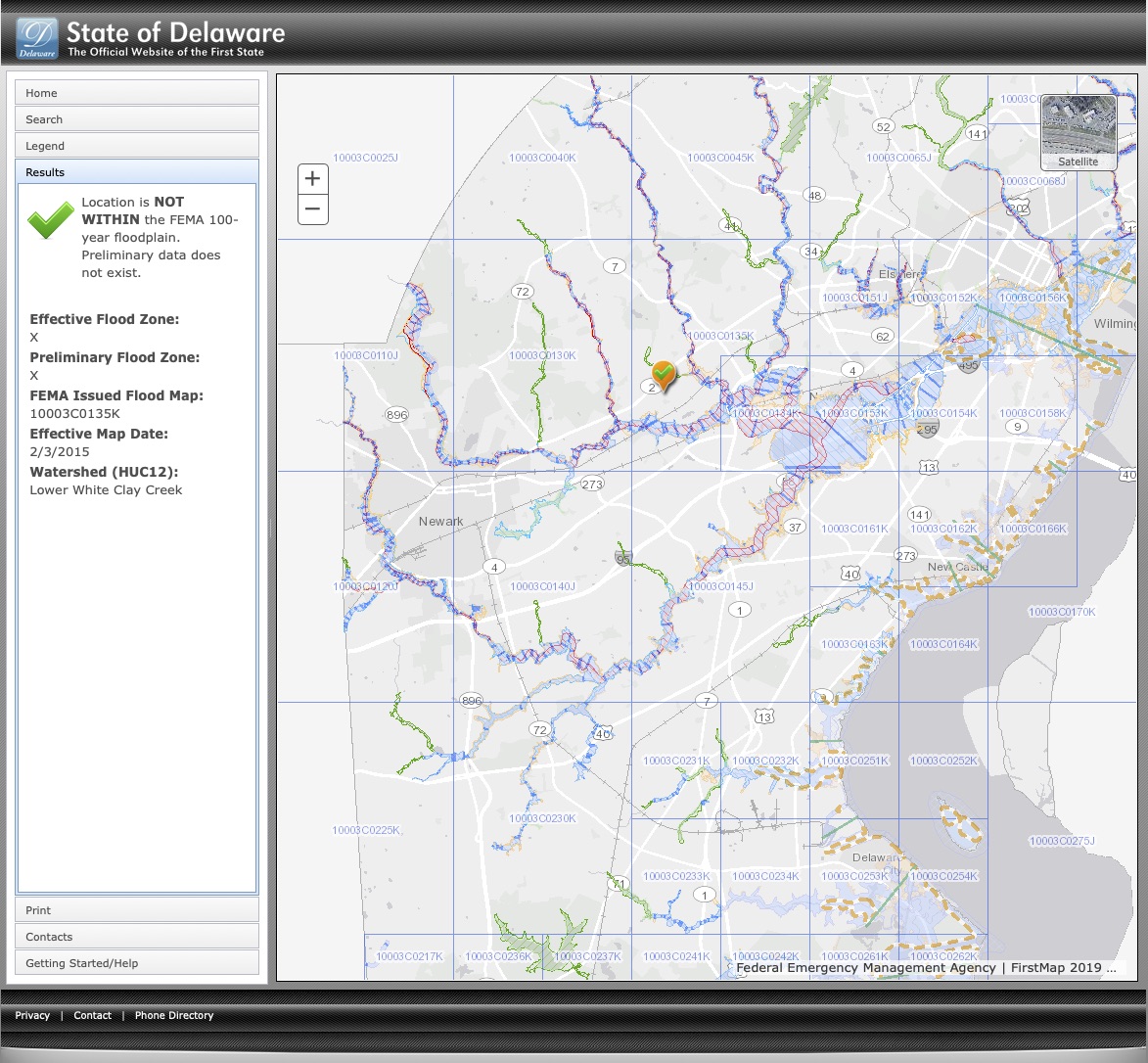

DOVER – DNREC’s Division of Watershed Stewardship announced today that revised FEMA Flood Insurance Rate Maps in portions of New Castle County will become effective Jan. 22. The revisions were made by DNREC through a cooperating technical partnership with FEMA, and include more than 96 miles of streams in areas at risk of flooding. Revised mapping is concentrated in the Brandywine-Christina Watershed, but includes streams throughout New Castle County.

Flood risks are generally increasing over time due to factors such as watershed development and sea level rise. Updating FEMA’s Flood Insurance Rate Map (FIRM) mapping to reflect current conditions is a critical way to depict these changing risks. Accurate maps give communities the tools they need to improve their resiliency to flood risk, and help consumers make informed decisions about flood insurance purchases.

Hydrologic studies that determine floodwater flows, base flood elevations, and more accurate floodplain boundaries, were performed by DNREC in parts of New Castle County that had been previously identified to have inaccurate floodplain maps. With these results, base flood elevations for many areas are now shown on FEMA’s maps for the first time, providing property owners with more detailed and accurate flood risk assessments.

Standard property insurance does not cover flood damage. FEMA’s National Flood Insurance Program makes flood insurance available to local property owners. Mortgage lenders require borrowers whose properties are located in designated special flood hazard areas (SFHAs) to purchase flood insurance as a condition of receiving a federally-backed mortgage loan. For structures that are newly mapped into the SFHA, property owners are eligible for a lower-cost preferred risk policy, if they purchase a policy during the first 12 months after the FIRMs are revised. Rates will then increase no more than 18 percent per year, until they reach the full-risk rate. For properties that are newly removed from the SFHA, property owners may convert their high-risk policy to a preferred risk policy, resulting in a lower premium.

For more information on the revised FIRMs, contact Gina Tonn, Division of Watershed Stewardship, at 302-739-9921. To view the maps online, DNREC’s flood mapping tool is available at de.gov/floodplanning.

Media Contact: Beth Shockley, Public Affairs, 302-739-9902

Related Topics: dnrec, drainage and stormwater, fema, floodplain, health and safety, maps, New Castle County

Keep up to date by receiving a daily digest email, around noon, of current news release posts from state agencies on news.delaware.gov.

Here you can subscribe to future news updates.

Department of Natural Resources and Environmental Control | Division of Watershed Stewardship | Date Posted: Wednesday, January 8, 2020

DOVER – DNREC’s Division of Watershed Stewardship announced today that revised FEMA Flood Insurance Rate Maps in portions of New Castle County will become effective Jan. 22. The revisions were made by DNREC through a cooperating technical partnership with FEMA, and include more than 96 miles of streams in areas at risk of flooding. Revised mapping is concentrated in the Brandywine-Christina Watershed, but includes streams throughout New Castle County.

Flood risks are generally increasing over time due to factors such as watershed development and sea level rise. Updating FEMA’s Flood Insurance Rate Map (FIRM) mapping to reflect current conditions is a critical way to depict these changing risks. Accurate maps give communities the tools they need to improve their resiliency to flood risk, and help consumers make informed decisions about flood insurance purchases.

Hydrologic studies that determine floodwater flows, base flood elevations, and more accurate floodplain boundaries, were performed by DNREC in parts of New Castle County that had been previously identified to have inaccurate floodplain maps. With these results, base flood elevations for many areas are now shown on FEMA’s maps for the first time, providing property owners with more detailed and accurate flood risk assessments.

Standard property insurance does not cover flood damage. FEMA’s National Flood Insurance Program makes flood insurance available to local property owners. Mortgage lenders require borrowers whose properties are located in designated special flood hazard areas (SFHAs) to purchase flood insurance as a condition of receiving a federally-backed mortgage loan. For structures that are newly mapped into the SFHA, property owners are eligible for a lower-cost preferred risk policy, if they purchase a policy during the first 12 months after the FIRMs are revised. Rates will then increase no more than 18 percent per year, until they reach the full-risk rate. For properties that are newly removed from the SFHA, property owners may convert their high-risk policy to a preferred risk policy, resulting in a lower premium.

For more information on the revised FIRMs, contact Gina Tonn, Division of Watershed Stewardship, at 302-739-9921. To view the maps online, DNREC’s flood mapping tool is available at de.gov/floodplanning.

Media Contact: Beth Shockley, Public Affairs, 302-739-9902

Related Topics: dnrec, drainage and stormwater, fema, floodplain, health and safety, maps, New Castle County

Keep up to date by receiving a daily digest email, around noon, of current news release posts from state agencies on news.delaware.gov.

Here you can subscribe to future news updates.