New HSCA Rate Goes Into Effect in January 2023

Department of Finance | Division of Revenue | Newsroom | Date Posted: Wednesday, October 19, 2022

Delaware accelerates statewide early literacy strategy with more than $8m to strengthen classroom reading instruction

Delaware accelerates statewide early literacy strategy with more than $8m to strengthen classroom reading instruction Upstate Trout Season to Open in New Castle County Streams with Youth-Only Day Set for April 4

Upstate Trout Season to Open in New Castle County Streams with Youth-Only Day Set for April 4 Delaware Division of the Arts Seeks Public Input in New Statewide Strategic Planning Process

Delaware Division of the Arts Seeks Public Input in New Statewide Strategic Planning Process DNREC Announces 2025-‘26 Deer Harvest Totals, Launches New Interactive Game Harvest Dashboard

DNREC Announces 2025-‘26 Deer Harvest Totals, Launches New Interactive Game Harvest Dashboard Property Reassessment & Your Insurance: What Really Drives Premium Costs

Property Reassessment & Your Insurance: What Really Drives Premium Costs Amid Hints of Spring, DNREC Reminds Delawareans of Yard Waste Options, Including Beneficial Reuse

Amid Hints of Spring, DNREC Reminds Delawareans of Yard Waste Options, Including Beneficial Reuse Governor Matt Meyer Returns from India Trade Mission with New Investment and Innovation Opportunities

Governor Matt Meyer Returns from India Trade Mission with New Investment and Innovation Opportunities DNREC Now Soliciting Community Water Quality Improvement Grant Project Proposals

DNREC Now Soliciting Community Water Quality Improvement Grant Project Proposals Delaware Officials Highlight DTRN360, Innovative Behavioral Health Care Coordination Platform

Delaware Officials Highlight DTRN360, Innovative Behavioral Health Care Coordination Platform AG Jennings sues Trump Administration to stop latest round of illegal tariffs

AG Jennings sues Trump Administration to stop latest round of illegal tariffs Delaware Policy Leaders Take Aim at Primary Care Reform, Health Care Affordability

Delaware Policy Leaders Take Aim at Primary Care Reform, Health Care Affordability Women and Tavern Keeping on the Dover Green at the Archives’ March First Saturday Program

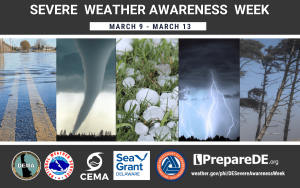

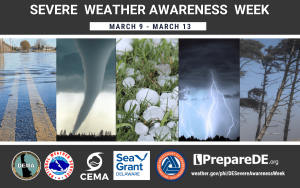

Women and Tavern Keeping on the Dover Green at the Archives’ March First Saturday Program Delaware Governor Matt Meyer Proclaims March 9-13, 2026 Severe Weather Awareness Week

Delaware Governor Matt Meyer Proclaims March 9-13, 2026 Severe Weather Awareness Week DNREC to Resume Sand Bypass Operations At Indian River Inlet After Signing Contract With First State Crane Service

DNREC to Resume Sand Bypass Operations At Indian River Inlet After Signing Contract With First State Crane Service Attention Ag Insurance Agents: Subsidy issues subject of Monday, March 9 virtual Q&A with USDA Risk Management Agency

Attention Ag Insurance Agents: Subsidy issues subject of Monday, March 9 virtual Q&A with USDA Risk Management Agency AG Jennings intervenes in USPS case that would allow guns to be mailed with virtually no limits

AG Jennings intervenes in USPS case that would allow guns to be mailed with virtually no limits Delaware Department of Education sets measurable targets to accelerate student achievement statewide

Delaware Department of Education sets measurable targets to accelerate student achievement statewide AG Jennings blocks another Trump Admin attempt to defund SNAP, collect personal data

AG Jennings blocks another Trump Admin attempt to defund SNAP, collect personal data Delaware Entradas a las fiestas para ver los partidos de la Copa Mundial de la FIFA 2026 saldrán

Delaware Entradas a las fiestas para ver los partidos de la Copa Mundial de la FIFA 2026 saldrán Delaware Lt. Gov Gay, Education Secretary Marten celebrate 302 Day with fourth graders

Delaware Lt. Gov Gay, Education Secretary Marten celebrate 302 Day with fourth graders Governor Matt Meyer Issues Statement on the Unanimous Upholding of Senate Bill 21 by the Delaware Supreme Court

Governor Matt Meyer Issues Statement on the Unanimous Upholding of Senate Bill 21 by the Delaware Supreme Court DSHA announces participants in zoning and land use reform pilot program

DSHA announces participants in zoning and land use reform pilot program Governor Matt Meyer Signs Executive Order Streamlining State Permitting Regulations

Governor Matt Meyer Signs Executive Order Streamlining State Permitting Regulations DNREC Closes The Point at Cape Henlopen March 1 to Protect Nesting, Migrating Birds

DNREC Closes The Point at Cape Henlopen March 1 to Protect Nesting, Migrating Birds DHSS, DNREC Reopen PFAS Awareness and Outreach Grant Opportunity Through March 27

DHSS, DNREC Reopen PFAS Awareness and Outreach Grant Opportunity Through March 27 Diverse Histories Virtual Exhibit Launches, Expanding Delaware’s Story Beyond 1776

Diverse Histories Virtual Exhibit Launches, Expanding Delaware’s Story Beyond 1776 AG Jennings, DOJ employee to accompany Rep. Sarah McBride and Sen. Lisa Blunt Rochester to State of the Union Address

AG Jennings, DOJ employee to accompany Rep. Sarah McBride and Sen. Lisa Blunt Rochester to State of the Union Address 15th Annual State Employee Art Exhibition Now Open at Delaware State University

15th Annual State Employee Art Exhibition Now Open at Delaware State University Delaware 250 to Host “Celebrate Delaware” Black-Tie Celebration at Hotel Du Pont

Delaware 250 to Host “Celebrate Delaware” Black-Tie Celebration at Hotel Du Pont Fee Season to Begin March 1, Kicking off Year-Long 75th Anniversary Celebration at Delaware State Parks

Fee Season to Begin March 1, Kicking off Year-Long 75th Anniversary Celebration at Delaware State Parks State of Delaware Announces 10 a.m. Opening for Kent and Sussex Counties on February 24, 2026

State of Delaware Announces 10 a.m. Opening for Kent and Sussex Counties on February 24, 2026 State of Delaware Announces Office Operations for Tuesday, February 24, 2026

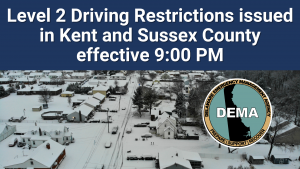

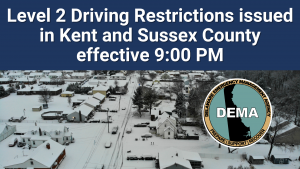

State of Delaware Announces Office Operations for Tuesday, February 24, 2026 Kent and Sussex County Downgraded to Level 2 Driving Restriction, New Castle County Remains at Level 1 Driving Warning

Kent and Sussex County Downgraded to Level 2 Driving Restriction, New Castle County Remains at Level 1 Driving Warning Driving Restrictions Update: New Castle County Downgraded to Level 1, Kent and Sussex Counties Remaining at Level 3

Driving Restrictions Update: New Castle County Downgraded to Level 1, Kent and Sussex Counties Remaining at Level 3 Level 3 Driving Ban for Kent County, Level 2 Driving Restriction for New Castle County to remain in effect

Level 3 Driving Ban for Kent County, Level 2 Driving Restriction for New Castle County to remain in effect Level 3 Driving Ban for Kent and Sussex Counties, Level 2 Driving Restrictions for New Castle County Starting at 10 pm

Level 3 Driving Ban for Kent and Sussex Counties, Level 2 Driving Restrictions for New Castle County Starting at 10 pm Level 2 Driving Restriction Issued for Kent and Sussex Counties Effective at 9pm.

Level 2 Driving Restriction Issued for Kent and Sussex Counties Effective at 9pm. State of Delaware Offices Will Be Closed on Monday, February 23, 2026

State of Delaware Offices Will Be Closed on Monday, February 23, 2026 State of Emergency Declaration National Guard Activated for Winter Storm Response

State of Emergency Declaration National Guard Activated for Winter Storm Response Significant Storm Expected to Bring Heavy Snow, Strong Winds, and Coastal Flooding to Delaware

Significant Storm Expected to Bring Heavy Snow, Strong Winds, and Coastal Flooding to Delaware Downtown Development District Rebate Program opening application process for new District designations

Downtown Development District Rebate Program opening application process for new District designations DPH Reports Measles Exposure at Nemours Children’s Hospital Emergency Department in Wilmington

DPH Reports Measles Exposure at Nemours Children’s Hospital Emergency Department in Wilmington Statement from AG Jennings and Gov. Meyer on victory over Trump tariffs at SCOTUS

Statement from AG Jennings and Gov. Meyer on victory over Trump tariffs at SCOTUS Governor Meyer, DSHA, Apennine celebrate start of new housing in Georgetown

Governor Meyer, DSHA, Apennine celebrate start of new housing in Georgetown Delaware Holds Career Fair to Expand Youth Pathways and State Employment Opportunities

Delaware Holds Career Fair to Expand Youth Pathways and State Employment Opportunities Spring Pond Trout Season to Open With Youth-Only Day March 7, Followed by Regular Downstate Opener March 8

Spring Pond Trout Season to Open With Youth-Only Day March 7, Followed by Regular Downstate Opener March 8 Charter School Accountability Committee recommends revocation of BASSE’s charter

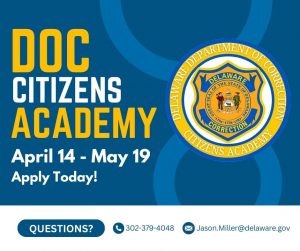

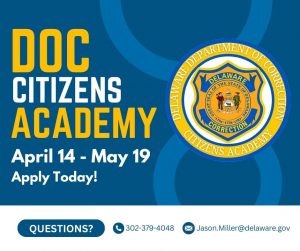

Charter School Accountability Committee recommends revocation of BASSE’s charter Join DOC’s Spring 2026 Citizens Academy for an insider’s look at Delaware’s correctional system

Join DOC’s Spring 2026 Citizens Academy for an insider’s look at Delaware’s correctional system Governor Meyer Orders the Lowering of Flags to Honor the Lives of George Bunting and John Viola; Rev. Jesse Jackson

Governor Meyer Orders the Lowering of Flags to Honor the Lives of George Bunting and John Viola; Rev. Jesse Jackson Governor Matt Meyer Presents Order of the First State to Five Delawareans

Governor Matt Meyer Presents Order of the First State to Five Delawareans DPA Calls for Extension of PJM Capacity Price Cap to Protect Consumers

DPA Calls for Extension of PJM Capacity Price Cap to Protect Consumers Delaware School Safety Center Hosts School Security Officer Training for Delaware School Constables

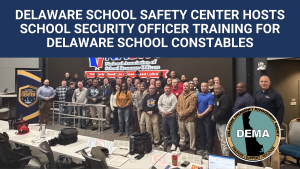

Delaware School Safety Center Hosts School Security Officer Training for Delaware School Constables LEADelaware welcomes 11 new members for Class VIII, celebrates Class VII graduation

LEADelaware welcomes 11 new members for Class VIII, celebrates Class VII graduation Department of Correction launches enhanced community notification system

Department of Correction launches enhanced community notification system Delaware Announces Second Annual “Futures in the Arts” Celebration Announced

Delaware Announces Second Annual “Futures in the Arts” Celebration Announced Delaware Behavioral Health Consortium to Create a Comprehensive State of the State of Perinatal Health Report

Delaware Behavioral Health Consortium to Create a Comprehensive State of the State of Perinatal Health Report DPH to Host Summit on Building Healthy, Strong Communities in Delaware

DPH to Host Summit on Building Healthy, Strong Communities in Delaware Delaware Department of Labor Marks Successful Paid Leave Launch in January

Delaware Department of Labor Marks Successful Paid Leave Launch in January Delaware Division of the Arts Announces 10 Finalists for Delaware’s 2026 Poetry Out Loud State Finals

Delaware Division of the Arts Announces 10 Finalists for Delaware’s 2026 Poetry Out Loud State Finals Delaware Organ and Tissue Donor Awareness Board Announces 2026 Video Scholarship Contest for High School Students

Delaware Organ and Tissue Donor Awareness Board Announces 2026 Video Scholarship Contest for High School Students DNREC Reopens Indian River Bay to Clamming and Shellfish Harvesting After Millsboro Sewage Release

DNREC Reopens Indian River Bay to Clamming and Shellfish Harvesting After Millsboro Sewage Release Delaware schools recognized for strong performance and progress in closing achievement gaps

Delaware schools recognized for strong performance and progress in closing achievement gaps Delaware accelerates statewide early literacy strategy with more than $8m to strengthen classroom reading instruction

Delaware accelerates statewide early literacy strategy with more than $8m to strengthen classroom reading instruction Upstate Trout Season to Open in New Castle County Streams with Youth-Only Day Set for April 4

Upstate Trout Season to Open in New Castle County Streams with Youth-Only Day Set for April 4 Delaware Division of the Arts Seeks Public Input in New Statewide Strategic Planning Process

Delaware Division of the Arts Seeks Public Input in New Statewide Strategic Planning Process DNREC Announces 2025-‘26 Deer Harvest Totals, Launches New Interactive Game Harvest Dashboard

DNREC Announces 2025-‘26 Deer Harvest Totals, Launches New Interactive Game Harvest Dashboard Property Reassessment & Your Insurance: What Really Drives Premium Costs

Property Reassessment & Your Insurance: What Really Drives Premium Costs Amid Hints of Spring, DNREC Reminds Delawareans of Yard Waste Options, Including Beneficial Reuse

Amid Hints of Spring, DNREC Reminds Delawareans of Yard Waste Options, Including Beneficial Reuse Governor Matt Meyer Returns from India Trade Mission with New Investment and Innovation Opportunities

Governor Matt Meyer Returns from India Trade Mission with New Investment and Innovation Opportunities DNREC Now Soliciting Community Water Quality Improvement Grant Project Proposals

DNREC Now Soliciting Community Water Quality Improvement Grant Project Proposals Delaware Officials Highlight DTRN360, Innovative Behavioral Health Care Coordination Platform

Delaware Officials Highlight DTRN360, Innovative Behavioral Health Care Coordination Platform AG Jennings sues Trump Administration to stop latest round of illegal tariffs

AG Jennings sues Trump Administration to stop latest round of illegal tariffs Delaware Policy Leaders Take Aim at Primary Care Reform, Health Care Affordability

Delaware Policy Leaders Take Aim at Primary Care Reform, Health Care Affordability Women and Tavern Keeping on the Dover Green at the Archives’ March First Saturday Program

Women and Tavern Keeping on the Dover Green at the Archives’ March First Saturday Program Delaware Governor Matt Meyer Proclaims March 9-13, 2026 Severe Weather Awareness Week

Delaware Governor Matt Meyer Proclaims March 9-13, 2026 Severe Weather Awareness Week DNREC to Resume Sand Bypass Operations At Indian River Inlet After Signing Contract With First State Crane Service

DNREC to Resume Sand Bypass Operations At Indian River Inlet After Signing Contract With First State Crane Service Attention Ag Insurance Agents: Subsidy issues subject of Monday, March 9 virtual Q&A with USDA Risk Management Agency

Attention Ag Insurance Agents: Subsidy issues subject of Monday, March 9 virtual Q&A with USDA Risk Management Agency AG Jennings intervenes in USPS case that would allow guns to be mailed with virtually no limits

AG Jennings intervenes in USPS case that would allow guns to be mailed with virtually no limits Delaware Department of Education sets measurable targets to accelerate student achievement statewide

Delaware Department of Education sets measurable targets to accelerate student achievement statewide AG Jennings blocks another Trump Admin attempt to defund SNAP, collect personal data

AG Jennings blocks another Trump Admin attempt to defund SNAP, collect personal data Delaware Entradas a las fiestas para ver los partidos de la Copa Mundial de la FIFA 2026 saldrán

Delaware Entradas a las fiestas para ver los partidos de la Copa Mundial de la FIFA 2026 saldrán Delaware Lt. Gov Gay, Education Secretary Marten celebrate 302 Day with fourth graders

Delaware Lt. Gov Gay, Education Secretary Marten celebrate 302 Day with fourth graders Governor Matt Meyer Issues Statement on the Unanimous Upholding of Senate Bill 21 by the Delaware Supreme Court

Governor Matt Meyer Issues Statement on the Unanimous Upholding of Senate Bill 21 by the Delaware Supreme Court DSHA announces participants in zoning and land use reform pilot program

DSHA announces participants in zoning and land use reform pilot program Governor Matt Meyer Signs Executive Order Streamlining State Permitting Regulations

Governor Matt Meyer Signs Executive Order Streamlining State Permitting Regulations DNREC Closes The Point at Cape Henlopen March 1 to Protect Nesting, Migrating Birds

DNREC Closes The Point at Cape Henlopen March 1 to Protect Nesting, Migrating Birds DHSS, DNREC Reopen PFAS Awareness and Outreach Grant Opportunity Through March 27

DHSS, DNREC Reopen PFAS Awareness and Outreach Grant Opportunity Through March 27 Diverse Histories Virtual Exhibit Launches, Expanding Delaware’s Story Beyond 1776

Diverse Histories Virtual Exhibit Launches, Expanding Delaware’s Story Beyond 1776 AG Jennings, DOJ employee to accompany Rep. Sarah McBride and Sen. Lisa Blunt Rochester to State of the Union Address

AG Jennings, DOJ employee to accompany Rep. Sarah McBride and Sen. Lisa Blunt Rochester to State of the Union Address 15th Annual State Employee Art Exhibition Now Open at Delaware State University

15th Annual State Employee Art Exhibition Now Open at Delaware State University Delaware 250 to Host “Celebrate Delaware” Black-Tie Celebration at Hotel Du Pont

Delaware 250 to Host “Celebrate Delaware” Black-Tie Celebration at Hotel Du Pont Fee Season to Begin March 1, Kicking off Year-Long 75th Anniversary Celebration at Delaware State Parks

Fee Season to Begin March 1, Kicking off Year-Long 75th Anniversary Celebration at Delaware State Parks State of Delaware Announces 10 a.m. Opening for Kent and Sussex Counties on February 24, 2026

State of Delaware Announces 10 a.m. Opening for Kent and Sussex Counties on February 24, 2026 State of Delaware Announces Office Operations for Tuesday, February 24, 2026

State of Delaware Announces Office Operations for Tuesday, February 24, 2026 Kent and Sussex County Downgraded to Level 2 Driving Restriction, New Castle County Remains at Level 1 Driving Warning

Kent and Sussex County Downgraded to Level 2 Driving Restriction, New Castle County Remains at Level 1 Driving Warning Driving Restrictions Update: New Castle County Downgraded to Level 1, Kent and Sussex Counties Remaining at Level 3

Driving Restrictions Update: New Castle County Downgraded to Level 1, Kent and Sussex Counties Remaining at Level 3 Level 3 Driving Ban for Kent County, Level 2 Driving Restriction for New Castle County to remain in effect

Level 3 Driving Ban for Kent County, Level 2 Driving Restriction for New Castle County to remain in effect Level 3 Driving Ban for Kent and Sussex Counties, Level 2 Driving Restrictions for New Castle County Starting at 10 pm

Level 3 Driving Ban for Kent and Sussex Counties, Level 2 Driving Restrictions for New Castle County Starting at 10 pm Level 2 Driving Restriction Issued for Kent and Sussex Counties Effective at 9pm.

Level 2 Driving Restriction Issued for Kent and Sussex Counties Effective at 9pm. State of Delaware Offices Will Be Closed on Monday, February 23, 2026

State of Delaware Offices Will Be Closed on Monday, February 23, 2026 State of Emergency Declaration National Guard Activated for Winter Storm Response

State of Emergency Declaration National Guard Activated for Winter Storm Response Significant Storm Expected to Bring Heavy Snow, Strong Winds, and Coastal Flooding to Delaware

Significant Storm Expected to Bring Heavy Snow, Strong Winds, and Coastal Flooding to Delaware Downtown Development District Rebate Program opening application process for new District designations

Downtown Development District Rebate Program opening application process for new District designations DPH Reports Measles Exposure at Nemours Children’s Hospital Emergency Department in Wilmington

DPH Reports Measles Exposure at Nemours Children’s Hospital Emergency Department in Wilmington Statement from AG Jennings and Gov. Meyer on victory over Trump tariffs at SCOTUS

Statement from AG Jennings and Gov. Meyer on victory over Trump tariffs at SCOTUS Governor Meyer, DSHA, Apennine celebrate start of new housing in Georgetown

Governor Meyer, DSHA, Apennine celebrate start of new housing in Georgetown Delaware Holds Career Fair to Expand Youth Pathways and State Employment Opportunities

Delaware Holds Career Fair to Expand Youth Pathways and State Employment Opportunities Spring Pond Trout Season to Open With Youth-Only Day March 7, Followed by Regular Downstate Opener March 8

Spring Pond Trout Season to Open With Youth-Only Day March 7, Followed by Regular Downstate Opener March 8 Charter School Accountability Committee recommends revocation of BASSE’s charter

Charter School Accountability Committee recommends revocation of BASSE’s charter Join DOC’s Spring 2026 Citizens Academy for an insider’s look at Delaware’s correctional system

Join DOC’s Spring 2026 Citizens Academy for an insider’s look at Delaware’s correctional system Governor Meyer Orders the Lowering of Flags to Honor the Lives of George Bunting and John Viola; Rev. Jesse Jackson

Governor Meyer Orders the Lowering of Flags to Honor the Lives of George Bunting and John Viola; Rev. Jesse Jackson Governor Matt Meyer Presents Order of the First State to Five Delawareans

Governor Matt Meyer Presents Order of the First State to Five Delawareans DPA Calls for Extension of PJM Capacity Price Cap to Protect Consumers

DPA Calls for Extension of PJM Capacity Price Cap to Protect Consumers Delaware School Safety Center Hosts School Security Officer Training for Delaware School Constables

Delaware School Safety Center Hosts School Security Officer Training for Delaware School Constables LEADelaware welcomes 11 new members for Class VIII, celebrates Class VII graduation

LEADelaware welcomes 11 new members for Class VIII, celebrates Class VII graduation Department of Correction launches enhanced community notification system

Department of Correction launches enhanced community notification system Delaware Announces Second Annual “Futures in the Arts” Celebration Announced

Delaware Announces Second Annual “Futures in the Arts” Celebration Announced Delaware Behavioral Health Consortium to Create a Comprehensive State of the State of Perinatal Health Report

Delaware Behavioral Health Consortium to Create a Comprehensive State of the State of Perinatal Health Report DPH to Host Summit on Building Healthy, Strong Communities in Delaware

DPH to Host Summit on Building Healthy, Strong Communities in Delaware Delaware Department of Labor Marks Successful Paid Leave Launch in January

Delaware Department of Labor Marks Successful Paid Leave Launch in January Delaware Division of the Arts Announces 10 Finalists for Delaware’s 2026 Poetry Out Loud State Finals

Delaware Division of the Arts Announces 10 Finalists for Delaware’s 2026 Poetry Out Loud State Finals Delaware Organ and Tissue Donor Awareness Board Announces 2026 Video Scholarship Contest for High School Students

Delaware Organ and Tissue Donor Awareness Board Announces 2026 Video Scholarship Contest for High School Students DNREC Reopens Indian River Bay to Clamming and Shellfish Harvesting After Millsboro Sewage Release

DNREC Reopens Indian River Bay to Clamming and Shellfish Harvesting After Millsboro Sewage Release Delaware schools recognized for strong performance and progress in closing achievement gaps

Delaware schools recognized for strong performance and progress in closing achievement gaps

Department of Finance | Division of Revenue | Newsroom | Date Posted: Wednesday, October 19, 2022

For Immediate Release

REVENUE ANNOUNCES NEW HSCA RATE EFFECTIVE JANUARY 2023

Statewide, DE – Division of Revenue Director Kathy Revel today announced that businesses subject to the Hazardous Substance Cleanup Act (HSCA) will see a decrease in last year’s rate from 1.675% to 0.8389%. The new tax rate will go into effect on January 1, 2023, and it applies to taxable gross receipts from the sale of petroleum or petroleum products.

Legislation was passed in 2018 calling for future rate increases to be based on a lookback period. The adjustable rates cannot be lower than 0.675% or greater than 1.675%, and are calculated by multiplying 0.9% (the original rate) by a fraction – the numerator of which is $15,000,000 and the denominator of which is the total collections in the fund during the lookback period (July 1 to June 30 of the prior year).

The HSCA was passed by the Delaware General Assembly in July of 1990 to ensure funding for the cleanup of facilities with a release or imminent threat of release of hazardous substances. The Department of Natural Resources and Environmental Control has identified over 1,100 sites in Delaware as potential hazardous substances release sites.

If you have questions about the new adjustable tax rate, please contact Leo Regalado with the Delaware Division of Revenue at (302) 577-8254.

###

Keep up to date by receiving a daily digest email, around noon, of current news release posts from state agencies on news.delaware.gov.

Here you can subscribe to future news updates.

Department of Finance | Division of Revenue | Newsroom | Date Posted: Wednesday, October 19, 2022

For Immediate Release

REVENUE ANNOUNCES NEW HSCA RATE EFFECTIVE JANUARY 2023

Statewide, DE – Division of Revenue Director Kathy Revel today announced that businesses subject to the Hazardous Substance Cleanup Act (HSCA) will see a decrease in last year’s rate from 1.675% to 0.8389%. The new tax rate will go into effect on January 1, 2023, and it applies to taxable gross receipts from the sale of petroleum or petroleum products.

Legislation was passed in 2018 calling for future rate increases to be based on a lookback period. The adjustable rates cannot be lower than 0.675% or greater than 1.675%, and are calculated by multiplying 0.9% (the original rate) by a fraction – the numerator of which is $15,000,000 and the denominator of which is the total collections in the fund during the lookback period (July 1 to June 30 of the prior year).

The HSCA was passed by the Delaware General Assembly in July of 1990 to ensure funding for the cleanup of facilities with a release or imminent threat of release of hazardous substances. The Department of Natural Resources and Environmental Control has identified over 1,100 sites in Delaware as potential hazardous substances release sites.

If you have questions about the new adjustable tax rate, please contact Leo Regalado with the Delaware Division of Revenue at (302) 577-8254.

###

Keep up to date by receiving a daily digest email, around noon, of current news release posts from state agencies on news.delaware.gov.

Here you can subscribe to future news updates.

Delaware's Governor

State Agencies

Elected Officials

General Assembly

Delaware Courts

State Employees

Cities & Towns

Delaware State Code

State Regulations

Business First Steps

Phone Directory

Locations Directory

Public Meetings

Voting & Elections

Transparency

Delaware Marketplace

Tax Center

Personal Income Tax

Privacy Policy

Weather & Travel

Contact Us

Corporations

Franchise Tax

Gross Receipts Tax

Withholding Tax

Delaware Topics

Help Center

Mobile Apps

E-mail / Text Alerts

Social Media