NEWS FEED

Governor Carney Orders Lowering of Flags

Date Posted: April 16, 2024

Delaware State Fire Commission Welcomes Mental Health and Wellness Administrator.

Date Posted: April 16, 2024

DelDOT Highlights National Work Zone Safety Awareness Week “Become a hero toward zero, their lives depend on it.”

Date Posted: April 16, 2024

The Delaware Office of Highway Safety Increases Enforcement for National Distracted Driving Awareness Month

Date Posted: April 15, 2024

Suspended Trooper faces prison after pleading guilty to six charges, including two felonies

Date Posted: April 12, 2024

Lt. Governor, School Districts, Philanthropist Launch Monetary Awards Program for Black Students

Date Posted: April 11, 2024

Attorney General Jennings obtains victory for manufactured housing residents

Date Posted: April 11, 2024

Delaware Cancer Consortium Hosts 2024 Biennial Retreat

Date Posted: April 10, 2024

$100,000 Grant Announced To Support Eviction Prevention Services In Delaware

Date Posted: April 9, 2024

Final NorthPak defendant convicted of two murders, more than 50 felonies

Date Posted: April 8, 2024

DHSS Seeks Comment on State Plan on Aging at Public Hearings This Month

Date Posted: April 5, 2024

Delaware Advances Toward 1 Million Tree Planting Goal

Date Posted: April 5, 2024

Treasurer Davis Encourages Delawareans to Prioritize Saving

Date Posted: April 5, 2024

Delaware Overdose Deaths Decrease for the First Time in Decade

Date Posted: April 4, 2024

State Offers Support for Students Applying for Financial Aid

Date Posted: April 4, 2024

Governor Carney, Secretary Garvin Celebrate Expansion of White Clay Creek State Park

Date Posted: April 3, 2024

State Agencies Join Forces Against Illegal Trash Dumping

Date Posted: April 2, 2024

DNREC to Offer Earth Day Beach Cleanup, Kids Crafts

Date Posted: April 2, 2024

Future Health Care Workers Win State Awards

Date Posted: April 2, 2024

The Mezzanine Gallery to exhibit “Within the Intimate Realm” by E. Schwinn

Date Posted: April 1, 2024

31-year DOC veteran named Warden of Howard R. Young Correctional Institution

Date Posted: March 28, 2024

Scotton Landing Boat Ramp Reopens for Spring

Date Posted: March 27, 2024

Delaware Teachers Named Finalists for National Mathematics, Science Teaching Award

Date Posted: March 27, 2024

Walk Down Memory Lane at Delaware Public Archives

Date Posted: March 27, 2024

DE Auditor Issues Special Report on Unemployment Insurance

Date Posted: March 26, 2024

DMV on the Go Gears Up for 2024 Season

Date Posted: March 26, 2024

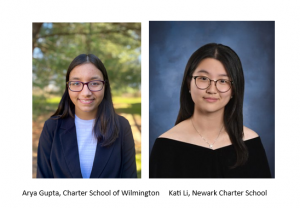

Two Students to Represent Delaware at National Science Camp

Date Posted: March 26, 2024

Department of Correction Expands Enhanced Mail Screening System To All State Prison Facilities

Date Posted: March 26, 2024

2024 Lt. Governor’s Challenge Seeks Applicants for Wellness Leader Awards

Date Posted: March 25, 2024

51st Annual DETSA Conference Celebrates Young Leaders, STEM and Innovation

Date Posted: March 25, 2024

DNREC Announces ‘Take a Kid Fishing!’ Spring Events

Date Posted: March 22, 2024

Bill Introduced to Protect Entities Serving the Legal Marijuana Industry

Date Posted: March 21, 2024

DNREC to Host Virtual Meeting on Deauville Beach Management Transition and New Entrance Fee Proposal

Date Posted: March 21, 2024

Delaware Inducts Three Farm Families into Century Farm Program

Date Posted: March 21, 2024

DPH Observes World Tuberculosis (TB) Day on March 24

Date Posted: March 21, 2024

DNREC, Kent Conservation District Offer Chesapeake Bay Implementation Grant Funding for Septic Tank Pump-outs

Date Posted: March 21, 2024

DNREC to Seek Community Water Project Proposals

Date Posted: March 20, 2024

Selbyville Fire

Date Posted: March 19, 2024

Delaware Department of Health and Social Services, Gov. Carney Announce Further Child Care Investments and Initiatives

Date Posted: March 19, 2024

Middle and High School Students Invited to Compete in Digital Mapping Technology Contest

Date Posted: March 19, 2024

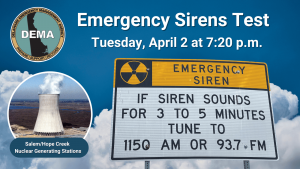

Emergency Sirens Test on April 2 and Potassium Iodide Event on April 4 in Middletown

Date Posted: March 19, 2024

Governor Carney Seeks Applications for Governor’s Summer Fellowship Program

Date Posted: March 19, 2024

Delaware to Open Upstate Trout Season With Youth-Only Fishing Day Set for April 6

Date Posted: March 19, 2024

First State Food System Program Opens Third Grant Application Cycle

Date Posted: March 18, 2024

Cynthia Karnai Confirmed As Director Of Delaware State Housing Authority

Date Posted: March 18, 2024

Governor’s Outstanding Volunteer Service Award Honorees to Be Recognized at April 4 Ceremony

Date Posted: March 18, 2024

DNREC’s DuPont Nature Center to Reopen April 3

Date Posted: March 18, 2024

Georgetown Fire

Date Posted: March 17, 2024

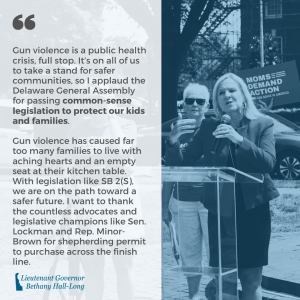

AG Jennings’ statement on Senate passage of Senate Bill 2

Date Posted: March 14, 2024

Lt. Gov. Hall-Long Applauds Passage of Senate Bill 2(S) Gun Safety Legislation

Date Posted: March 14, 2024

Governor Carney’s Statement on the Passage of Senate Substitute 1 for Senate Bill 2

Date Posted: March 14, 2024

Volunteers Sought to Join Concord Pond Cleanup April 13

Date Posted: March 14, 2024

Prosecutors secure conviction against Jordan Ellerbe’s murderer

Date Posted: March 14, 2024

Governor Carney’s Statement on Senate Confirmation of Cynthia Karnai as Director of State Housing Authority

Date Posted: March 13, 2024

State of Delaware Seeking Third Consecutive Year of Record Hiring: Job Fair for Students and Skilled Workers

Date Posted: March 13, 2024

Nominations Open for State of Delaware Compassionate Champion Awards

Date Posted: March 13, 2024

DOJ secures over seven life sentences, habitual offender status for Keith Gibson after violent killing spree

Date Posted: March 13, 2024

Delaware Department of Agriculture Opens Request for Applications for Resilient Food Systems Infrastructure Program

Date Posted: March 12, 2024

With gun safety in Court, Delaware, New Jersey, Pennsylvania AGs stand for common sense

Date Posted: March 11, 2024

The Office of the Marijuana Commissioner released additional sections of the informal draft regulations for review.

Date Posted: March 11, 2024

Lt. Governor, Partners Raise Awareness of Infant Formula Distribution Program

Date Posted: March 11, 2024

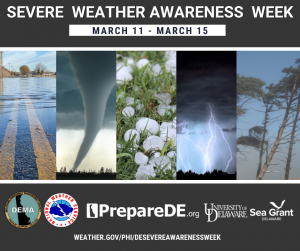

Severe Weather Awareness Week March 11-15, 2024

Date Posted: March 9, 2024

DPH Reports High Levels of Lead in Certain Cinnamon Products

Date Posted: March 8, 2024

Governor Carney Orders Lowering of Flags

Date Posted: March 8, 2024

Maiss Hussein to Represent Delaware in 2024 Poetry Out Loud National Finals

Date Posted: March 7, 2024

DNREC’s Mosquito Control Section Set to Spray Woodland Pools

Date Posted: March 7, 2024

Governor Carney’s Statement on Senate Confirmations

Date Posted: March 6, 2024

Get Involved in Earth Month: Register Now for the April 13 Christina River Watershed Cleanup

Date Posted: March 6, 2024

Governor Carney Delivers 2024 State of the State Address

Date Posted: March 6, 2024

Change Your Clocks, Check Your Batteries

Date Posted: March 6, 2024

Parks Plans Wind Transmission Line Informational Event

Date Posted: March 4, 2024

Celebrating Delaware’s Trailblazers: Women’s Hall of Fame Art Exhibition in Partnership with the University of Delaware

Date Posted: March 1, 2024

DNREC Announces Changes to 2024 Summer Flounder and Scup Recreational Fishing Regs

Date Posted: March 1, 2024

Mary and Charles Vinson sentenced to over 150 years in serial child abuse case

Date Posted: February 29, 2024

The Office of the Marijuana Commissioner (OMC) has released additional sections of the informal draft regulations.

Date Posted: February 29, 2024

Delaware Division of the Arts Encourages Arts Philanthropy Through Do More 24 Delaware

Date Posted: February 29, 2024

The Mezzanine Gallery to Exhibit “Unspoken Trajectories” by Aaron Keith Hoffer

Date Posted: February 29, 2024

DNREC Opens Youth Environmental Summit

Date Posted: February 29, 2024

Major Cybersecurity Event Impacting Health Care, Pharmacy Operations

Date Posted: February 29, 2024

Delaware State Parks Fee Season Begins March 1

Date Posted: February 29, 2024

DOJ secures over a dozen convictions for violent gun offender following nine-month manhunt

Date Posted: February 28, 2024

Students Win Big at State Educators Rising Event

Date Posted: February 28, 2024

DNREC to Close The Point at Cape Henlopen for Beach-nesting Season

Date Posted: February 28, 2024

Claymont Fire

Date Posted: February 27, 2024

Newark Fire

Date Posted: February 27, 2024

AG Jennings Announces Appeal Of Superior Court Voting Ruling, Vows Support For Constitutional Amendment

Date Posted: February 27, 2024

Delaware Division of the Arts Announces 12 Finalists for Delaware’s 2024 Poetry Out Loud State Finals

Date Posted: February 27, 2024

Controlled Burn at Brandywine Creek State Park Aims to Boost Native Wildlife and Plant Growth

Date Posted: February 27, 2024

Four-Legged Assistant Helps Change Lives Canine Companions Facility Dog Joins Delaware State Fire Commission

Date Posted: February 26, 2024

DNREC to Close Mulberry Landing Boat Ramp in Sussex County Temporarily for Expansion and Paving of Parking Lot

Date Posted: February 26, 2024

DOJ secures guilty pleas, prison time in fatal shooting case

Date Posted: February 23, 2024

Children’s pastor arrested on child pornography charges

Date Posted: February 23, 2024

DNREC to Offer Feb. 28 Webinar on Living Shoreline Cost Share Program for Home and Property Owners

Date Posted: February 23, 2024

Delaware State Fire Commission K9 Ajax To Get Donation of Body Armor.

Date Posted: February 23, 2024

DOJ secures felony conviction in first of several cases related to abuses of the 2022 Delaware Relief Rebate Program

Date Posted: February 22, 2024

Delaware, New Jersey, Illinois lead multistate coalition supporting PA gun safety law

Date Posted: February 22, 2024

Delaware State Fire Commission Updates Fire Regulations.

Date Posted: February 20, 2024

GACEC Hosts Celebration for Disability History and Awareness Month Poster Contest

Date Posted: February 20, 2024

Governor Carney Announces Delaware State Housing Authority Nomination

Date Posted: February 20, 2024

Treasurer Davis Honored for Delaware EARNS

Date Posted: February 20, 2024