NEWS FEED

Delaware’s First 2024 Evidence of West Nile Virus Detected in DNREC’s Sentinel Chickens

Date Posted: July 26, 2024

Governor Carney Honors DNREC’s 2024 Young Environmentalists, Youth Anglers at Delaware State Fair

Date Posted: July 25, 2024

DelDOT Announces EPA Climate Pollution Reduction Grant Award

Date Posted: July 24, 2024

Health Equity Institute of Delaware Offers Training to Clinical and Public Health Workers

Date Posted: July 24, 2024

Cape Henlopen State Park Community Workshop to be Held July 31

Date Posted: July 24, 2024

Delaware Tourism Office to Reopen the Sports Tourism Capital Investment Fund

Date Posted: July 24, 2024

Governor Carney Signs House Bill 125

Date Posted: July 23, 2024

Commissioner Navarro Launches Office of Long-Term Care Insurance

Date Posted: July 23, 2024

Use Extreme Caution Traveling through Work Zones

Date Posted: July 22, 2024

DSHA Celebrates $500 Million in Mortgage Financing with Discover Bank, Launches New Mortgage Products

Date Posted: July 22, 2024

DNREC Sinks Two Vintage Vessels on Delaware Reef Site 11, ‘The Redbird Reef,’ to Enhance Recreational Opportunities

Date Posted: July 22, 2024

AG Jennings takes action against financial adviser for charging unreasonable fees

Date Posted: July 19, 2024

Fire Commission Releases New Updates for EMS Protocols

Date Posted: July 19, 2024

DOJ secures significant prison time for habitual shoplifter turned robber

Date Posted: July 18, 2024

Application Period for Tree-Planting Project Funding Open

Date Posted: July 18, 2024

DNREC Highlights Boating Safety with New Life Rings at Woodland Beach

Date Posted: July 17, 2024

Volunteers Needed to Clean Up the Coast

Date Posted: July 16, 2024

DPH Urges the Public to Attempt to Reunite Stray Pets

Date Posted: July 16, 2024

Box Tree Moth Found at Private Residence in Kent County, Delaware

Date Posted: July 15, 2024

DNREC Unveils Delaware’s First Publicly Available All-Terrain Wheelchair

Date Posted: July 12, 2024

Delaware Students Excel at National STEM Conference

Date Posted: July 12, 2024

Grants to Support Students Experiencing Homelessness

Date Posted: July 12, 2024

DOJ secures lengthy prison sentence for violent gun offender

Date Posted: July 11, 2024

DNREC Again to Offer Popular ‘Life in the Bay’ Educational Seining Program for Families of All Ages

Date Posted: July 11, 2024

Delaware and r4 Technologies Launch Innovative Project to Address Food Insecurity and Food Waste

Date Posted: July 10, 2024

DNREC Soliciting Project Proposals For Surface Water Matching Planning Grants

Date Posted: July 10, 2024

SkillsUSA Students Earn National Recognition

Date Posted: July 9, 2024

“Odd Little Creatures” Take Over The Mezzanine Gallery This Summer

Date Posted: July 8, 2024

Governor Carney Announces Selections to Delaware Women’s Hall of Fame for 2024

Date Posted: July 8, 2024

AG Jennings launches portal to help businesses prepare for Personal Data Privacy Act enforcement

Date Posted: July 8, 2024

Governor Carney Orders Lowering of Flags

Date Posted: July 8, 2024

Delaware Division of Child Support Services Holding Town Hall Meetings

Date Posted: July 8, 2024

Explore Delaware’s Public Health Data Portal During National Environmental Public Health Tracking Awareness Week

Date Posted: July 8, 2024

Grants to Support Community Learning Centers

Date Posted: July 5, 2024

Free and Reduced-Price Meal Policy: Annual Announcement

Date Posted: July 5, 2024

Future Health Professionals Bring Home Honors

Date Posted: July 5, 2024

DNREC to Hold Virtual Joint Public Hearing July 9 on Proposed Offshore Wind Project

Date Posted: July 3, 2024

Mark Short Named Administrator of Delaware Standardbred Breeders’ Fund

Date Posted: July 2, 2024

Warning: Be Cautious of Predatory Practices related to Social Equity Licenses

Date Posted: July 2, 2024

Smyrna future educators bring home second consecutive national win

Date Posted: July 2, 2024

DPH Releases 2024 Burden of Chronic Disease Report

Date Posted: July 1, 2024

Groundbreaking Study Reveals Economic and Social Impact of Non-Profit Arts and Culture Sector in Delaware

Date Posted: July 1, 2024

Registration is Now Open for Delaware EARNS Retirement Benefit Program

Date Posted: July 1, 2024

DNREC Announces Arrival of 2024/25 Delaware Hunting and Trapping Guide

Date Posted: July 1, 2024

Hall-Long Highlights Historic Investments, Action for Delawareans

Date Posted: June 30, 2024

Governor Carney Shares Highlights from the Legislative Session

Date Posted: June 30, 2024

Governor Carney’s Statement on the Delaware Supreme Court Ruling

Date Posted: June 28, 2024

In unanimous ruling, Court sides with Jennings on voting rights

Date Posted: June 28, 2024

Governor Carney’s Statement on House Bill 282

Date Posted: June 27, 2024

AG Jennings’ statement on Supreme Court ruling in Harrington v. Purdue Pharma

Date Posted: June 27, 2024

Delaware Rare Disease Advisory Council Hosts First Meeting

Date Posted: June 27, 2024

AG Jennings announces leadership changes at DOJ

Date Posted: June 27, 2024

Fireworks in Delaware

Date Posted: June 26, 2024

DNREC Reminds Drive-On Surf Anglers Reservations are Required for Fourth of July Holiday

Date Posted: June 26, 2024

Black Bear in Newark Area Struck and Killed by Vehicle

Date Posted: June 26, 2024

DPH Cautions Public to Watch for Rabid Animals During Active Season

Date Posted: June 26, 2024

Former “Smackdown” defendant sentenced to 12 years for fentanyl charges

Date Posted: June 26, 2024

Safe Harbor for Financial Institutions Serving Legal Cannabis Businesses

Date Posted: June 26, 2024

Governor Carney’s Statement on Veto of House Bill 282

Date Posted: June 25, 2024

Deadline for Young Environmentalist Awards Nominations Extended to July 5

Date Posted: June 24, 2024

DNREC Invites Youngsters to Enjoy ‘Small Fry Adventures’ at Aquatic Resources Education Center

Date Posted: June 24, 2024

Two Men Arrested After Assaulting a Child and His Mother

Date Posted: June 23, 2024

With Delaware Under Severe Heat Watch for the Weekend, DPH Offers Tips to Vulnerable Populations at Risk

Date Posted: June 21, 2024

Governor Carney’s Statement on the Passage of the FY25 Budget and One-Time Supplemental

Date Posted: June 20, 2024

Delaware Tourism Office Announces Sports Tourism Capital Investment Fund Awardees

Date Posted: June 20, 2024

Governor Carney’s Statement on Senate Confirmations

Date Posted: June 20, 2024

DPH Partners with Delta Sigma Theta Sorority to Provide Free Health Screenings, Cancer Prevention Education to Kent Co.

Date Posted: June 20, 2024

DOJ secures conviction in violent gun case

Date Posted: June 20, 2024

Electronic Speed Safety Program to begin in I-95/Route 896 Construction Zone

Date Posted: June 18, 2024

The Office of the Marijuana Commissioner launched the Social Equity Eligibility Validation Application and DIA Map

Date Posted: June 18, 2024

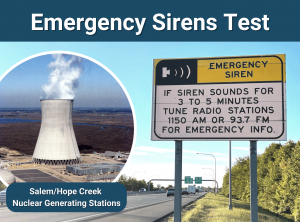

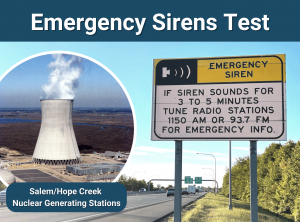

Emergency Sirens Test on July 2

Date Posted: June 18, 2024

DPH Notifies of Rise in Pertussis (Whooping Cough) Cases in New Castle County

Date Posted: June 14, 2024

Jennings can fight for Nemours funding, appeals court rules

Date Posted: June 14, 2024

Governor Carney Signs House Bill 350

Date Posted: June 13, 2024

DNREC Revises Recreational Striped Bass Summer Slot Season Limit for Compliance With ASMFC Plan

Date Posted: June 13, 2024

Summer Safety

Date Posted: June 12, 2024

DNREC to Treat Two Downstate Public Ponds During June for Invasive Aquatic Weed Hydrilla

Date Posted: June 12, 2024

End of Cape Henlopen Fishing Pier to Remain Closed for Structural Repairs

Date Posted: June 12, 2024

Attorney General Kathy Jennings Reaches $700 Million Settlement Against Johnson and Johnson

Date Posted: June 11, 2024

Information Meetings To Highlight Energy Efficiency Programs

Date Posted: June 11, 2024

DNREC and Kent Conservation District Announce Fall Cover Crop Cost Share Sign-Up Period Through Aug. 30

Date Posted: June 10, 2024

Delaware Announces Option for Dolly Parton’s Imagination Library Bilingual Book Collection

Date Posted: June 10, 2024

Winners Announced in DNREC’s Haiku Poetry Contest

Date Posted: June 8, 2024

DelDOT, Georgetown Celebrate Completion of Park Avenue Phase 1 Project

Date Posted: June 7, 2024

Delaware 250 Grants for Museums, Heritage Groups, and Non-Profits – Summer 2024 Cycle

Date Posted: June 7, 2024

The Mezzanine Gallery to exhibit Don James’ “Beyond the Facade: Architectural Portraits”

Date Posted: June 7, 2024

DPH’s PANO Program Hosts Second Annual Advancing Healthy Lifestyles Conference

Date Posted: June 6, 2024

Dagsboro Angler Wins Annual Youth Fishing Tournament Second Year in a Row

Date Posted: June 6, 2024

Middle and High School Students Honored in Digital Mapping Technology Contest

Date Posted: June 6, 2024

Governor Carney Orders Lowering of Flags

Date Posted: June 6, 2024

DNREC to Offer June 13 Lecture on Living Shorelines for Home and Property Owners

Date Posted: June 4, 2024

Governor Carney Announces Judicial Nominations

Date Posted: June 3, 2024

Delaware First to Focus on Healthier Start for New Moms with 12 Weeks of Free Diapers, Home-Delivered Meals

Date Posted: June 3, 2024

Gov. Carney, DSHA and Habitat for Humanity of New Castle County Join Forces to Promote Homeownership Month

Date Posted: June 3, 2024

Program to Help Foster Youth Pursue Higher Education Returns

Date Posted: June 3, 2024

Delaware Day of Action with REFORM Alliance Highlights Reentry Supports, System Change

Date Posted: May 31, 2024

Defendant faces lengthy prison sentence after child pornography convictions

Date Posted: May 31, 2024

Delaware 250 Announces Spring 2024 Grant Recipients

Date Posted: May 31, 2024

Fentanyl dealer sentenced to 18 years

Date Posted: May 30, 2024

Hall-Long, Community Leaders Celebrate 2024 Lt. Governor’s Challenge Honorees

Date Posted: May 30, 2024