Medicare Assistance Bureau: Open Enrollment Reminders

Captive | Captive Insurance | Insurance Commissioner | Date Posted: Monday, October 2, 2023

Captive | Captive Insurance | Insurance Commissioner | Date Posted: Monday, October 2, 2023

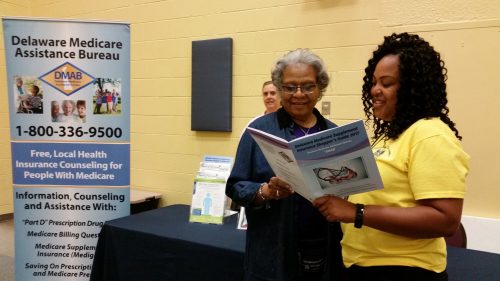

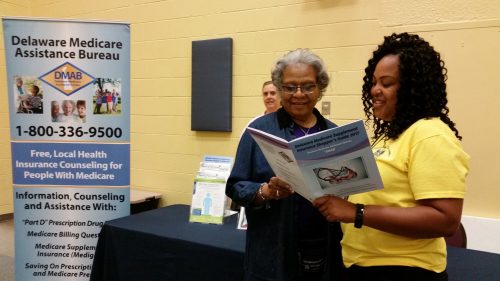

Free one-on-one counseling saved Delawareans $1.5M in 2022

As Medicare Open Enrollment approaches, the Delaware Department of Insurance and its Medicare Assistance Bureau (DMAB) are sharing their annual consumer information update. From October 15 to December 7, consumers can join, switch, or drop a Medicare Prescription Drug Plan (Part D) or Medicare Advantage Plan. DMAB’s free, confidential, unbiased one-on-one assistance can help residents determine if making a coverage change is the right choice. In 2022, the team completed 5,123 counseling sessions, saving beneficiaries a combined $1.5 million.

When selecting 2024 coverage, there are important changes to keep in mind. Extra Help is expanding to offer full subsidy benefits to those up to 150% of the federal poverty level, allowing more people access to $0 premiums for coverage and fixed prescription copays. Additionally, those with Medicare Part D who fall into the catastrophic phase of their benefits will no longer have to pay 5% coinsurance for covered drugs during that period of coverage. And, on July 1, 2024, CMS will institute a new cap on Part B payment amounts for new biosimilars when average sales price data is not available.

2023 Medicare changes will continue into the new plan year. As of July 1, people with Traditional Medicare who take insulin through a traditional pump pay no more than $35 a month for their supply, and deductibles do not apply. Free vaccine coverage has expanded, and as of April 1 persons with Part B have lower coinsurance for drugs whose price increased faster than the rate of inflation.

“Delaware’s Medicare Assistance Bureau provides consumers with the education and empowerment they need to find the coverage they need at a cost they can afford,” said Insurance Commissioner Trinidad Navarro, who reminded residents to be smart shoppers this enrollment season.

“Part of being a smart shopper is knowing what to ask, and where to find trustworthy answers,” shared DMAB Director Lakia Turner. “There is no shortage of marketing during Open Enrollment, and bad actors may disguise themselves by offering information about changes for 2024. Our team can help you cut through the noise by answering your questions and identifying the best plan for your needs.”

In addition to scheduled phone and virtual appointments, DMAB is offering weekly appointments at all three Department of Insurance offices from October 17 to November 30:

Top Tips for a Successful Medicare Open Enrollment

About the Delaware Medicare Assistance Bureau

The Delaware Medicare Assistance Bureau provides free one-on-one health insurance counseling for people eligible for Medicare. Residents can call DMAB at 1 (800) 336-9500 or (302) 674-7364 to set up a free, confidential session or visit the DMAB website for important educational resources. Counselors can assist with Medicare, Medicare Advantage, Medigap (Medicare Supplement Insurance), long-term care insurance, billing issues, prescription savings, and much more. DMAB has a Virtual Welcome to Medicare Seminar helpful for new and soon-to-be Medicare beneficiaries and those exploring enrollment changes.

The department does not manage benefits offered to state employees, pensioners, or spouses. While DMAB can counsel Medicare-eligible state plan members, questions about the state’s proposed Medicare Advantage plan or transition, they should first contact the Office of Pensions at 1 (800) 722-7300 and explore their online guide.

Medicare Advantage plans are regulated at the federal level, though the Insurance Commissioner and his peers are advocating for increased state regulatory authority.

Be aware of non-compliant alternative health plans

Related Topics: Commissioner Navarro, Consumer Alert, Department of Insurance, DMAB, Insurance Commissioner, Insurance Department, medicare, Medicare Advantage, Medicare Assistance Bureau, Medicare Part D, open enrollment, Trinidad Navarro

Keep up to date by receiving a daily digest email, around noon, of current news release posts from state agencies on news.delaware.gov.

Here you can subscribe to future news updates.

Captive | Captive Insurance | Insurance Commissioner | Date Posted: Monday, October 2, 2023

Free one-on-one counseling saved Delawareans $1.5M in 2022

As Medicare Open Enrollment approaches, the Delaware Department of Insurance and its Medicare Assistance Bureau (DMAB) are sharing their annual consumer information update. From October 15 to December 7, consumers can join, switch, or drop a Medicare Prescription Drug Plan (Part D) or Medicare Advantage Plan. DMAB’s free, confidential, unbiased one-on-one assistance can help residents determine if making a coverage change is the right choice. In 2022, the team completed 5,123 counseling sessions, saving beneficiaries a combined $1.5 million.

When selecting 2024 coverage, there are important changes to keep in mind. Extra Help is expanding to offer full subsidy benefits to those up to 150% of the federal poverty level, allowing more people access to $0 premiums for coverage and fixed prescription copays. Additionally, those with Medicare Part D who fall into the catastrophic phase of their benefits will no longer have to pay 5% coinsurance for covered drugs during that period of coverage. And, on July 1, 2024, CMS will institute a new cap on Part B payment amounts for new biosimilars when average sales price data is not available.

2023 Medicare changes will continue into the new plan year. As of July 1, people with Traditional Medicare who take insulin through a traditional pump pay no more than $35 a month for their supply, and deductibles do not apply. Free vaccine coverage has expanded, and as of April 1 persons with Part B have lower coinsurance for drugs whose price increased faster than the rate of inflation.

“Delaware’s Medicare Assistance Bureau provides consumers with the education and empowerment they need to find the coverage they need at a cost they can afford,” said Insurance Commissioner Trinidad Navarro, who reminded residents to be smart shoppers this enrollment season.

“Part of being a smart shopper is knowing what to ask, and where to find trustworthy answers,” shared DMAB Director Lakia Turner. “There is no shortage of marketing during Open Enrollment, and bad actors may disguise themselves by offering information about changes for 2024. Our team can help you cut through the noise by answering your questions and identifying the best plan for your needs.”

In addition to scheduled phone and virtual appointments, DMAB is offering weekly appointments at all three Department of Insurance offices from October 17 to November 30:

Top Tips for a Successful Medicare Open Enrollment

About the Delaware Medicare Assistance Bureau

The Delaware Medicare Assistance Bureau provides free one-on-one health insurance counseling for people eligible for Medicare. Residents can call DMAB at 1 (800) 336-9500 or (302) 674-7364 to set up a free, confidential session or visit the DMAB website for important educational resources. Counselors can assist with Medicare, Medicare Advantage, Medigap (Medicare Supplement Insurance), long-term care insurance, billing issues, prescription savings, and much more. DMAB has a Virtual Welcome to Medicare Seminar helpful for new and soon-to-be Medicare beneficiaries and those exploring enrollment changes.

The department does not manage benefits offered to state employees, pensioners, or spouses. While DMAB can counsel Medicare-eligible state plan members, questions about the state’s proposed Medicare Advantage plan or transition, they should first contact the Office of Pensions at 1 (800) 722-7300 and explore their online guide.

Medicare Advantage plans are regulated at the federal level, though the Insurance Commissioner and his peers are advocating for increased state regulatory authority.

Be aware of non-compliant alternative health plans

Related Topics: Commissioner Navarro, Consumer Alert, Department of Insurance, DMAB, Insurance Commissioner, Insurance Department, medicare, Medicare Advantage, Medicare Assistance Bureau, Medicare Part D, open enrollment, Trinidad Navarro

Keep up to date by receiving a daily digest email, around noon, of current news release posts from state agencies on news.delaware.gov.

Here you can subscribe to future news updates.