School District Authorized Tax Rate Agreed-Upon Procedures Report – Fiscal Years Ended June 30, 2015 and 2016

Auditor of Accounts | Former Auditor of Accounts - R. Thomas Wagner, Jr. | Date Posted: Tuesday, May 2, 2017

The Delaware Office of Highway Safety Increases Enforcement for National Distracted Driving Awareness Month

Date Posted: April 15, 2024

Suspended Trooper faces prison after pleading guilty to six charges, including two felonies

Date Posted: April 12, 2024

Lt. Governor, School Districts, Philanthropist Launch Monetary Awards Program for Black Students

Date Posted: April 11, 2024

Attorney General Jennings obtains victory for manufactured housing residents

Date Posted: April 11, 2024

Delaware Cancer Consortium Hosts 2024 Biennial Retreat

Date Posted: April 10, 2024

$100,000 Grant Announced To Support Eviction Prevention Services In Delaware

Date Posted: April 9, 2024

Final NorthPak defendant convicted of two murders, more than 50 felonies

Date Posted: April 8, 2024

DHSS Seeks Comment on State Plan on Aging at Public Hearings This Month

Date Posted: April 5, 2024

Delaware Advances Toward 1 Million Tree Planting Goal

Date Posted: April 5, 2024

Treasurer Davis Encourages Delawareans to Prioritize Saving

Date Posted: April 5, 2024

Delaware Overdose Deaths Decrease for the First Time in Decade

Date Posted: April 4, 2024

State Offers Support for Students Applying for Financial Aid

Date Posted: April 4, 2024

Governor Carney, Secretary Garvin Celebrate Expansion of White Clay Creek State Park

Date Posted: April 3, 2024

State Agencies Join Forces Against Illegal Trash Dumping

Date Posted: April 2, 2024

DNREC to Offer Earth Day Beach Cleanup, Kids Crafts

Date Posted: April 2, 2024

Future Health Care Workers Win State Awards

Date Posted: April 2, 2024

The Mezzanine Gallery to exhibit “Within the Intimate Realm” by E. Schwinn

Date Posted: April 1, 2024

31-year DOC veteran named Warden of Howard R. Young Correctional Institution

Date Posted: March 28, 2024

Scotton Landing Boat Ramp Reopens for Spring

Date Posted: March 27, 2024

Delaware Teachers Named Finalists for National Mathematics, Science Teaching Award

Date Posted: March 27, 2024

Walk Down Memory Lane at Delaware Public Archives

Date Posted: March 27, 2024

DE Auditor Issues Special Report on Unemployment Insurance

Date Posted: March 26, 2024

DMV on the Go Gears Up for 2024 Season

Date Posted: March 26, 2024

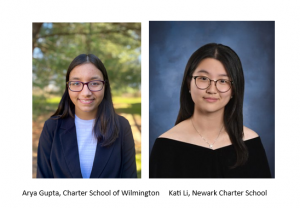

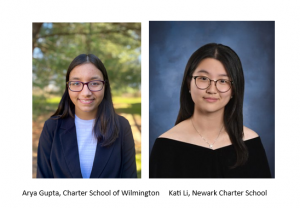

Two Students to Represent Delaware at National Science Camp

Date Posted: March 26, 2024

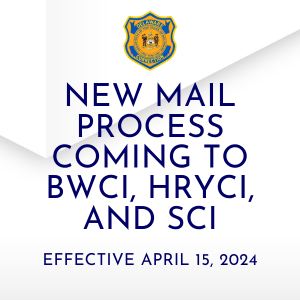

Department of Correction Expands Enhanced Mail Screening System To All State Prison Facilities

Date Posted: March 26, 2024

2024 Lt. Governor’s Challenge Seeks Applicants for Wellness Leader Awards

Date Posted: March 25, 2024

51st Annual DETSA Conference Celebrates Young Leaders, STEM and Innovation

Date Posted: March 25, 2024

DNREC Announces ‘Take a Kid Fishing!’ Spring Events

Date Posted: March 22, 2024

Bill Introduced to Protect Entities Serving the Legal Marijuana Industry

Date Posted: March 21, 2024

DNREC to Host Virtual Meeting on Deauville Beach Management Transition and New Entrance Fee Proposal

Date Posted: March 21, 2024

Delaware Inducts Three Farm Families into Century Farm Program

Date Posted: March 21, 2024

DPH Observes World Tuberculosis (TB) Day on March 24

Date Posted: March 21, 2024

DNREC, Kent Conservation District Offer Chesapeake Bay Implementation Grant Funding for Septic Tank Pump-outs

Date Posted: March 21, 2024

DNREC to Seek Community Water Project Proposals

Date Posted: March 20, 2024

Selbyville Fire

Date Posted: March 19, 2024

Delaware Department of Health and Social Services, Gov. Carney Announce Further Child Care Investments and Initiatives

Date Posted: March 19, 2024

Middle and High School Students Invited to Compete in Digital Mapping Technology Contest

Date Posted: March 19, 2024

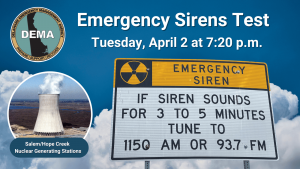

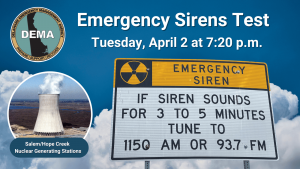

Emergency Sirens Test on April 2 and Potassium Iodide Event on April 4 in Middletown

Date Posted: March 19, 2024

Governor Carney Seeks Applications for Governor’s Summer Fellowship Program

Date Posted: March 19, 2024

Delaware to Open Upstate Trout Season With Youth-Only Fishing Day Set for April 6

Date Posted: March 19, 2024

First State Food System Program Opens Third Grant Application Cycle

Date Posted: March 18, 2024

Cynthia Karnai Confirmed As Director Of Delaware State Housing Authority

Date Posted: March 18, 2024

Governor’s Outstanding Volunteer Service Award Honorees to Be Recognized at April 4 Ceremony

Date Posted: March 18, 2024

DNREC’s DuPont Nature Center to Reopen April 3

Date Posted: March 18, 2024

Georgetown Fire

Date Posted: March 17, 2024

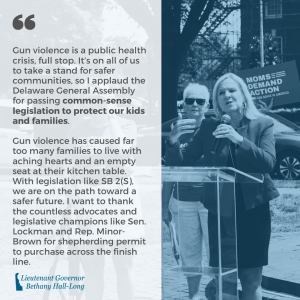

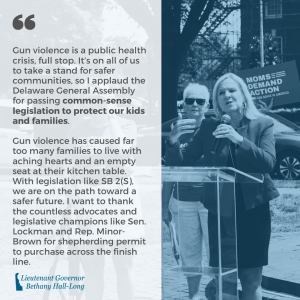

AG Jennings’ statement on Senate passage of Senate Bill 2

Date Posted: March 14, 2024

Lt. Gov. Hall-Long Applauds Passage of Senate Bill 2(S) Gun Safety Legislation

Date Posted: March 14, 2024

Governor Carney’s Statement on the Passage of Senate Substitute 1 for Senate Bill 2

Date Posted: March 14, 2024

Volunteers Sought to Join Concord Pond Cleanup April 13

Date Posted: March 14, 2024

Prosecutors secure conviction against Jordan Ellerbe’s murderer

Date Posted: March 14, 2024

Governor Carney’s Statement on Senate Confirmation of Cynthia Karnai as Director of State Housing Authority

Date Posted: March 13, 2024

State of Delaware Seeking Third Consecutive Year of Record Hiring: Job Fair for Students and Skilled Workers

Date Posted: March 13, 2024

Nominations Open for State of Delaware Compassionate Champion Awards

Date Posted: March 13, 2024

DOJ secures over seven life sentences, habitual offender status for Keith Gibson after violent killing spree

Date Posted: March 13, 2024

Delaware Department of Agriculture Opens Request for Applications for Resilient Food Systems Infrastructure Program

Date Posted: March 12, 2024

With gun safety in Court, Delaware, New Jersey, Pennsylvania AGs stand for common sense

Date Posted: March 11, 2024

The Office of the Marijuana Commissioner released additional sections of the informal draft regulations for review.

Date Posted: March 11, 2024

Lt. Governor, Partners Raise Awareness of Infant Formula Distribution Program

Date Posted: March 11, 2024

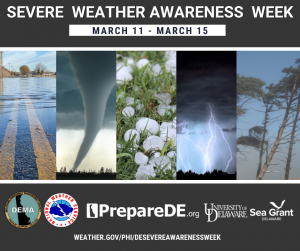

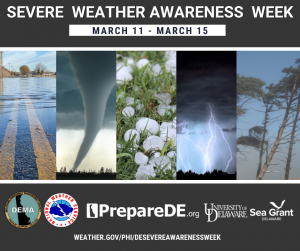

Severe Weather Awareness Week March 11-15, 2024

Date Posted: March 9, 2024

DPH Reports High Levels of Lead in Certain Cinnamon Products

Date Posted: March 8, 2024

Governor Carney Orders Lowering of Flags

Date Posted: March 8, 2024

Maiss Hussein to Represent Delaware in 2024 Poetry Out Loud National Finals

Date Posted: March 7, 2024

DNREC’s Mosquito Control Section Set to Spray Woodland Pools

Date Posted: March 7, 2024

Governor Carney’s Statement on Senate Confirmations

Date Posted: March 6, 2024

Get Involved in Earth Month: Register Now for the April 13 Christina River Watershed Cleanup

Date Posted: March 6, 2024

Governor Carney Delivers 2024 State of the State Address

Date Posted: March 6, 2024

Change Your Clocks, Check Your Batteries

Date Posted: March 6, 2024

Parks Plans Wind Transmission Line Informational Event

Date Posted: March 4, 2024

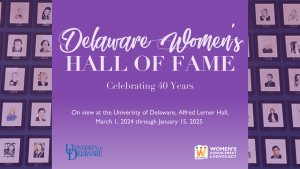

Celebrating Delaware’s Trailblazers: Women’s Hall of Fame Art Exhibition in Partnership with the University of Delaware

Date Posted: March 1, 2024

DNREC Announces Changes to 2024 Summer Flounder and Scup Recreational Fishing Regs

Date Posted: March 1, 2024

Mary and Charles Vinson sentenced to over 150 years in serial child abuse case

Date Posted: February 29, 2024

The Office of the Marijuana Commissioner (OMC) has released additional sections of the informal draft regulations.

Date Posted: February 29, 2024

Delaware Division of the Arts Encourages Arts Philanthropy Through Do More 24 Delaware

Date Posted: February 29, 2024

The Mezzanine Gallery to Exhibit “Unspoken Trajectories” by Aaron Keith Hoffer

Date Posted: February 29, 2024

DNREC Opens Youth Environmental Summit

Date Posted: February 29, 2024

Major Cybersecurity Event Impacting Health Care, Pharmacy Operations

Date Posted: February 29, 2024

Delaware State Parks Fee Season Begins March 1

Date Posted: February 29, 2024

DOJ secures over a dozen convictions for violent gun offender following nine-month manhunt

Date Posted: February 28, 2024

Students Win Big at State Educators Rising Event

Date Posted: February 28, 2024

DNREC to Close The Point at Cape Henlopen for Beach-nesting Season

Date Posted: February 28, 2024

Claymont Fire

Date Posted: February 27, 2024

Newark Fire

Date Posted: February 27, 2024

AG Jennings Announces Appeal Of Superior Court Voting Ruling, Vows Support For Constitutional Amendment

Date Posted: February 27, 2024

Delaware Division of the Arts Announces 12 Finalists for Delaware’s 2024 Poetry Out Loud State Finals

Date Posted: February 27, 2024

Controlled Burn at Brandywine Creek State Park Aims to Boost Native Wildlife and Plant Growth

Date Posted: February 27, 2024

Four-Legged Assistant Helps Change Lives Canine Companions Facility Dog Joins Delaware State Fire Commission

Date Posted: February 26, 2024

DNREC to Close Mulberry Landing Boat Ramp in Sussex County Temporarily for Expansion and Paving of Parking Lot

Date Posted: February 26, 2024

DOJ secures guilty pleas, prison time in fatal shooting case

Date Posted: February 23, 2024

Children’s pastor arrested on child pornography charges

Date Posted: February 23, 2024

DNREC to Offer Feb. 28 Webinar on Living Shoreline Cost Share Program for Home and Property Owners

Date Posted: February 23, 2024

Delaware State Fire Commission K9 Ajax To Get Donation of Body Armor.

Date Posted: February 23, 2024

DOJ secures felony conviction in first of several cases related to abuses of the 2022 Delaware Relief Rebate Program

Date Posted: February 22, 2024

Delaware, New Jersey, Illinois lead multistate coalition supporting PA gun safety law

Date Posted: February 22, 2024

Delaware State Fire Commission Updates Fire Regulations.

Date Posted: February 20, 2024

GACEC Hosts Celebration for Disability History and Awareness Month Poster Contest

Date Posted: February 20, 2024

Governor Carney Announces Delaware State Housing Authority Nomination

Date Posted: February 20, 2024

Treasurer Davis Honored for Delaware EARNS

Date Posted: February 20, 2024

Lt. Gov. Hall-Long Outlines Recommendations to Protect State Retiree Healthcare, Foster Fiscal Sustainability

Date Posted: February 19, 2024

Secretary of State Presents 2023 John Lewis Youth Leadership Award

Date Posted: February 19, 2024

Governor Carney Announces Judicial Nominations

Date Posted: February 19, 2024

The Delaware Office of Highway Safety Increases Enforcement for National Distracted Driving Awareness Month

Date Posted: April 15, 2024

Suspended Trooper faces prison after pleading guilty to six charges, including two felonies

Date Posted: April 12, 2024

Lt. Governor, School Districts, Philanthropist Launch Monetary Awards Program for Black Students

Date Posted: April 11, 2024

Attorney General Jennings obtains victory for manufactured housing residents

Date Posted: April 11, 2024

Delaware Cancer Consortium Hosts 2024 Biennial Retreat

Date Posted: April 10, 2024

$100,000 Grant Announced To Support Eviction Prevention Services In Delaware

Date Posted: April 9, 2024

Final NorthPak defendant convicted of two murders, more than 50 felonies

Date Posted: April 8, 2024

DHSS Seeks Comment on State Plan on Aging at Public Hearings This Month

Date Posted: April 5, 2024

Delaware Advances Toward 1 Million Tree Planting Goal

Date Posted: April 5, 2024

Treasurer Davis Encourages Delawareans to Prioritize Saving

Date Posted: April 5, 2024

Delaware Overdose Deaths Decrease for the First Time in Decade

Date Posted: April 4, 2024

State Offers Support for Students Applying for Financial Aid

Date Posted: April 4, 2024

Governor Carney, Secretary Garvin Celebrate Expansion of White Clay Creek State Park

Date Posted: April 3, 2024

State Agencies Join Forces Against Illegal Trash Dumping

Date Posted: April 2, 2024

DNREC to Offer Earth Day Beach Cleanup, Kids Crafts

Date Posted: April 2, 2024

Future Health Care Workers Win State Awards

Date Posted: April 2, 2024

The Mezzanine Gallery to exhibit “Within the Intimate Realm” by E. Schwinn

Date Posted: April 1, 2024

31-year DOC veteran named Warden of Howard R. Young Correctional Institution

Date Posted: March 28, 2024

Scotton Landing Boat Ramp Reopens for Spring

Date Posted: March 27, 2024

Delaware Teachers Named Finalists for National Mathematics, Science Teaching Award

Date Posted: March 27, 2024

Walk Down Memory Lane at Delaware Public Archives

Date Posted: March 27, 2024

DE Auditor Issues Special Report on Unemployment Insurance

Date Posted: March 26, 2024

DMV on the Go Gears Up for 2024 Season

Date Posted: March 26, 2024

Two Students to Represent Delaware at National Science Camp

Date Posted: March 26, 2024

Department of Correction Expands Enhanced Mail Screening System To All State Prison Facilities

Date Posted: March 26, 2024

2024 Lt. Governor’s Challenge Seeks Applicants for Wellness Leader Awards

Date Posted: March 25, 2024

51st Annual DETSA Conference Celebrates Young Leaders, STEM and Innovation

Date Posted: March 25, 2024

DNREC Announces ‘Take a Kid Fishing!’ Spring Events

Date Posted: March 22, 2024

Bill Introduced to Protect Entities Serving the Legal Marijuana Industry

Date Posted: March 21, 2024

DNREC to Host Virtual Meeting on Deauville Beach Management Transition and New Entrance Fee Proposal

Date Posted: March 21, 2024

Delaware Inducts Three Farm Families into Century Farm Program

Date Posted: March 21, 2024

DPH Observes World Tuberculosis (TB) Day on March 24

Date Posted: March 21, 2024

DNREC, Kent Conservation District Offer Chesapeake Bay Implementation Grant Funding for Septic Tank Pump-outs

Date Posted: March 21, 2024

DNREC to Seek Community Water Project Proposals

Date Posted: March 20, 2024

Selbyville Fire

Date Posted: March 19, 2024

Delaware Department of Health and Social Services, Gov. Carney Announce Further Child Care Investments and Initiatives

Date Posted: March 19, 2024

Middle and High School Students Invited to Compete in Digital Mapping Technology Contest

Date Posted: March 19, 2024

Emergency Sirens Test on April 2 and Potassium Iodide Event on April 4 in Middletown

Date Posted: March 19, 2024

Governor Carney Seeks Applications for Governor’s Summer Fellowship Program

Date Posted: March 19, 2024

Delaware to Open Upstate Trout Season With Youth-Only Fishing Day Set for April 6

Date Posted: March 19, 2024

First State Food System Program Opens Third Grant Application Cycle

Date Posted: March 18, 2024

Cynthia Karnai Confirmed As Director Of Delaware State Housing Authority

Date Posted: March 18, 2024

Governor’s Outstanding Volunteer Service Award Honorees to Be Recognized at April 4 Ceremony

Date Posted: March 18, 2024

DNREC’s DuPont Nature Center to Reopen April 3

Date Posted: March 18, 2024

Georgetown Fire

Date Posted: March 17, 2024

AG Jennings’ statement on Senate passage of Senate Bill 2

Date Posted: March 14, 2024

Lt. Gov. Hall-Long Applauds Passage of Senate Bill 2(S) Gun Safety Legislation

Date Posted: March 14, 2024

Governor Carney’s Statement on the Passage of Senate Substitute 1 for Senate Bill 2

Date Posted: March 14, 2024

Volunteers Sought to Join Concord Pond Cleanup April 13

Date Posted: March 14, 2024

Prosecutors secure conviction against Jordan Ellerbe’s murderer

Date Posted: March 14, 2024

Governor Carney’s Statement on Senate Confirmation of Cynthia Karnai as Director of State Housing Authority

Date Posted: March 13, 2024

State of Delaware Seeking Third Consecutive Year of Record Hiring: Job Fair for Students and Skilled Workers

Date Posted: March 13, 2024

Nominations Open for State of Delaware Compassionate Champion Awards

Date Posted: March 13, 2024

DOJ secures over seven life sentences, habitual offender status for Keith Gibson after violent killing spree

Date Posted: March 13, 2024

Delaware Department of Agriculture Opens Request for Applications for Resilient Food Systems Infrastructure Program

Date Posted: March 12, 2024

With gun safety in Court, Delaware, New Jersey, Pennsylvania AGs stand for common sense

Date Posted: March 11, 2024

The Office of the Marijuana Commissioner released additional sections of the informal draft regulations for review.

Date Posted: March 11, 2024

Lt. Governor, Partners Raise Awareness of Infant Formula Distribution Program

Date Posted: March 11, 2024

Severe Weather Awareness Week March 11-15, 2024

Date Posted: March 9, 2024

DPH Reports High Levels of Lead in Certain Cinnamon Products

Date Posted: March 8, 2024

Governor Carney Orders Lowering of Flags

Date Posted: March 8, 2024

Maiss Hussein to Represent Delaware in 2024 Poetry Out Loud National Finals

Date Posted: March 7, 2024

DNREC’s Mosquito Control Section Set to Spray Woodland Pools

Date Posted: March 7, 2024

Governor Carney’s Statement on Senate Confirmations

Date Posted: March 6, 2024

Get Involved in Earth Month: Register Now for the April 13 Christina River Watershed Cleanup

Date Posted: March 6, 2024

Governor Carney Delivers 2024 State of the State Address

Date Posted: March 6, 2024

Change Your Clocks, Check Your Batteries

Date Posted: March 6, 2024

Parks Plans Wind Transmission Line Informational Event

Date Posted: March 4, 2024

Celebrating Delaware’s Trailblazers: Women’s Hall of Fame Art Exhibition in Partnership with the University of Delaware

Date Posted: March 1, 2024

DNREC Announces Changes to 2024 Summer Flounder and Scup Recreational Fishing Regs

Date Posted: March 1, 2024

Mary and Charles Vinson sentenced to over 150 years in serial child abuse case

Date Posted: February 29, 2024

The Office of the Marijuana Commissioner (OMC) has released additional sections of the informal draft regulations.

Date Posted: February 29, 2024

Delaware Division of the Arts Encourages Arts Philanthropy Through Do More 24 Delaware

Date Posted: February 29, 2024

The Mezzanine Gallery to Exhibit “Unspoken Trajectories” by Aaron Keith Hoffer

Date Posted: February 29, 2024

DNREC Opens Youth Environmental Summit

Date Posted: February 29, 2024

Major Cybersecurity Event Impacting Health Care, Pharmacy Operations

Date Posted: February 29, 2024

Delaware State Parks Fee Season Begins March 1

Date Posted: February 29, 2024

DOJ secures over a dozen convictions for violent gun offender following nine-month manhunt

Date Posted: February 28, 2024

Students Win Big at State Educators Rising Event

Date Posted: February 28, 2024

DNREC to Close The Point at Cape Henlopen for Beach-nesting Season

Date Posted: February 28, 2024

Claymont Fire

Date Posted: February 27, 2024

Newark Fire

Date Posted: February 27, 2024

AG Jennings Announces Appeal Of Superior Court Voting Ruling, Vows Support For Constitutional Amendment

Date Posted: February 27, 2024

Delaware Division of the Arts Announces 12 Finalists for Delaware’s 2024 Poetry Out Loud State Finals

Date Posted: February 27, 2024

Controlled Burn at Brandywine Creek State Park Aims to Boost Native Wildlife and Plant Growth

Date Posted: February 27, 2024

Four-Legged Assistant Helps Change Lives Canine Companions Facility Dog Joins Delaware State Fire Commission

Date Posted: February 26, 2024

DNREC to Close Mulberry Landing Boat Ramp in Sussex County Temporarily for Expansion and Paving of Parking Lot

Date Posted: February 26, 2024

DOJ secures guilty pleas, prison time in fatal shooting case

Date Posted: February 23, 2024

Children’s pastor arrested on child pornography charges

Date Posted: February 23, 2024

DNREC to Offer Feb. 28 Webinar on Living Shoreline Cost Share Program for Home and Property Owners

Date Posted: February 23, 2024

Delaware State Fire Commission K9 Ajax To Get Donation of Body Armor.

Date Posted: February 23, 2024

DOJ secures felony conviction in first of several cases related to abuses of the 2022 Delaware Relief Rebate Program

Date Posted: February 22, 2024

Delaware, New Jersey, Illinois lead multistate coalition supporting PA gun safety law

Date Posted: February 22, 2024

Delaware State Fire Commission Updates Fire Regulations.

Date Posted: February 20, 2024

GACEC Hosts Celebration for Disability History and Awareness Month Poster Contest

Date Posted: February 20, 2024

Governor Carney Announces Delaware State Housing Authority Nomination

Date Posted: February 20, 2024

Treasurer Davis Honored for Delaware EARNS

Date Posted: February 20, 2024

Lt. Gov. Hall-Long Outlines Recommendations to Protect State Retiree Healthcare, Foster Fiscal Sustainability

Date Posted: February 19, 2024

Secretary of State Presents 2023 John Lewis Youth Leadership Award

Date Posted: February 19, 2024

Governor Carney Announces Judicial Nominations

Date Posted: February 19, 2024

Auditor of Accounts | Former Auditor of Accounts - R. Thomas Wagner, Jr. | Date Posted: Tuesday, May 2, 2017

State Auditor, R. Thomas Wagner, Jr., has released the School District Authorized Tax Rate Agreed-Upon Procedures Report for Fiscal Years Ended June 30, 2015 and 2016.

The Office of Auditor of Accounts (AOA) performed procedures to determine whether Delaware school districts’ tax rates were adequately supported and properly authorized. The majority of our exceptions resulted from procedures performed on match tax rates. The exceptions identify school districts that collected a tax rate higher than the authorized amount, which is largely attributable to the minimal guidance regarding how a match tax rate should be calculated and the level of discretion afforded to school districts when calculating these match tax rates.

The engagement was performed by AOA in accordance with Government Auditing Standards, issued by the Comptroller General of the United States.

For the full results of School District Authorized Tax Rate Agreed-Upon Procedures Engagement, please see the published report.

If you have any questions, please contact R. Thomas Wagner, Jr., State Auditor, at 302-739-5055 or r.thomas.wagner@delaware.gov.

Keep up to date by receiving a daily digest email, around noon, of current news release posts from state agencies on news.delaware.gov.

Here you can subscribe to future news updates.

Auditor of Accounts | Former Auditor of Accounts - R. Thomas Wagner, Jr. | Date Posted: Tuesday, May 2, 2017

State Auditor, R. Thomas Wagner, Jr., has released the School District Authorized Tax Rate Agreed-Upon Procedures Report for Fiscal Years Ended June 30, 2015 and 2016.

The Office of Auditor of Accounts (AOA) performed procedures to determine whether Delaware school districts’ tax rates were adequately supported and properly authorized. The majority of our exceptions resulted from procedures performed on match tax rates. The exceptions identify school districts that collected a tax rate higher than the authorized amount, which is largely attributable to the minimal guidance regarding how a match tax rate should be calculated and the level of discretion afforded to school districts when calculating these match tax rates.

The engagement was performed by AOA in accordance with Government Auditing Standards, issued by the Comptroller General of the United States.

For the full results of School District Authorized Tax Rate Agreed-Upon Procedures Engagement, please see the published report.

If you have any questions, please contact R. Thomas Wagner, Jr., State Auditor, at 302-739-5055 or r.thomas.wagner@delaware.gov.

Keep up to date by receiving a daily digest email, around noon, of current news release posts from state agencies on news.delaware.gov.

Here you can subscribe to future news updates.

Delaware's Governor

State Agencies

Elected Officials

General Assembly

Delaware Courts

State Employees

Cities & Towns

Delaware State Code

State Regulations

Business First Steps

Phone Directory

Locations Directory

Public Meetings

Voting & Elections

Transparency

Delaware Marketplace

Tax Center

Personal Income Tax

Privacy Policy

Weather & Travel

Contact Us

Corporations

Franchise Tax

Gross Receipts Tax

Withholding Tax

Delaware Topics

Help Center

Mobile Apps

E-mail / Text Alerts

Social Media

Built by the Government Information Center

©MMXXIV Delaware.gov