Delaware’s Tax Season Starts February 12, 2021

Department of Finance | Division of Revenue | Date Posted: Wednesday, January 27, 2021

Significant Storm Expected to Bring Heavy Snow, Strong Winds, and Coastal Flooding to Delaware

Significant Storm Expected to Bring Heavy Snow, Strong Winds, and Coastal Flooding to Delaware Downtown Development District Rebate Program opening application process for new District designations

Downtown Development District Rebate Program opening application process for new District designations DPH Reports Measles Exposure at Nemours Children’s Hospital Emergency Department in Wilmington

DPH Reports Measles Exposure at Nemours Children’s Hospital Emergency Department in Wilmington Statement from AG Jennings and Gov. Meyer on victory over Trump tariffs at SCOTUS

Statement from AG Jennings and Gov. Meyer on victory over Trump tariffs at SCOTUS Governor Meyer, DSHA, Apennine celebrate start of new housing in Georgetown

Governor Meyer, DSHA, Apennine celebrate start of new housing in Georgetown Delaware Holds Career Fair to Expand Youth Pathways and State Employment Opportunities

Delaware Holds Career Fair to Expand Youth Pathways and State Employment Opportunities Spring Pond Trout Season to Open With Youth-Only Day March 7, Followed by Regular Downstate Opener March 8

Spring Pond Trout Season to Open With Youth-Only Day March 7, Followed by Regular Downstate Opener March 8 Charter School Accountability Committee recommends revocation of BASSE’s charter

Charter School Accountability Committee recommends revocation of BASSE’s charter Join DOC’s Spring 2026 Citizens Academy for an insider’s look at Delaware’s correctional system

Join DOC’s Spring 2026 Citizens Academy for an insider’s look at Delaware’s correctional system Governor Meyer Orders the Lowering of Flags to Honor the Lives of George Bunting and John Viola; Rev. Jesse Jackson

Governor Meyer Orders the Lowering of Flags to Honor the Lives of George Bunting and John Viola; Rev. Jesse Jackson Governor Matt Meyer Presents Order of the First State to Five Delawareans

Governor Matt Meyer Presents Order of the First State to Five Delawareans DPA Calls for Extension of PJM Capacity Price Cap to Protect Consumers

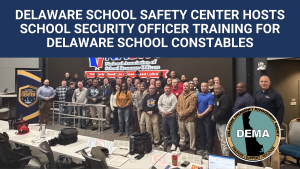

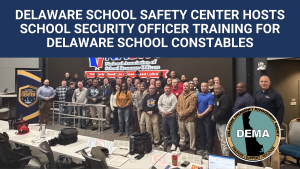

DPA Calls for Extension of PJM Capacity Price Cap to Protect Consumers Delaware School Safety Center Hosts School Security Officer Training for Delaware School Constables

Delaware School Safety Center Hosts School Security Officer Training for Delaware School Constables LEADelaware welcomes 11 new members for Class VIII, celebrates Class VII graduation

LEADelaware welcomes 11 new members for Class VIII, celebrates Class VII graduation Department of Correction launches enhanced community notification system

Department of Correction launches enhanced community notification system Delaware Announces Second Annual “Futures in the Arts” Celebration Announced

Delaware Announces Second Annual “Futures in the Arts” Celebration Announced Delaware Behavioral Health Consortium to Create a Comprehensive State of the State of Perinatal Health Report

Delaware Behavioral Health Consortium to Create a Comprehensive State of the State of Perinatal Health Report DPH to Host Summit on Building Healthy, Strong Communities in Delaware

DPH to Host Summit on Building Healthy, Strong Communities in Delaware Delaware Department of Labor Marks Successful Paid Leave Launch in January

Delaware Department of Labor Marks Successful Paid Leave Launch in January Delaware Division of the Arts Announces 10 Finalists for Delaware’s 2026 Poetry Out Loud State Finals

Delaware Division of the Arts Announces 10 Finalists for Delaware’s 2026 Poetry Out Loud State Finals Delaware Organ and Tissue Donor Awareness Board Announces 2026 Video Scholarship Contest for High School Students

Delaware Organ and Tissue Donor Awareness Board Announces 2026 Video Scholarship Contest for High School Students DNREC Reopens Indian River Bay to Clamming and Shellfish Harvesting After Millsboro Sewage Release

DNREC Reopens Indian River Bay to Clamming and Shellfish Harvesting After Millsboro Sewage Release Delaware schools recognized for strong performance and progress in closing achievement gaps

Delaware schools recognized for strong performance and progress in closing achievement gaps DOC Announces leadership promotions at Bureau of Community Corrections and Baylor Women’s Correctional Institution

DOC Announces leadership promotions at Bureau of Community Corrections and Baylor Women’s Correctional Institution Spring Turkey Season Lottery Attracts Record Number of Applicants for Hunting State Wildlife Areas

Spring Turkey Season Lottery Attracts Record Number of Applicants for Hunting State Wildlife Areas AG Jennings secures $17.85 million settlement with Lannett and Bausch over conspiracies to inflate prices

AG Jennings secures $17.85 million settlement with Lannett and Bausch over conspiracies to inflate prices State Employees’ Charitable Campaign Seeks Delaware Nonprofits for 2026 Giving Campaign

State Employees’ Charitable Campaign Seeks Delaware Nonprofits for 2026 Giving Campaign DNREC Expands Paid Summer Internship Program for College Students and Recent Graduates

DNREC Expands Paid Summer Internship Program for College Students and Recent Graduates Governor Meyer Announces Historic Investments in Early Education, Tags Lt. Governor Gay to Lead Systemic Change

Governor Meyer Announces Historic Investments in Early Education, Tags Lt. Governor Gay to Lead Systemic Change  Governor Meyer Opens Nominations for The 2026 Delaware Women’s Hall of Fame & She’s on Her Way Awards

Governor Meyer Opens Nominations for The 2026 Delaware Women’s Hall of Fame & She’s on Her Way Awards Governor Matt Meyer Signs Executive Order Certifying Updated Delaware Land Use Strategies

Governor Matt Meyer Signs Executive Order Certifying Updated Delaware Land Use Strategies Delaware Department of Labor Publishes New Economic Articles Highlighting Delaware’s GDP and Future Workforce Trends

Delaware Department of Labor Publishes New Economic Articles Highlighting Delaware’s GDP and Future Workforce Trends Attention Nursery Owners and Gardeners: Boxwood Workshop set for Wednesday, Feb. 4

Attention Nursery Owners and Gardeners: Boxwood Workshop set for Wednesday, Feb. 4 Governor Matt Meyer Unveils FY 27 Recommended Budget Focused on Delaware-First, Affordability, and Responsible Growth

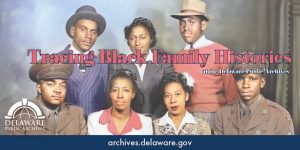

Governor Matt Meyer Unveils FY 27 Recommended Budget Focused on Delaware-First, Affordability, and Responsible Growth First Saturday Program Explores Black Family History at the Delaware Public Archives

First Saturday Program Explores Black Family History at the Delaware Public Archives AG Jennings secures additional $25 million natural resource damage settlement payment

AG Jennings secures additional $25 million natural resource damage settlement payment Governor Meyer’s Office Launches Applications for Spring Internship Program

Governor Meyer’s Office Launches Applications for Spring Internship Program Kent County State Offices Open at 10 a.m. on January 27, 2026; New Castle and Sussex Operate on a Regular Schedule

Kent County State Offices Open at 10 a.m. on January 27, 2026; New Castle and Sussex Operate on a Regular Schedule Governor Matt Meyer Announces Closure of All State Offices for Monday, January 26

Governor Matt Meyer Announces Closure of All State Offices for Monday, January 26 Level 2 Driving Restriction For New Castle & Kent Counties Effective 10 Am – Level 1 Remains In Sussex

Level 2 Driving Restriction For New Castle & Kent Counties Effective 10 Am – Level 1 Remains In Sussex State of Emergency Declared – DEMA Emergency Operations Center Activated For Winter Storm Response

State of Emergency Declared – DEMA Emergency Operations Center Activated For Winter Storm Response 2025 Annual Report showcases $8.1M investment in Downtown Development District Rebate Program

2025 Annual Report showcases $8.1M investment in Downtown Development District Rebate Program AG Jennings, colleagues demand action from xAI over Grok’s Creation of Nonconsensual Sexual Content

AG Jennings, colleagues demand action from xAI over Grok’s Creation of Nonconsensual Sexual Content Delaware Forest Service Announces 11th Annual Arborist and Tree Care Seminar at Winterthur Museum, Garden & Library

Delaware Forest Service Announces 11th Annual Arborist and Tree Care Seminar at Winterthur Museum, Garden & Library Governor Matt Meyer Lays Out Delaware-First Agenda in State of the State Address

Governor Matt Meyer Lays Out Delaware-First Agenda in State of the State Address Delaware Division of the Arts Announces 2026 Individual Artist Fellowship Awardees

Delaware Division of the Arts Announces 2026 Individual Artist Fellowship Awardees Attorney General Jennings sues HHS for discriminating against transgender Delawareans

Attorney General Jennings sues HHS for discriminating against transgender Delawareans Visit Delaware & DRA Host Premiere Event For “Back of House” Film Series

Visit Delaware & DRA Host Premiere Event For “Back of House” Film Series Public Housing Authorities urge individuals to update waiting list applications

Public Housing Authorities urge individuals to update waiting list applications Delaware Public Archives Explores Civilian Conservation Corps Legacy in New Digital Exhibit

Delaware Public Archives Explores Civilian Conservation Corps Legacy in New Digital Exhibit Governor Matt Meyer Issues Statement on Retirement of Senate President Pro Tempore Dave Sokola

Governor Matt Meyer Issues Statement on Retirement of Senate President Pro Tempore Dave Sokola Appeals court blocks Trump Administration from defunding medical and public health research

Appeals court blocks Trump Administration from defunding medical and public health research Governor Matt Meyer Nominates Jon Sheehan for Delaware State Board of Education President

Governor Matt Meyer Nominates Jon Sheehan for Delaware State Board of Education President AG Jennings Opposes Trump Administration’s Proposals Aimed at Further Restricting Access to Gender-Affirming Care

AG Jennings Opposes Trump Administration’s Proposals Aimed at Further Restricting Access to Gender-Affirming Care Delaware to Solicit Water Quality Improvement Projects With Infrastructure Investment and Jobs Act Funding

Delaware to Solicit Water Quality Improvement Projects With Infrastructure Investment and Jobs Act Funding Secretary Clifton announces Jimmy Kroon’s appointment as Deputy Secretary

Secretary Clifton announces Jimmy Kroon’s appointment as Deputy Secretary Delaware announces presumptive positive avian influenza case in Kent County commercial flock

Delaware announces presumptive positive avian influenza case in Kent County commercial flock Significant Storm Expected to Bring Heavy Snow, Strong Winds, and Coastal Flooding to Delaware

Significant Storm Expected to Bring Heavy Snow, Strong Winds, and Coastal Flooding to Delaware Downtown Development District Rebate Program opening application process for new District designations

Downtown Development District Rebate Program opening application process for new District designations DPH Reports Measles Exposure at Nemours Children’s Hospital Emergency Department in Wilmington

DPH Reports Measles Exposure at Nemours Children’s Hospital Emergency Department in Wilmington Statement from AG Jennings and Gov. Meyer on victory over Trump tariffs at SCOTUS

Statement from AG Jennings and Gov. Meyer on victory over Trump tariffs at SCOTUS Governor Meyer, DSHA, Apennine celebrate start of new housing in Georgetown

Governor Meyer, DSHA, Apennine celebrate start of new housing in Georgetown Delaware Holds Career Fair to Expand Youth Pathways and State Employment Opportunities

Delaware Holds Career Fair to Expand Youth Pathways and State Employment Opportunities Spring Pond Trout Season to Open With Youth-Only Day March 7, Followed by Regular Downstate Opener March 8

Spring Pond Trout Season to Open With Youth-Only Day March 7, Followed by Regular Downstate Opener March 8 Charter School Accountability Committee recommends revocation of BASSE’s charter

Charter School Accountability Committee recommends revocation of BASSE’s charter Join DOC’s Spring 2026 Citizens Academy for an insider’s look at Delaware’s correctional system

Join DOC’s Spring 2026 Citizens Academy for an insider’s look at Delaware’s correctional system Governor Meyer Orders the Lowering of Flags to Honor the Lives of George Bunting and John Viola; Rev. Jesse Jackson

Governor Meyer Orders the Lowering of Flags to Honor the Lives of George Bunting and John Viola; Rev. Jesse Jackson Governor Matt Meyer Presents Order of the First State to Five Delawareans

Governor Matt Meyer Presents Order of the First State to Five Delawareans DPA Calls for Extension of PJM Capacity Price Cap to Protect Consumers

DPA Calls for Extension of PJM Capacity Price Cap to Protect Consumers Delaware School Safety Center Hosts School Security Officer Training for Delaware School Constables

Delaware School Safety Center Hosts School Security Officer Training for Delaware School Constables LEADelaware welcomes 11 new members for Class VIII, celebrates Class VII graduation

LEADelaware welcomes 11 new members for Class VIII, celebrates Class VII graduation Department of Correction launches enhanced community notification system

Department of Correction launches enhanced community notification system Delaware Announces Second Annual “Futures in the Arts” Celebration Announced

Delaware Announces Second Annual “Futures in the Arts” Celebration Announced Delaware Behavioral Health Consortium to Create a Comprehensive State of the State of Perinatal Health Report

Delaware Behavioral Health Consortium to Create a Comprehensive State of the State of Perinatal Health Report DPH to Host Summit on Building Healthy, Strong Communities in Delaware

DPH to Host Summit on Building Healthy, Strong Communities in Delaware Delaware Department of Labor Marks Successful Paid Leave Launch in January

Delaware Department of Labor Marks Successful Paid Leave Launch in January Delaware Division of the Arts Announces 10 Finalists for Delaware’s 2026 Poetry Out Loud State Finals

Delaware Division of the Arts Announces 10 Finalists for Delaware’s 2026 Poetry Out Loud State Finals Delaware Organ and Tissue Donor Awareness Board Announces 2026 Video Scholarship Contest for High School Students

Delaware Organ and Tissue Donor Awareness Board Announces 2026 Video Scholarship Contest for High School Students DNREC Reopens Indian River Bay to Clamming and Shellfish Harvesting After Millsboro Sewage Release

DNREC Reopens Indian River Bay to Clamming and Shellfish Harvesting After Millsboro Sewage Release Delaware schools recognized for strong performance and progress in closing achievement gaps

Delaware schools recognized for strong performance and progress in closing achievement gaps DOC Announces leadership promotions at Bureau of Community Corrections and Baylor Women’s Correctional Institution

DOC Announces leadership promotions at Bureau of Community Corrections and Baylor Women’s Correctional Institution Spring Turkey Season Lottery Attracts Record Number of Applicants for Hunting State Wildlife Areas

Spring Turkey Season Lottery Attracts Record Number of Applicants for Hunting State Wildlife Areas AG Jennings secures $17.85 million settlement with Lannett and Bausch over conspiracies to inflate prices

AG Jennings secures $17.85 million settlement with Lannett and Bausch over conspiracies to inflate prices State Employees’ Charitable Campaign Seeks Delaware Nonprofits for 2026 Giving Campaign

State Employees’ Charitable Campaign Seeks Delaware Nonprofits for 2026 Giving Campaign DNREC Expands Paid Summer Internship Program for College Students and Recent Graduates

DNREC Expands Paid Summer Internship Program for College Students and Recent Graduates Governor Meyer Announces Historic Investments in Early Education, Tags Lt. Governor Gay to Lead Systemic Change

Governor Meyer Announces Historic Investments in Early Education, Tags Lt. Governor Gay to Lead Systemic Change  Governor Meyer Opens Nominations for The 2026 Delaware Women’s Hall of Fame & She’s on Her Way Awards

Governor Meyer Opens Nominations for The 2026 Delaware Women’s Hall of Fame & She’s on Her Way Awards Governor Matt Meyer Signs Executive Order Certifying Updated Delaware Land Use Strategies

Governor Matt Meyer Signs Executive Order Certifying Updated Delaware Land Use Strategies Delaware Department of Labor Publishes New Economic Articles Highlighting Delaware’s GDP and Future Workforce Trends

Delaware Department of Labor Publishes New Economic Articles Highlighting Delaware’s GDP and Future Workforce Trends Attention Nursery Owners and Gardeners: Boxwood Workshop set for Wednesday, Feb. 4

Attention Nursery Owners and Gardeners: Boxwood Workshop set for Wednesday, Feb. 4 Governor Matt Meyer Unveils FY 27 Recommended Budget Focused on Delaware-First, Affordability, and Responsible Growth

Governor Matt Meyer Unveils FY 27 Recommended Budget Focused on Delaware-First, Affordability, and Responsible Growth First Saturday Program Explores Black Family History at the Delaware Public Archives

First Saturday Program Explores Black Family History at the Delaware Public Archives AG Jennings secures additional $25 million natural resource damage settlement payment

AG Jennings secures additional $25 million natural resource damage settlement payment Governor Meyer’s Office Launches Applications for Spring Internship Program

Governor Meyer’s Office Launches Applications for Spring Internship Program Kent County State Offices Open at 10 a.m. on January 27, 2026; New Castle and Sussex Operate on a Regular Schedule

Kent County State Offices Open at 10 a.m. on January 27, 2026; New Castle and Sussex Operate on a Regular Schedule Governor Matt Meyer Announces Closure of All State Offices for Monday, January 26

Governor Matt Meyer Announces Closure of All State Offices for Monday, January 26 Level 2 Driving Restriction For New Castle & Kent Counties Effective 10 Am – Level 1 Remains In Sussex

Level 2 Driving Restriction For New Castle & Kent Counties Effective 10 Am – Level 1 Remains In Sussex State of Emergency Declared – DEMA Emergency Operations Center Activated For Winter Storm Response

State of Emergency Declared – DEMA Emergency Operations Center Activated For Winter Storm Response 2025 Annual Report showcases $8.1M investment in Downtown Development District Rebate Program

2025 Annual Report showcases $8.1M investment in Downtown Development District Rebate Program AG Jennings, colleagues demand action from xAI over Grok’s Creation of Nonconsensual Sexual Content

AG Jennings, colleagues demand action from xAI over Grok’s Creation of Nonconsensual Sexual Content Delaware Forest Service Announces 11th Annual Arborist and Tree Care Seminar at Winterthur Museum, Garden & Library

Delaware Forest Service Announces 11th Annual Arborist and Tree Care Seminar at Winterthur Museum, Garden & Library Governor Matt Meyer Lays Out Delaware-First Agenda in State of the State Address

Governor Matt Meyer Lays Out Delaware-First Agenda in State of the State Address Delaware Division of the Arts Announces 2026 Individual Artist Fellowship Awardees

Delaware Division of the Arts Announces 2026 Individual Artist Fellowship Awardees Attorney General Jennings sues HHS for discriminating against transgender Delawareans

Attorney General Jennings sues HHS for discriminating against transgender Delawareans Visit Delaware & DRA Host Premiere Event For “Back of House” Film Series

Visit Delaware & DRA Host Premiere Event For “Back of House” Film Series Public Housing Authorities urge individuals to update waiting list applications

Public Housing Authorities urge individuals to update waiting list applications Delaware Public Archives Explores Civilian Conservation Corps Legacy in New Digital Exhibit

Delaware Public Archives Explores Civilian Conservation Corps Legacy in New Digital Exhibit Governor Matt Meyer Issues Statement on Retirement of Senate President Pro Tempore Dave Sokola

Governor Matt Meyer Issues Statement on Retirement of Senate President Pro Tempore Dave Sokola Appeals court blocks Trump Administration from defunding medical and public health research

Appeals court blocks Trump Administration from defunding medical and public health research Governor Matt Meyer Nominates Jon Sheehan for Delaware State Board of Education President

Governor Matt Meyer Nominates Jon Sheehan for Delaware State Board of Education President AG Jennings Opposes Trump Administration’s Proposals Aimed at Further Restricting Access to Gender-Affirming Care

AG Jennings Opposes Trump Administration’s Proposals Aimed at Further Restricting Access to Gender-Affirming Care Delaware to Solicit Water Quality Improvement Projects With Infrastructure Investment and Jobs Act Funding

Delaware to Solicit Water Quality Improvement Projects With Infrastructure Investment and Jobs Act Funding Secretary Clifton announces Jimmy Kroon’s appointment as Deputy Secretary

Secretary Clifton announces Jimmy Kroon’s appointment as Deputy Secretary Delaware announces presumptive positive avian influenza case in Kent County commercial flock

Delaware announces presumptive positive avian influenza case in Kent County commercial flock

Department of Finance | Division of Revenue | Date Posted: Wednesday, January 27, 2021

Delaware’s Division of Revenue will begin processing 2020 individual income tax returns on Friday, February 12, 2021. Delaware opens its filing season in tandem with the IRS, who have been delayed this year due to programming required in administering economic impact payments. Taxpayers may still file in advance of this date, and returns will be held until processing begins on February 12.

In an effort to combat refund fraud, the Division of Revenue will be holding all personal income tax refunds until February 25, 2021. For faster turnaround times, citizens are encouraged to file their taxes online at de.gov/filetax or through other electronic filing programs and request direct deposit. This year’s filing deadline for personal income tax will be Friday, April 30, 2021.

Taxpayers should be aware that Delaware does not maintain reciprocity agreements with other states, therefore is important that anyone who is not a Delaware resident, but who has worked in Delaware, understands that they must file a Delaware tax return. Delaware Residents who work out-of-state are required to file returns with Delaware in addition to the state where they worked. By law, Delaware employees should receive their W-2 employment forms by January 31, 2021 for any job worked during the 2020 calendar year. Those who haven’t received a W-2 by January 31st should contact their employer.

For filing information and more, please visit revenue.delaware.gov.

Keep up to date by receiving a daily digest email, around noon, of current news release posts from state agencies on news.delaware.gov.

Here you can subscribe to future news updates.

Department of Finance | Division of Revenue | Date Posted: Wednesday, January 27, 2021

Delaware’s Division of Revenue will begin processing 2020 individual income tax returns on Friday, February 12, 2021. Delaware opens its filing season in tandem with the IRS, who have been delayed this year due to programming required in administering economic impact payments. Taxpayers may still file in advance of this date, and returns will be held until processing begins on February 12.

In an effort to combat refund fraud, the Division of Revenue will be holding all personal income tax refunds until February 25, 2021. For faster turnaround times, citizens are encouraged to file their taxes online at de.gov/filetax or through other electronic filing programs and request direct deposit. This year’s filing deadline for personal income tax will be Friday, April 30, 2021.

Taxpayers should be aware that Delaware does not maintain reciprocity agreements with other states, therefore is important that anyone who is not a Delaware resident, but who has worked in Delaware, understands that they must file a Delaware tax return. Delaware Residents who work out-of-state are required to file returns with Delaware in addition to the state where they worked. By law, Delaware employees should receive their W-2 employment forms by January 31, 2021 for any job worked during the 2020 calendar year. Those who haven’t received a W-2 by January 31st should contact their employer.

For filing information and more, please visit revenue.delaware.gov.

Keep up to date by receiving a daily digest email, around noon, of current news release posts from state agencies on news.delaware.gov.

Here you can subscribe to future news updates.

Delaware's Governor

State Agencies

Elected Officials

General Assembly

Delaware Courts

State Employees

Cities & Towns

Delaware State Code

State Regulations

Business First Steps

Phone Directory

Locations Directory

Public Meetings

Voting & Elections

Transparency

Delaware Marketplace

Tax Center

Personal Income Tax

Privacy Policy

Weather & Travel

Contact Us

Corporations

Franchise Tax

Gross Receipts Tax

Withholding Tax

Delaware Topics

Help Center

Mobile Apps

E-mail / Text Alerts

Social Media